Avantor's (AVTR) New Offerings to Aid Cell and Gene Therapy Suite

Avantor, Inc. AVTR recently expanded its cell science offerings to include MULTISCREEN cell lines, membranes and custom cell engineering and assay services from Multispan, Inc. The latest Multispan offerings in its portfolio are currently available for customers in the United States, Canada and Europe.

MULTISCREEN cell lines, membranes and custom cell engineering and assay services will be available to purchase via Avantor’s global e-commerce platform and its direct regional sales force.

The latest expanded cell science offerings are expected to significantly solidify Avantor’s foothold in the global cell and gene therapy space.

Significance of the Offerings

The new offerings are expected to support the rapidly growing cell and gene therapy market and other life science research markets. Avantor’s life sciences customers will likely have access to Multispan’s proprietary stable cell lines and cell membranes, as well as custom cell engineering and cellular assay services.

Avantor’s management believes that cell and gene therapies are a rapidly growing area that holds great promise. The company expects to provide its customers with products, materials and services that would aid in accelerating advanced therapeutics.

Multispan’s management feels that being a supplier to Avantor will likely enable its broad range of proprietary products and custom services to seamlessly reach a vast network of scientists and researchers and help accelerate their drug discovery research.

Industry Prospects

Per a report by Coherent Market Insights, the global cell and gene therapy market was valued at $22.7 billion in 2023 and is anticipated to witness a CAGR of 28.7% between 2023 and 2030. Factors like the increasing demand for innovative treatments and the developing interest in cell and gene treatments for cancer treatments are likely to drive the market.

Given the market potential, the latest expanded cell science offerings will likely provide a significant impetus to Avantor in the cell and gene therapy space worldwide.

Notable Developments

Last month, Avantor reported its third-quarter 2023 results, wherein it witnessed continued strong growth in sales to its higher education customers and the biomaterials platform. On the third-quarter earnings call, management confirmed that Avantor’s focus on cell and gene therapy has been yielding double-digit growth in several critical product lines targeting these workflows. Management also confirmed that Avantor continued to add innovative proprietary products to the portfolio with its Avantor magnetic mixing system for single-use mixing needs and J.T. Baker MCA tips for the Tecan Fluent Handling platform.

In July, Avantor announced its plans to relocate and significantly expand its Innovation Center in Bridgewater, NJ. The latest expansion plans are expected to significantly solidify Avantor’s foothold in the cell and gene therapy and mRNA space, among others, and boost its Research & Development and Innovation wing.

Price Performance

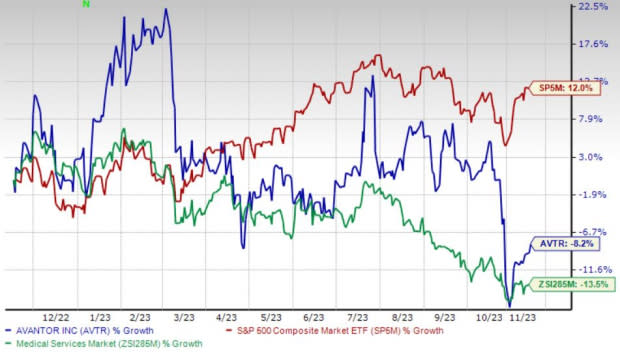

Shares of Avantor have lost 8.2% in the past year compared with the industry’s 13.5% decline. The S&P 500 has witnessed 11.9% growth in the said time frame.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Currently, Avantor carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, HealthEquity, Inc. HQY and Integer Holdings Corporation ITGR.

DaVita, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated long-term growth rate of 18.3%. DVA’s earnings surpassed estimates in all the trailing four quarters, with an average surprise of 36.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita has gained 32.9% against the industry’s 0.5% decline over the past year.

HealthEquity, flaunting a Zacks Rank of 1 at present, has an estimated long-term growth rate of 26.7%. HQY’s earnings surpassed estimates in all the trailing four quarters, with an average of 13%.

HealthEquity has gained 18.5% against the industry’s 13.5% decline over the past year.

Integer Holdings, carrying a Zacks Rank of 2 (Buy) at present, has an estimated long-term growth rate of 15.8%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 11.9%.

Integer Holdings has gained 23.6% against the industry’s 11.9% decline over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report

Avantor, Inc. (AVTR) : Free Stock Analysis Report