Aviat Networks (AVNW): A Fairly Valued Stock in the Hardware Industry

Aviat Networks Inc (NASDAQ:AVNW) recently recorded a daily gain of 15.7% and a three-month gain of 8.14%. With an Earnings Per Share (EPS) (EPS) of 1.06, the question arises: is the stock fairly valued? This article provides a comprehensive valuation analysis of Aviat Networks, offering insights into the company's financial performance and intrinsic value.

Company Overview

Aviat Networks Inc is a global provider of networking solutions. The company designs, manufactures, and sells wireless networking products, solutions, and services to a wide range of clients, including mobile and fixed operators, private network operators, government agencies, transportation and utility companies, public safety agencies, and broadcast network operators. Aviat Networks operates in various regions, including the United States, Western and Southern Africa, the Philippines, and the European Union.

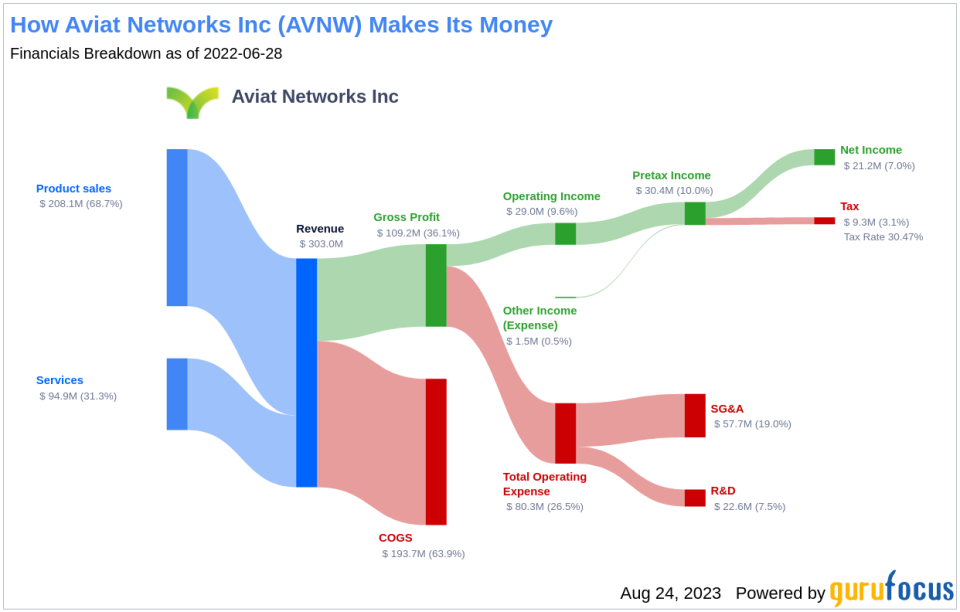

Here's a breakdown of Aviat Networks' income:

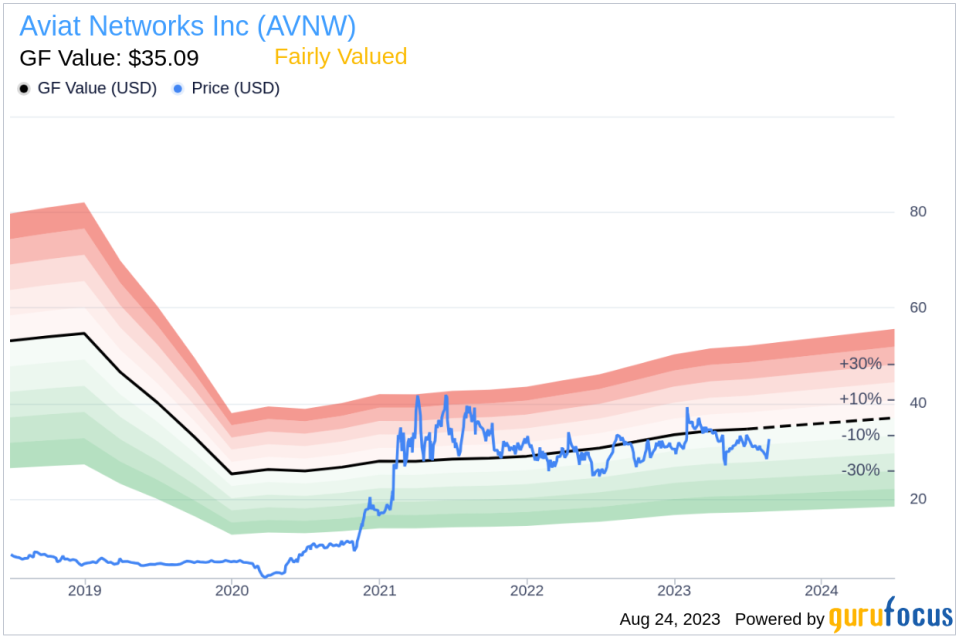

Understanding the GF Value

The GF Value is a unique valuation method that provides an estimation of a stock's intrinsic value. The GF Value is calculated based on historical trading multiples, an adjustment factor based on the company's past performance and growth, and future business performance estimates. The GF Value Line offers a visual representation of the stock's fair trading value.

