Avient (AVNT) Declares Debt Paydown & Refinancing of Term Loan

Avient Corporation AVNT announced the successful completion of its senior secured term loan re-pricing and extension. The revision to the term loan agreement is expected to reduce the interest rate on all outstanding term loans and extend the maturity date for all outstanding tranches to 2029, among other things. The company paid off $100 million in existing term loans, bringing the total outstanding balance to $732 million.

Pursuant to the amendment, the term loan will have interest at the sum of the Base Rate plus 1.50% or the total of the Adjusted Term SOFR plus 2.50%. The $100-million pay down and the reduced interest rate will have a net annual impact on interest expense of about $10 million.

Adjusted earnings of Avient in the second quarter of 2023 declined to 63 cents per share from 83 cents in the year-ago quarter. The figure surpassed the Zacks Consensus Estimate of 61 cents.

Avient had cash and cash equivalents of $528.7 million at the end of 2021, down around 18% year over year. Long-term debt was $2,179.2 million, up roughly 74% from the year-ago quarter’s level.

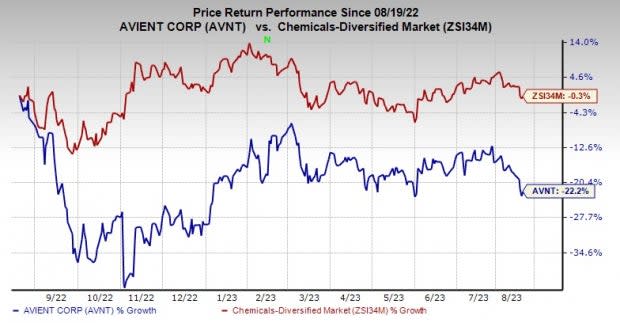

Shares of Avient have lost 22.2% over the past year compared with its industry’s 0.3% decline.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Avient currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Carpenter Technology Corporation CRS, Denison Mine Corp. DNN and Veritiv Corporation VRTV.

Capenter Technology currently sports a Zacks Rank #1 (Strong Buy). CRS’ shares have rallied roughly 49.6% in the past year. The company’s earnings beat the Zacks Consensus Estimate in three of the last four quarters and missed once, delivering an average surprise of 9.8%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Denison Mines currently sports a Zacks Rank #1. Its shares have risen roughly 18% in the past year. DNN’s earnings beat the Zacks Consensus Estimate in three of the last four quarters and met once, delivering an average surprise of 75%.

Veritiv currently carries a Zacks Rank #2 (Buy). Its shares have rallied roughly 22.7% in the past year. VRTV’s earnings beat the Zacks Consensus Estimate in three of the last four quarters and missed once, delivering an average surprise of 6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Denison Mine Corp (DNN) : Free Stock Analysis Report

Veritiv Corporation (VRTV) : Free Stock Analysis Report

Avient Corporation (AVNT) : Free Stock Analysis Report