AutoNation Inc: A Strong Contender in the Vehicles & Parts Industry with a High GF Score

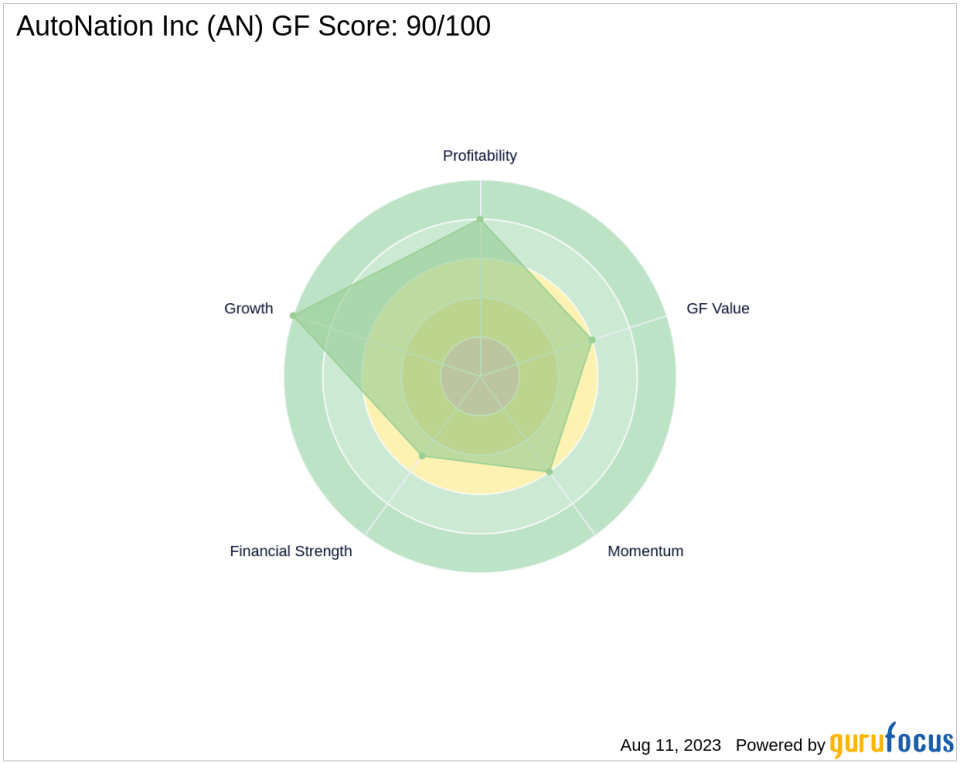

AutoNation Inc (NYSE:AN), a leading player in the Vehicles & Parts industry, is currently trading at $161.01 with a market capitalization of $7.09 billion. The company's stock price has seen a gain of 4.38% today, despite a loss of 9.58% over the past four weeks. AutoNation's GF Score stands at an impressive 90 out of 100, indicating good outperformance potential. The GF Score is a comprehensive stock performance ranking system developed by GuruFocus, which takes into account five key aspects: Financial Strength, Profitability Rank, Growth Rank, GF Value Rank, and Momentum Rank.

Financial Strength Analysis

AutoNation's Financial Strength rank is 5/10. This metric evaluates the robustness of a company's financial situation, considering factors such as its debt burden, debt to revenue ratio, and Altman Z-Score. AutoNation's interest coverage is 7.36, indicating a manageable debt burden. Its debt to revenue ratio is 0.27, suggesting a healthy balance between debt and revenue. The company's Altman Z score is 3.85, further confirming its financial stability.

Profitability Rank Analysis

The company's Profitability Rank is 8/10, indicating a high level of profitability. This rank is determined by factors such as operating margin, Piotroski F-Score, trend of the operating margin, consistency of profitability, and predictability rank. AutoNation's operating margin is 6.87%, and its Piotroski F-Score is 5, suggesting a stable financial situation. The company has maintained consistent profitability for the past 10 years, with a 5-year average operating margin trend of 17.00% and a predictability rank of 3.5.

Growth Rank Analysis

AutoNation's Growth Rank is a perfect 10/10, reflecting strong revenue and profitability growth. The company's 5-year revenue growth rate is 15.40%, and its 3-year revenue growth rate is 26.40%. Its 5-year EBITDA growth rate is an impressive 31.40%, indicating robust business operations growth.

GF Value Rank Analysis

The company's GF Value Rank is 6/10, suggesting a fair valuation. This rank is determined by the price-to-GF-Value ratio, a proprietary metric calculated based on historical multiples and an adjustment factor based on a company's past returns and growth and future estimates of the business' performance.

Momentum Rank Analysis

AutoNation's Momentum Rank is 6/10, indicating a moderate momentum in its stock price. This rank is determined using the standardized momentum ratio and other momentum indicators.

Competitor Analysis

AutoNation's main competitors in the industry are Lithia Motors Inc (NYSE:LAD) with a GF Score of 95, Carvana Co (NYSE:CVNA) with a GF Score of 72, and Asbury Automotive Group Inc (NYSE:ABG) with a GF Score of 92. You can find more details about these competitors here.

Conclusion

In conclusion, AutoNation Inc's high GF Score of 90/100 suggests good outperformance potential. The company's strong financial strength, high profitability, robust growth, fair value, and moderate momentum make it a compelling choice for investors. However, as with any investment, it's essential to consider the broader market conditions and the company's competitive landscape.

This article first appeared on GuruFocus.