AvidXchange (AVDX) to Report Q2 Earnings: What to Expect

AvidXchange Holdings AVDX is slated to release its second-quarter 2023 results on Aug 2.

For the second quarter, the Zacks Consensus Estimate for revenues stands at $89 million, suggesting an increase of 16.22% from the figure reported in the year-ago quarter.

The consensus mark for loss stands at 5 cents per share, suggesting an increase of 16.22% from the year-ago quarter.

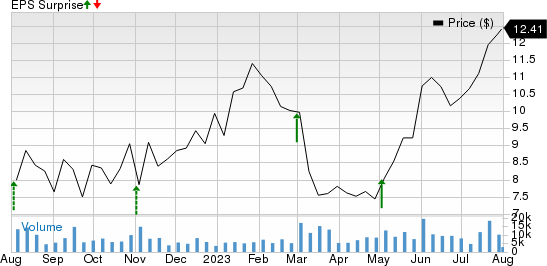

AvidXchange’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 53.46%.

AvidXchange Holdings, Inc. Price and EPS Surprise

AvidXchange Holdings, Inc. price-eps-surprise | AvidXchange Holdings, Inc. Quote

Let’s see how things have shaped up for this announcement.

Factors to Note

AvidXchange’s second-quarter performance is likely to have benefited from its expanding portfolio and strong partner base that includes the likes of CINC Systems and Corelation.

The company has been gaining customers in the construction vertical, thanks to its TimberScan and Titanium suite of flagship accounts payable processing and content management software.

In the to-be-reported quarter, AvidXchange announced Lien Waiver Management for TimberScan, a premium feature embedded in its full purchase-to-pay solution with a seamless Sage 300 CRE integration. The feature improves the payment process for construction industry professionals, which is expected to have aided the user base in second-quarter 2023.

AVDX’s expansion into the hospitality vertical is expected to have driven top-line growth. The vertical comprises roughly 10,000 middle market customers, including subsegments such as recreation and country clubs.

At the end of the first quarter, the company had already gained 50 hospitality customers organically. AVDX also inked a partnership with M3, which has a customer base of more than 1,000 management groups and owner-operators, including 50% of the top U.S. hotel managers and operators.

What Our Model Says

Per the Zacks model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

AvidXchange has an Earnings ESP of 0.00% and a Zacks Rank #2 currently. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks to Consider

Here are a few companies worth considering, as our model shows that these have the right combination of elements to beat on earnings in their upcoming releases:

Itron ITRI has an Earnings ESP of +7.61% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Itron shares have gained 51.1% year to date. ITRI is set to report its second-quarter 2023 results on Aug 3.

Super Micro Computer SMCI has an Earnings ESP of +15.84% and a Zacks Rank of 1, at present.

Super Micro shares have surged 307.4% year to date. SMCI is set to report its fourth-quarter fiscal 2023 results on Aug 8.

BILL Holdings BILL has an Earnings ESP of +4.35% and a Zacks Rank #2.

BILL Holdings shares have gained 90.3% in the year-to-date period. BILL is set to report its fourth-quarter fiscal 2023 results on Aug 17.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Itron, Inc. (ITRI) : Free Stock Analysis Report

Super Micro Computer, Inc. (SMCI) : Free Stock Analysis Report

AvidXchange Holdings, Inc. (AVDX) : Free Stock Analysis Report

BILL Holdings, Inc. (BILL) : Free Stock Analysis Report