Avantor (AVTR) Q2 Earnings Lag Estimates, FY23 View Revised

Avantor, Inc. AVTR reported second-quarter 2023 adjusted earnings per share (EPS) of 28 cents, down 24.3% year over year. The bottom line missed the Zacks Consensus Estimate by a penny.

GAAP loss per share for the quarter was a penny against the year-ago period’s EPS of 28 cents.

Revenue Details

Revenues grossed $1.74 billion in the reported quarter, down 8.7% year over year. The metric lagged the Zacks Consensus Estimate by 3.1%.

Despite Avantor's foreign currency translation reflecting a 0.4% favorable impact in the reported quarter, organic sales declined 9.1%. Excluding COVID-19 headwinds, Avantor's core organic sales growth rate declined 6.5% during the reported period.

Per management, the year-over-year decline in the second quarter’s core organic sales reflected high single-digit declines in Biopharma and Advanced Technologies and Applied Materials, resulting from lower activity levels, constrained spending and continued inventory destocking by Avantor's customers. However, this was partially offset by ongoing growth in its healthcare and education and government end markets.

Segmental Analysis

Avantor reports financial results in three geographic segments based on customer location — the Americas, Europe and AMEA (Asia, Middle-East and Africa).

The Americas segment’s net sales were $1.03 billion, reflecting a reported decline of 11.3% year over year. Core organic sales fell 8.8% in the reported quarter, reflecting weaker customer demand in Biopharma and Advanced Technologies and Applied Materials. This compares to our projection of second-quarter segmental revenues of $1.06 billion.

Europe’s net sales were $606.9 million, reflecting a reported decrease of 2.7%, whereas core organic sales decreased 1.8% year over year. Per management, the decline in core organic sales was due to weakness in Biopharma and Education and Government end markets. This compares to our projection of second-quarter segmental revenues of $601.8 million.

AMEA arm’s net sales were $111.4 million, indicating a reported fall of 14.4% year over year. The core organic sales decreased 8.7% year over year due to declines in formulated solutions for Avantor’s semiconductor customers (down about 70% in the region) and sluggish demand in research settings across all end markets. However, this was partially offset by strong core organic revenue growth in bioproduction. This compares to our projection of second-quarter segmental revenues of $125.8 million.

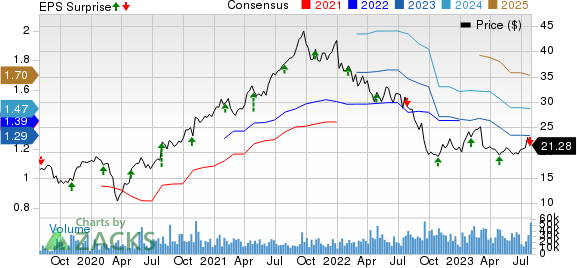

Avantor, Inc. Price, Consensus and EPS Surprise

Avantor, Inc. price-consensus-eps-surprise-chart | Avantor, Inc. Quote

Margin Analysis

In the quarter under review, Avantor’s gross profit declined 8.9% to $590 million. The gross margin contracted 7 basis points (bps) to 33.8%.

We had projected 32.9% of gross margin for the second quarter.

Selling, general and administrative expenses rose 1.5% to $357.5 million year over year.

Operating profit totaled $232.5 million, down 21.3% from the prior-year quarter’s level. The operating margin in the quarter also contracted 214 bps to 13.3%.

Financial Position

Avantor exited second-quarter 2023 with cash and cash equivalents of $ 236.4 million compared with $294.6 million at the end of the first quarter. Total debt at the end of second-quarter 2023 was $5.88 billion compared with $6.06 billion at the first-quarter end.

Cumulative net cash flow from operating activities at the end of second-quarter 2023 was $387.7 million compared with $379.7 million a year ago.

Guidance

Avantor has revised its outlook for 2023.

The company now expects revenues in the range of $6.89 billion-$7.04 billion, reflecting organic revenue declines of 9-7% and core organic revenue declines of 6.5-4.5%. This compares with prior organic and core organic revenue outlooks of declines of 3-1% and decline of 0.5% to growth of 1.5%, respectively. The Zacks Consensus Estimate for the same is currently pegged at $7.32 billion.

Avantor expects its adjusted EPS to now lie within $1.04-$1.12 for the full year, down from the earlier projection of $1.28-$1.36. The Zacks Consensus Estimate for the same is pegged at $1.29.

Our Take

Avantor exited the second quarter of 2023 with lower-than-expected results. The dismal top-line and bottom-line performances in the quarter were disappointing. The decline in segmental revenues and weakness in end markets were discouraging. Per management, the macroeconomic contraction over the past two quarters in the Eurozone, including the recession in Germany, also put pressure on Equipment and Instrument sales. This raises our apprehension about the stock. The contraction of both margins also does not bode well.

On a positive note, strong core organic revenue growth in bioproduction in the reported quarter looked promising. On the second-quarter earnings call, management confirmed that Avantor’s focus on cell and gene therapy has been yielding double-digit growth in several critical product lines targeting these workflows. Management also confirmed that Avantor launched integrated pressure sensors for its Masterflex, MasterSense pumps. The company also introduced novel volume sampling systems to support Cell & Gene Therapy workflows, Cryogenic Storage Vials to support long-term storage of critical biological samples and a new robotics tip line, the J.T.Baker HT2. These look promising for the stock.

Zacks Rank and Stocks to Consider

Avantor currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader medical space that have announced quarterly results are Abbott Laboratories ABT, Elevance Health, Inc. ELV and Intuitive Surgical, Inc. ISRG.

Abbott, carrying a Zacks Rank of 2 (Buy), reported second-quarter 2023 adjusted EPS of $1.08, beating the Zacks Consensus Estimate by 3.8%. Revenues of $9.98 billion outpaced the consensus mark by 2.9%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Abbott has a long-term estimated growth rate of 5.1%. ABT’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 12.4%.

Elevance Health reported second-quarter 2023 adjusted EPS of $9.04, beating the Zacks Consensus Estimate by 2.5%. Revenues of $43.38 billion surpassed the Zacks Consensus Estimate by 4.5%. It currently carries a Zacks Rank #2.

Elevance Health has a long-term estimated growth rate of 12.1%. ELV’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 2.8%.

Intuitive Surgical reported second-quarter 2023 adjusted EPS of $1.42, beating the Zacks Consensus Estimate by 7.6%. Revenues of $1.76 billion surpassed the Zacks Consensus Estimate by 1.4%. It currently carries a Zacks Rank #2.

Intuitive Surgical has a long-term estimated growth rate of 15.7%. ISRG’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 4.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abbott Laboratories (ABT) : Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

Avantor, Inc. (AVTR) : Free Stock Analysis Report

Elevance Health, Inc. (ELV) : Free Stock Analysis Report