AutoZone (AZO) Q4 Earnings & Revenues Surpass Estimates

AutoZone Inc. AZO reported earnings of $46.46 per share for fourth-quarter fiscal 2023 (ended Aug 26, 2023), up 14.7% year over year. Earnings surpassed the Zacks Consensus Estimate of $44.51.

Net sales grew 6.4% year over year to $5,690.6 million. The top line also surpassed the Zacks Consensus Estimate of $5,581 million.

In the reported quarter, domestic commercial sales totaled $1,499 million, up from $1,442.3 million recorded in the year-ago period. Domestic same-store sales (sales at stores open at least for a year) rose by 1.7%.

Gross profit increased to $2,999.7 million from the prior-year quarter’s figure of $2,755.9 million. Operating profit increased 10.8% year over year to $1,222.5 million.

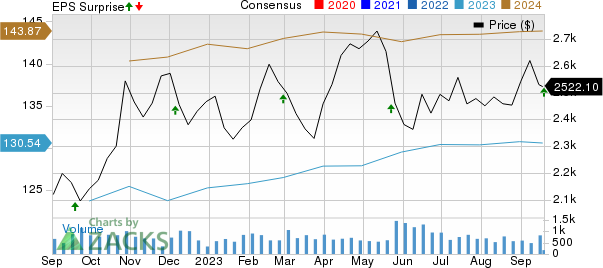

AutoZone, Inc. Price, Consensus and EPS Surprise

AutoZone, Inc. price-consensus-eps-surprise-chart | AutoZone, Inc. Quote

Store Opening & Inventory

During the quarter, AutoZone opened 53 new stores in the United States, 27 in Mexico and 17 in Brazil. It exited the quarter with 6,300 stores in the United States, 740 in Mexico and 100 in Brazil. The total store count was 7,140 as of Aug 26, 2023.

Its inventory increased by 2.2% year over year in the reported quarter, led by new store growth. At quarter-end, the inventory per location was negative $201,000 compared with negative $240,000 a year ago.

Financials and Share Repurchases

As of Aug 26, 2023, AutoZone had cash and cash equivalents of $277.1 million, up from $264.4 million as of Aug 27, 2022. The total debt amounted to $7,668.5 million as of Aug 26, marking an increase from $6,122.1 million as of Aug 27, 2022.

The company repurchased 403,000 shares of its common stock for $1 billion during the fiscal fourth quarter of 2023 at an average price of $2,502 per share. At quarter-end, it had $1.8 billion remaining under its current share repurchase authorization.

Zacks Rank & Key Picks

AZO currently carries a Zacks Rank #3 (Hold).

Some top-ranked players in the auto space include Oshkosh Corporation OSK, Gentex Corporation GNTX and Allison Transmission Holdings, Inc. ALSN, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for OSK’s 2023 sales and earnings implies year-over-year growth of 15% and 126.9%, respectively. The EPS estimate for 2023 has moved north by $1.75 in the past 60 days. The EPS estimate for 2024 has moved up by 6 cents in the past 30 days.

The Zacks Consensus Estimate for GNTX’s 2023 sales and earnings indicates year-over-year rises of 17.3% and 29.4%, respectively. The EPS estimates for 2023 and 2024 have moved up by 9 cents each in the past 60 days.

The Zacks Consensus Estimate for ALSN’s 2023 sales and earnings suggests year-over-year increases of 9.4% and 25.3%, respectively. The EPS estimate for 2023 and 2024 has moved up by 39 cents and 43 cents, respectively, in the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AutoZone, Inc. (AZO) : Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report

Oshkosh Corporation (OSK) : Free Stock Analysis Report

Gentex Corporation (GNTX) : Free Stock Analysis Report