Aviat Networks (NASDAQ:AVNW) appears to be fairly valued according to the GF Value. The stock's current price of $33.05 per share aligns closely with our estimation of its fair value. With a market cap of $378.10 million, Aviat Networks' future returns are likely to be close to the rate of its business growth, given that it is fairly valued.

For more potential high return opportunities, check out these high-quality, low capex companies.

Financial Strength of Aviat Networks

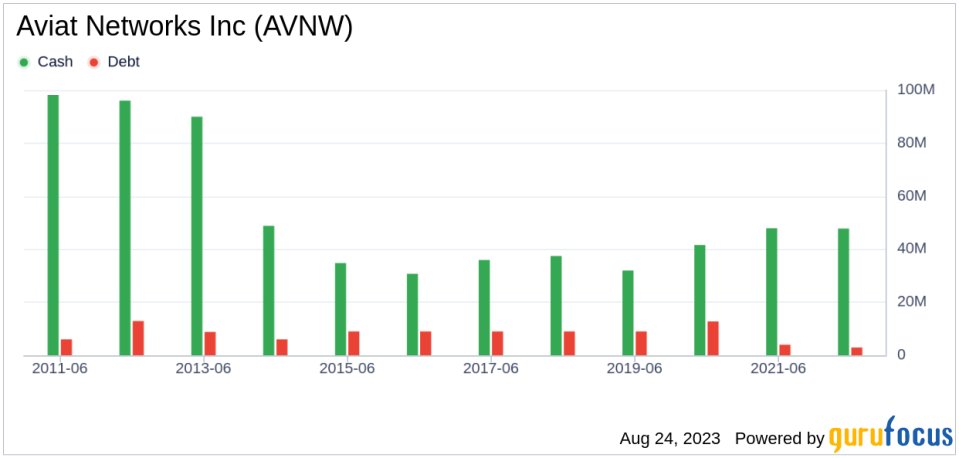

Investing in companies with robust financial strength can mitigate the risk of permanent capital loss. Aviat Networks has a cash-to-debt ratio of 2.45, ranking better than 61.26% of companies in the Hardware industry. This suggests a fair balance sheet and a financial strength rank of 7 out of 10.

Here's a look at Aviat Networks' debt and cash over the years:

Profitability and Growth

Investing in profitable companies typically carries less risk. Aviat Networks has been profitable for 5 out of the past 10 years, with an operating margin of 8.65%, better than 70.78% of companies in the Hardware industry. However, its profitability is considered poor overall.

On the growth front, Aviat Networks' average annual revenue growth is 5.7%, ranking better than 54.54% of companies in the Hardware industry. Its 3-year average EBITDA growth is 73.2%, ranking better than 95.38% of companies in the industry.

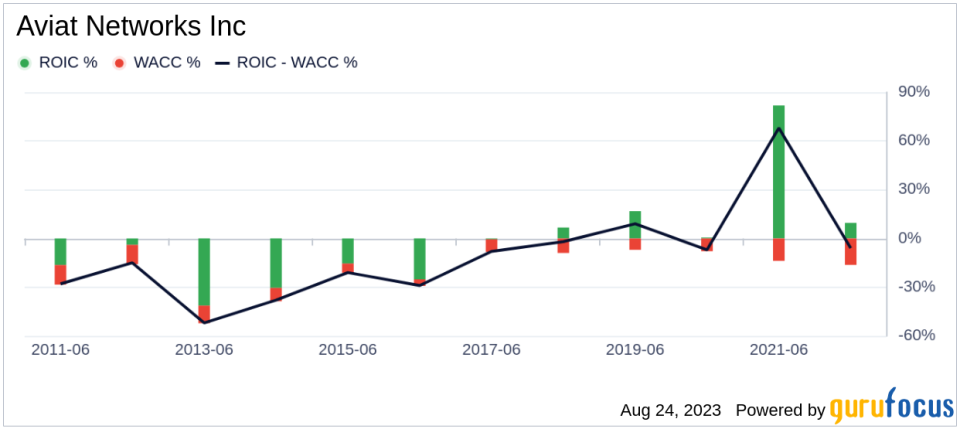

ROIC vs WACC

Comparing a company's Return on Invested Capital (ROIC) to its Weighted Average Cost of Capital (WACC) can provide insights into its profitability. When the ROIC is higher than the WACC, it suggests the company is creating value for shareholders. Over the past 12 months, Aviat Networks' ROIC was 6.15, while its WACC was 14.67.

Here's a historical comparison of Aviat Networks' ROIC and WACC:

Conclusion

In conclusion, Aviat Networks (NASDAQ:AVNW) appears to be fairly valued. The company's financial condition is fair, but its profitability is poor. Its growth, however, ranks better than 95.38% of companies in the Hardware industry. For more detailed financial information about Aviat Networks, you can check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, check out GuruFocus' High Quality Low Capex Screener.

This article first appeared on GuruFocus.