Avanos' (AVNS) Latest Buyout to Boost Its RF Product Offering

Avanos Medical, Inc. AVNS recently announced a definitive agreement to acquire Diros Technology Inc. The company intended to share additional details about the transaction, which is expected to be closed in the third quarter of 2023 (subject to customary closing conditions), on its Investor Day event on Jun 20.

Avanos expects the new business to be immediately accretive to its revenue growth, gross margins, operating margins and earnings per share (EPS).

Toronto, Canada-based Diros Technology is a well-known manufacturer of innovative radiofrequency (RF) products to treat chronic pain conditions.

The latest acquisition is likely to significantly boost Avanos’ pain management treatment options and complement its premium COOLIEF Cooled RF product offerings.

Rationale Behind the Acquisition

Per Avanos, more than a million radiofrequency ablation (RFA) procedures are performed annually for the treatment of chronic musculoskeletal pain. Diros Technology's products deliver RF energy via precisely placed, minimally-invasive probes for chronic pain management. The RF energy thus delivered heat the nervous tissues near the probe's tip, deactivating the nerve's ability to transmit pain signals.

Avanos’ management believes that the buyout of Diros Technology will likely strengthen its foothold in RF technology by providing a full range of high-quality, differentiated pain management products. The enhanced portfolio is expected to offer significant opportunities to deliver non-opioid-based and minimally-invasive treatments to patients worldwide.

Industry Prospects

Per a report by Facts and Factors, the global RFA devices market was worth around $3.59 billion in 2021 and is anticipated to reach $10.21 billion by 2030 at a CAGR of approximately 11%. Factors like the rising prevalence of chronic pain disorders and the growing demand for pain management are expected to drive the market.

Given the market potential, the latest buyout is expected to significantly strengthen Avanos’ global business.

Recent Developments

This month, Avanos entered into a definitive agreement to sell its Respiratory Health (RH) business to SunMed Group Holdings, LLC. Per Avanos, the divestiture of the RH business represents a key component of its ongoing three-year transformation process and accelerates its efforts to focus its portfolio on markets where it is well-positioned to succeed.

Last month, Avanos announced its first-quarter 2023 results, wherein it registered a solid adjusted EPS performance. Strength in the Chronic Care segment from a solid Digestive health business and robust growth in NeoMed (fueled by strong execution of customer conversions to Avanos’ ENFit technology in North America) and CORTRAK were also recorded.

Price Performance

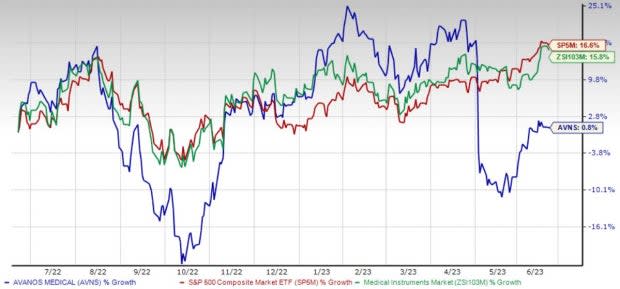

Shares of Avanos have gained 0.8% in the past year compared with the industry’s 15.8% rise and the S&P 500's 16.7% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, Avanos carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Hologic, Inc. HOLX, Merit Medical Systems, Inc. MMSI and Boston Scientific Corporation BSX.

Hologic, carrying a Zacks Rank #2 (Buy) at present, has an estimated growth rate of 5.1% for fiscal 2024. HOLX’s earnings surpassed estimates in all the trailing four quarters, the average being 27.3%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Hologic has gained 20.5% compared with the industry’s 15.8% rise in the past year.

Merit Medical, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 11%. MMSI’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 20.2%.

Merit Medical has gained 59.5% compared with the industry’s 20.8% rise over the past year.

Boston Scientific, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 11.5%. BSX’s earnings surpassed estimates in two of the trailing four quarters and missed in the other two, the average surprise being 1.9%.

Boston Scientific has gained 45.9% against the industry’s 20.9% decline over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

AVANOS MEDICAL, INC. (AVNS) : Free Stock Analysis Report