Avis Budget (CAR) Gains 34% in Year-to-Date Period: Here's How

Avis Budget Group, Inc. CAR has had an impressive run in the year-to-date period, gaining 34%. The gain significantly outperformed the 18% increase of the industry and the 15.3% rise of the Zacks S&P 500 composite.

What’s Aiding the Stock?

Avis Budget posted better-than-expected earnings and revenue performance in the last four quarters, with an average of 65.2% driven by strong demand, pricing and a robust cost strategy.

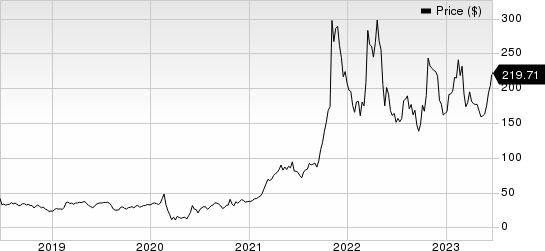

Avis Budget Group, Inc. Price

Avis Budget Group, Inc. price | Avis Budget Group, Inc. Quote

Avis Budget’s ability to cater to different markets has been one of the key differentiators for the company. The company operates through Avis, a premium brand that targets corporate and upscale leisure travelers, while Budget is a mid-tier brand eyeing value-conscious travelers. Zipcar offers an urban alternative to car ownership and Payless and Apex, among other brands, are meant for the value segment.

CAR is continuously investing in technology to improve the quality of its offering. Simplifying customers’ online interaction to make the reservation, pick-up and return process easier and more user-friendly is the company’s main focus. Simultaneously, Avis Budget is trying to invest in newer technology.

The company’s attempts to reward its shareholders through share repurchases are praiseworthy. In 2022, 2021 and 2020, the company bought back shares worth $3.33 billion, $1.46 billion and $119 million, respectively. These moves instill shareholders’ confidence in the shares.

Zacks Rank and Stocks to Consider

CAR currently carries a Zacks Rank #3 (Hold).

Investors interested in the broader Zacks Business Services can consider the following stocks:

Green Dot GDOT: For second-quarter 2023, the Zacks Consensus Estimate of Green Dot’s revenues suggests a decline of 4.5% year over year to $339.2 million and the same for earnings indicates a 59.5% plunge to 30 cents per share. The company has an impressive earning surprise history, beating the consensus mark in all four trailing quarters, the average surprise being 37.3%.

GDOT has a Value score of A and a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Maximus MMS: For second-quarter 2023, the Zacks Consensus Estimate of Maximus’ revenues suggests an increase of 6.9% year over year to $1.2 billion and the same for earnings indicates a 46.2% rise to $1.14 per share. The company has an impressive earning surprise history, beating the consensus mark in three instances and missing on one instance, the average surprise being 9.6%.

MMS has a VGM score of B along with a Zacks Rank of 2.

Rollins ROL: For second-quarter 2023, the Zacks Consensus Estimate of Rollins’ revenues suggests growth of 12.6% year over year to $803.6 million and the same for earnings indicates a 15% increase to 23 cents per share. The company has an impressive earning surprise history, beating the consensus mark in three of the four trailing quarters and missing on one instance, the average surprise being 5.53%.

ROL currently carries a Zacks Rank of 2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

Green Dot Corporation (GDOT) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report

Maximus, Inc. (MMS) : Free Stock Analysis Report