Avantor's (AVTR) New Expansion Plans to Boost Workflow

Avantor, Inc. AVTR recently announced its plans to relocate and significantly expand its Innovation Center in Bridgewater, NJ. The expanded Innovation Center, expected to open in August 2024, will be at a nearby location in Bridgewater, NJ.

The latest expansion plans are expected to significantly solidify Avantor’s foothold in the cell and gene therapy and mRNA space, among others, and boost its Research & Development and Innovation wing.

Significance of the Relocation

The Bridgewater Innovation Center currently serves as a technology-driven research and collaboration environment where Avantor works with customers to develop and enhance their offerings. The new location is expected to have a significantly expanded space compared to the present available lab and pilot space.

The new site will likely support customers' pipelines across all modalities, including monoclonals, cell and gene therapy and mRNA, and feature a development and application area, including a viral vector laboratory. Avantor's expanded Innovation Center is also expected to feature digital service offerings, such as its Inventory Manager (IM).

Per management, the expansion is expected to allow Avantor to adopt a more collaborative approach to deliver customized solutions. By adding capacity and capability to its Innovation Center, Avantor is expected to better support the increasing demands for gene therapy and mRNA workflows, facilitate pipeline project execution and enable quicker production scale-up.

Industry Prospects

Per a report by Coherent Market Insights, the global cell and gene therapy market was valued at $15,580.3 million in 2022 and is anticipated to witness a CAGR of 24.7% between 2022 and 2030. Factors like the increasing demand for innovative treatments and the developing interest in cell and gene treatments for cancer treatments are likely to drive the market.

Given the market potential, the latest expansion will likely provide a significant impetus to Avantor in the cell and gene therapy space, among others, worldwide.

Recent Developments

This month, Avantor inaugurated its expanded Singapore Hub, which includes newly-added cGMP (current Good Manufacturing Practice) manufacturing and an improved quality control laboratory. The hub is expected to serve customers across Asia, the Middle East, and Africa (AMEA).

In May, Avantor entered into an agreement with Labguru. The collaboration aims to integrate Avantor's IM and e-commerce channel into Labguru's Lab Information Management Software and Electronic Lab Notebook.

In April, Avantor announced its first-quarter 2023 results, wherein it registered a year-over-year uptick in its Europe and AMEA core organic sales. Strength in Avantor’s end markets was also recorded.

Price Performance

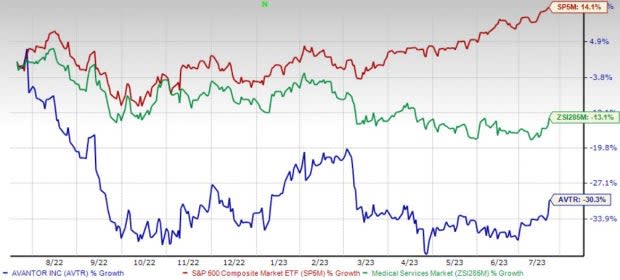

Shares of Avantor have lost 30.3% in the past year compared with the industry’s 13.1% decline. The S&P 500 witnessed 14.1% growth in the said time frame.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, Avantor carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Becton, Dickinson and Company BDX, popularly known as BD, HealthEquity, Inc. HQY and Boston Scientific Corporation BSX.

BD, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 10.1%. BDX’s earnings surpassed estimates in all the trailing four quarters, with an average of 5.8%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

BD has gained 6.7% compared with the industry’s 16.5% rise over the past year.

HealthEquity, flaunting a Zacks Rank #1 at present, has an estimated long-term growth rate of 22%. HQY’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 9.1%.

HealthEquity has gained 9.8% against the industry’s 13.1% decline over the past year.

Boston Scientific, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 11.5%. BSX’s earnings surpassed estimates in two of the trailing four quarters and missed in the other two, the average surprise being 1.9%.

Boston Scientific has gained 39.8% against the industry’s 23.8% decline over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Becton, Dickinson and Company (BDX) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Avantor, Inc. (AVTR) : Free Stock Analysis Report