Avery Dennison Corp (AVY) Posts Mixed Fourth Quarter and Full Year 2023 Results

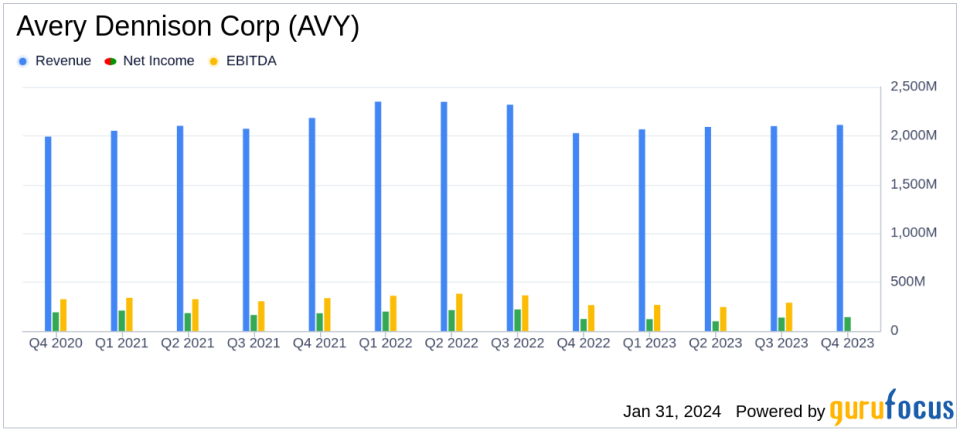

Net Sales: Q4 net sales increased by 4.2% to $2.11 billion, full-year sales declined by 7.5% to $8.36 billion.

Operating Income: Q4 operating income rose by 18% to $220.4 million, full-year operating income decreased by 27% to $782.9 million.

Net Income: Q4 net income improved by 16% to $143.1 million, full-year net income dropped by 34% to $503.0 million.

Earnings Per Share (EPS): Q4 EPS increased by 17% to $1.77, full-year EPS decreased by 33% to $6.20.

Adjusted EBITDA: Q4 adjusted EBITDA up by 16% to $338.1 million, full-year adjusted EBITDA down by 7.5% to $1.26 billion.

Capital Deployment: $225 million spent on acquisitions and $394 million returned to shareholders in 2023.

2024 Guidance: Projected reported EPS of $8.65 to $9.15 and adjusted EPS of $9.00 to $9.50.

On January 31, 2024, Avery Dennison Corp (NYSE:AVY) released its 8-K filing, detailing its fourth quarter and full year 2023 financial results. The company, a global materials science and digital identification solutions provider, faced a challenging year marked by significant inventory destocking but is looking forward to a rebound in 2024.

Avery Dennison manufactures pressure-sensitive materials, merchandise tags, and labels, and operates a specialty converting business that includes radio-frequency identification (RFID) inlays and labels. With a substantial portion of its revenue generated from international operations, the company's performance is a bellwether for the broader Packaging & Containers industry.

Despite a year-over-year decline in full-year net sales, the company's fourth quarter showed improvement, with a 4.2% increase in net sales to $2.11 billion. The Solutions Group segment was a strong performer, with an 18.3% increase in Q4 sales, driven by a 13.9% organic growth. However, the Materials Group experienced a 1.6% decline in Q4 sales.

Operating income for the fourth quarter rose to $220.4 million, an 18% increase, reflecting the company's strategic focus on cost reduction and efficiency. However, full-year operating income saw a significant decline of 27% to $782.9 million, due to the challenging market conditions faced throughout the year.

Net income for the fourth quarter was $143.1 million, a 16% increase from the previous year, while full-year net income fell by 34% to $503.0 million. Earnings per share for the fourth quarter increased by 17% to $1.77, but the full-year figure dropped by 33% to $6.20.

The company's adjusted EBITDA for the fourth quarter improved by 16% to $338.1 million, while the full-year adjusted EBITDA decreased by 7.5% to $1.26 billion. The adjusted EBITDA margin for the fourth quarter was 16.0%, up from 12.9% in the same period last year.

In terms of capital deployment, Avery Dennison invested $225 million in acquisitions and returned $394 million to shareholders through dividends and share repurchases in 2023. The company's net debt to adjusted EBITDA ratio stood at 2.4x at the end of the fourth quarter.

Looking ahead to 2024, Avery Dennison expects reported earnings per share of $8.65 to $9.15 and adjusted earnings per share of $9.00 to $9.50. The company's CEO, Deon Stander, remains confident in the execution of their strategies and the achievement of long-term goals for value creation.

Despite the mixed results, Avery Dennison's strategic focus on Intelligent Labels and cost reduction actions, including approximately $69 million in pre-tax savings from restructuring, positions the company for a potential rebound in the coming year.

For more detailed financial information and analysis, investors are encouraged to review the full 8-K filing and supplemental materials provided by Avery Dennison.

Explore the complete 8-K earnings release (here) from Avery Dennison Corp for further details.

This article first appeared on GuruFocus.