Aviat Networks Inc (AVNW) Reports Fiscal 2024 Second Quarter Results, Raises Full Year Guidance

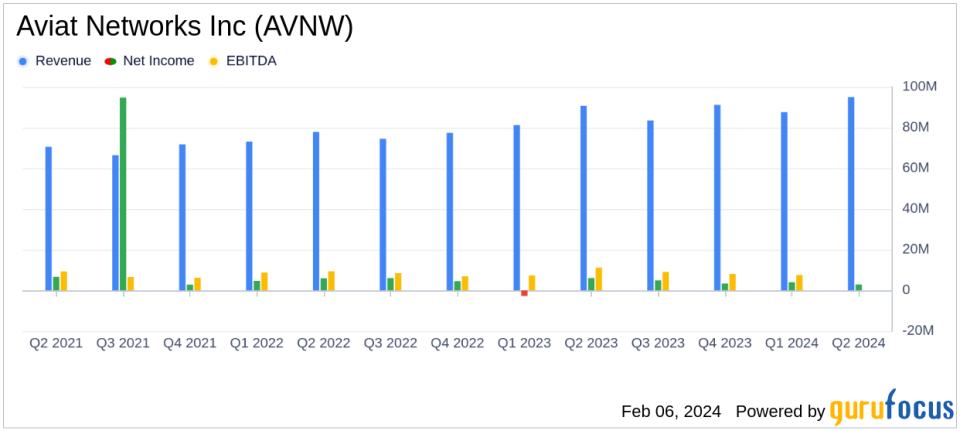

Total Revenue: $95.0 million, a 4.8% increase year-over-year.

Gross Margin: Improved to 38.8%, up 330 basis points from the previous year.

Operating Income: GAAP operating income was $5.0 million; Non-GAAP operating income reached $12.6 million.

Net Income: GAAP net income stood at $2.9 million, with earnings per diluted share of $0.24.

Adjusted EBITDA: Grew by 6.5% year-over-year to $13.7 million.

Balance Sheet: Cash and cash equivalents totaled $45.9 million, with a net debt of $3.6 million.

Full Year Guidance: Raised to a revenue between $425 and $432 million and Adjusted EBITDA between $51.0 and $56.0 million.

On February 6, 2024, Aviat Networks Inc (NASDAQ:AVNW) released its 8-K filing, announcing financial results for the fiscal second quarter ended December 29, 2023. The company, a leading expert in wireless transport solutions, reported a year-over-year increase in total revenue to $95.0 million, marking a 4.8% growth. This performance reflects the company's consistent focus on delivering high-quality wireless networking products and solutions to a global customer base.

Financial Performance and Challenges

Aviat Networks Inc (NASDAQ:AVNW) has demonstrated a robust financial performance with a notable increase in gross margin to 38.8%, up 330 basis points compared to the same quarter last year. This improvement was attributed to higher software sales and favorable project mix. However, GAAP operating income saw a decrease of 42.5% to $5.0 million, primarily due to merger and acquisition-related expenses. Despite this, the company achieved a record adjusted EBITDA margin and raised its full-year guidance, signaling confidence in its operational efficiency and market position.

Key Financial Metrics

Aviat Networks Inc (NASDAQ:AVNW)'s financial achievements are critical in the competitive hardware industry, where margins can be tight and innovation is key. The company's ability to improve gross margins while expanding its revenue base is a testament to its strategic focus on high-margin software sales and efficient project execution. Additionally, the company's successful acquisition and integration of NEC Corporation's wireless transport business, referred to as 'Pasolink', is expected to further strengthen its market position.

From the income statement, the company reported a non-GAAP net income of $11.9 million, or $0.97 per share, compared to $11.1 million, or $0.94 per share in the prior year. The balance sheet shows a healthy cash position of $45.9 million, with total debt increasing to $49.7 million due to the acquisition of Pasolink. The cash flow statement details were not provided in the summary, but the increase in cash and cash equivalents suggests positive cash flow performance.

"This quarter was significant for Aviat Networks in many ways. We executed on revenue and gross margin growth and reached a record adjusted EBITDA margin. Aviat also closed its transformational acquisition of the NEC Wireless business, which we now refer to as Pasolink, said Pete Smith, President and Chief Executive Officer of Aviat Networks.

Analysis of Company's Performance

Aviat Networks Inc (NASDAQ:AVNW) has shown resilience in a challenging market, with its 14th consecutive quarter of growth in both revenue and Adjusted EBITDA on a trailing twelve-month basis. The company's strategic acquisitions and focus on high-margin products have positioned it well for future growth. However, the increase in operating expenses, primarily due to the acquisition, has impacted operating income, which investors should monitor in future quarters.

The company's raised guidance for the full fiscal year 2024 indicates management's confidence in the continued growth trajectory and potential synergies from the Pasolink integration. Value investors may find Aviat Networks Inc (NASDAQ:AVNW) an attractive proposition due to its solid financials, strategic growth initiatives, and management's commitment to operational excellence.

For a more detailed analysis and ongoing updates, investors are encouraged to visit GuruFocus.com for comprehensive financial data and investment insights.

Explore the complete 8-K earnings release (here) from Aviat Networks Inc for further details.

This article first appeared on GuruFocus.