Avantor Inc (AVTR) Faces Decline in 2023 Sales and Net Income Amid Market Challenges

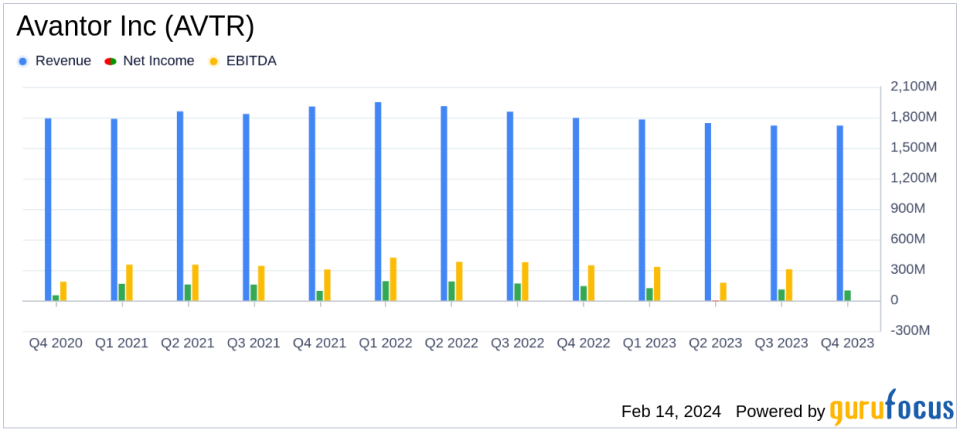

Net Sales: Reported a decrease of 7.3% year-over-year to $6.97 billion.

Net Income: Dropped to $321.1 million from $686.5 million in the previous year.

Adjusted EBITDA: Reached $1,309.1 million with a margin of 18.8%.

Diluted EPS: GAAP EPS was $0.47, while adjusted EPS stood at $1.06.

Free Cash Flow: Increased to $723.6 million, demonstrating strong cash generation.

Debt Repayment: Approximately $850 million of debt repaid in 2023.

On February 14, 2024, Avantor Inc (NYSE:AVTR) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. Avantor, a Fortune 500 company, is a leading global provider of mission-critical products and services to customers in the life sciences and advanced technology industries. The company's offerings are essential across various stages of research, development, and production activities in the industries it serves.

Despite a challenging market environment, Avantor's financial results for the fourth quarter and full year of 2023 reflect the company's resilience and strategic focus. The company reported a decrease in net sales and net income, attributing the decline to a core organic sales decrease and the impact of COVID-19 headwinds. However, Avantor's adjusted EBITDA remained robust, and the company demonstrated strong free cash flow generation.

Avantor's President and CEO, Michael Stubblefield, commented on the results:

"We had a solid finish to the year with fourth quarter revenue, margin and adjusted EPS coming in at the high end of our updated guidance. Our free cash flow for the year exceeded the top end of our guidance range, representing more than 120% conversion in the quarter. I am proud of our commercial teams continued drive and intensity, which resulted in additional wins and expanded relationships among biotech, biopharma, and academic customers. Avantors results reflect our focus on operating with discipline through our Avantor Business System, our market position, and our relevance to customers workflows."

Avantor's performance in the fourth quarter saw net sales of $1.72 billion, a 4.0% decrease from the previous year, with a core organic decline of 4.8%. The adjusted EBITDA for the quarter was $302.1 million, and the adjusted EBITDA margin stood at 17.5%. The diluted GAAP EPS was $0.15, while the adjusted EPS was $0.25. The operating cash flow for the quarter was $251.6 million, and the free cash flow was $201.0 million.

For the full year, Avantor reported net sales of $6.97 billion, a 7.3% decrease from 2022, with a core organic decline of 5.2%. The adjusted EBITDA for the year was $1,309.1 million, with an adjusted EBITDA margin of 18.8%. The net income for the year decreased to $321.1 million from $686.5 million in 2022, and the adjusted net income was $720.1 million. The diluted GAAP EPS was $0.47, while the adjusted EPS was $1.06. The operating cash flow for the year was $870.0 million, and the free cash flow was $723.6 million. Avantor also managed to reduce its adjusted net leverage to 3.9X and repaid approximately $850 million of debt in 2023.

Segment-wise, the Americas, Europe, and AMEA all experienced declines in net sales and adjusted EBITDA margins. Despite these challenges, Avantor's management remains focused on positioning the company for long-term growth and is advancing a new operating model to unlock significant operating efficiencies.

Avantor's balance sheet reflects a solid financial position, with total assets of $12.97 billion and total liabilities of $7.72 billion as of December 31, 2023. The company's stockholders' equity stood at $5.25 billion.

Avantor's financial performance in 2023 demonstrates the company's ability to navigate market headwinds and maintain a strong financial foundation. The company's focus on cash flow generation, debt repayment, and strategic initiatives positions it well for future growth and stability.

For more detailed information on Avantor's financial results, including reconciliations of non-GAAP measures, please refer to the full earnings release.

Investors and stakeholders interested in Avantor's future prospects can look forward to the company's conference call, where further insights and discussions on the financial results will be provided.

For value investors and potential GuruFocus.com members seeking comprehensive financial analysis and insights, Avantor's earnings report offers a clear view of the company's financial health and strategic direction. Stay tuned to GuruFocus.com for more updates and expert financial coverage.

Explore the complete 8-K earnings release (here) from Avantor Inc for further details.

This article first appeared on GuruFocus.