AvalonBay (AVB) Q3 FFO Tops Estimates on Higher Rental Revenues

AvalonBay Communities AVB reported a third-quarter 2023 core FFO per share of $2.66, beating the Zacks Consensus Estimate of $2.64. Moreover, the figure climbed 6.4% from the prior-year quarter’s tally.

The quarterly results reflect a year-over-year increase in same-store residential rental revenues, driven by effective lease rates. AVB also raised its core FFO per share outlook for 2023.

Reflecting positive sentiments, shares of AVB were up more than 8% during the pre-market hours today.

Total revenues in the quarter came in at $697.6 million, outpacing the Zacks Consensus Estimate of $692.1 million. The figure increased 4.9% on a year-over-year basis.

Quarter in Detail

In the reported quarter, same-store residential rental revenues increased 5.2% year over year to $635.3 million. Same-store residential operating expenses rose 5% to $202.8 million. As a result, the same-store residential NOI climbed 5.3% to $432.9 million from the prior-year period.

Same-store average rental revenues per occupied home rose to $2,962 in the third quarter, up from $2,920 in the third quarter of 2023. While the same-store economic occupancy shrunk 20 basis points year over year to 95.7%, it came in better than our projection of 95.6%.

As of Sep 30, 2023, AvalonBay had 16 consolidated development communities under construction (expected to contain 5,402 apartment homes and 59,000 square feet of commercial space). The estimated total capital cost of these development communities at completion is $2.26 billion.

During the third quarter, AVB acquired Avalon Frisco at Main, which is a wholly owned community in Frisco, TX, comprising 360 apartment homes, for $83.1 million.

Balance Sheet

AVB had $508.6 million in unrestricted cash and cash equivalents and $234.0 million in restricted cash as of Sep 30, 2023. As of the same date, the company did not have any borrowings outstanding under its $2.25 billion unsecured revolving credit facility and had $70 million outstanding under its $500 million unsecured commercial paper note program.

Additionally, its annualized net debt-to-core EBITDAre for the July-September period was 4.1 times, and the unencumbered NOI for the nine months ended Sep 30, 2023 was 95%.

2023 Outlook Raised

For fourth-quarter 2023, AvalonBay expects core FFO per share in the range of $2.69-$2.79. The Zacks Consensus Estimate is currently pegged at $2.72, which lies within the guided range.

For the full year, AVB expects core FFO per share between $10.58 and $10.68. This implies 8.6% growth year over year at the midpoint, up from 7.9% growth projected earlier. The Zacks Consensus Estimate presently stands at $10.59, within the projected range.

For the full year, management expects same-store residential rental revenue growth to be 6.3% at the midpoint, up from 6% guided earlier. Same-store residential NOI growth is estimated at 6.3%, ahead of 6% projected before.

AvalonBay currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

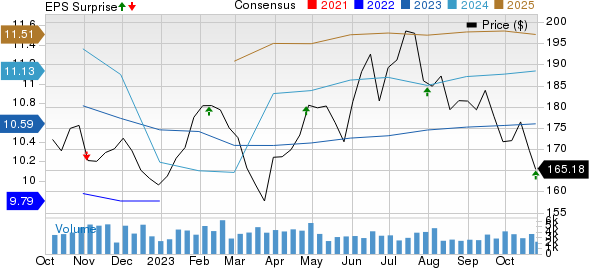

AvalonBay Communities, Inc. Price, Consensus and EPS Surprise

AvalonBay Communities, Inc. price-consensus-eps-surprise-chart | AvalonBay Communities, Inc. Quote

Performance of Another Residential REIT

Mid-America Apartment Communities MAA reported a third-quarter 2023 core FFO per share of $2.29, which surpassed the Zacks Consensus Estimate by a penny. Moreover, the reported figure climbed 4.6% year over year.

This residential REIT’s quarterly results were driven by an increase in the average effective rent per unit for the same-store portfolio. MAA also revised its outlook for 2023.

Upcoming Earnings Release

We look forward to the earnings release of another residential REIT — Equity Residential EQR — which is slated to report its results on Oct 31.

The Zacks Consensus Estimate for Equity Residential’s third-quarter 2023 FFO per share is pegged at 97 cents, suggesting year-over-year growth of 5.43%. EQR currently carries a Zacks Rank #3 (Hold).

Note: Anything related to earnings presented in this write-up represents FFO — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AvalonBay Communities, Inc. (AVB) : Free Stock Analysis Report

Equity Residential (EQR) : Free Stock Analysis Report

Mid-America Apartment Communities, Inc. (MAA) : Free Stock Analysis Report