Avis Budget (CAR) Q2 Earnings Beat Estimates but Revenues Missed

Avis Budget Group, Inc. CAR reported mixed second-quarter 2023 results wherein earnings surpassed the Zacks Consensus Estimate but revenues missed the same.

Adjusted earnings of $11.01 per share beat the Zacks Consensus Estimate by more than 12.5% but plunged 30.9% year over year. Total revenues of $3.12 billion missed the consensus estimate by 2.7% and declined 3.7% year over year.

Avis Budget has declined 1.1% from the date of earning release, compared with its industry’s 3.7% decrease.

Segmental Revenues

The Americas segment’s revenues of $2.43 billion were down 5% year over year. The figure missed our estimate of $2.46 billion.

The International segment’s revenues of $695 million beat our estimate of $676.7 million and were up 3% year over year.

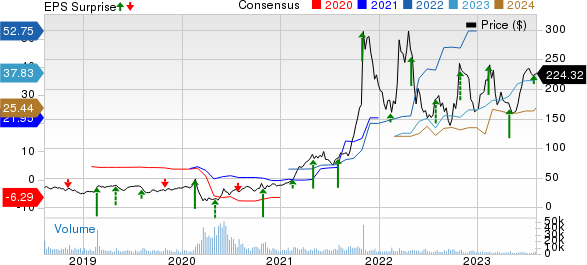

Avis Budget Group, Inc. Price, Consensus and EPS Surprise

Avis Budget Group, Inc. price-consensus-eps-surprise-chart | Avis Budget Group, Inc. Quote

Profitability

Adjusted EBITDA was $737 million, down 39% year over year. Adjusted EBITDA margin was 23.6%, compared with 37.1% in the year-ago quarter.

Adjusted EBITDA for the Americas segment was $631 million, down 39% year over year. Internationally, adjusted EBITDA was $126 million, 31% lower than the year-ago figure.

Balance Sheet and Cash Flow

Avis Budget exited second-quarter 2023 with cash and cash equivalents of $571 million, compared with $548 million at the end of the prior quarter. Corporate debt was $4.7 billion, flat with the reported figure at the end of the prior quarter.

CAR generated $963 million in net cash from operating activities in the reported quarter. Adjusted free cash flow was $202 million while capital expenditures were $78 million in the reported quarter.

Currently, Avis Budget carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings Snapshot

Gartner IT reported better-than-expected second-quarter 2023 results. Adjusted earnings per share (EPS) (excluding 37 cents from non-recurring items) of $2.85 beat the Zacks Consensus Estimate by 14.9% but matched the year-ago reported figure. Revenues of $1.5 billion beat the consensus estimate by 1% and improved 9.2% year over year on a reported basis and 10% on a foreign-currency-neutral basis. Total contract value was $4.6 billion, up 8.9% year over year on a foreign-currency-neutral basis.

Automatic Data ADP reported better-than-expected fourth-quarter fiscal 2023 results. Adjusted EPS of $1.89 (excluding 1 cent from non-recurring items) beat the Zacks Consensus Estimate by 3.3% and grew 26% from the year-ago fiscal quarter’s figure. Total revenues of $4.47 billion beat the consensus estimate by 1.8% and improved 8.5% from the year-ago fiscal quarter’s reading on a reported basis and 9% on an organic constant-currency basis.

TransUnion TRU reported impressive second-quarter 2023 results wherein earnings and revenues beat the Zacks Consensus Estimate. Quarterly adjusted earnings of 86 cents per share (adjusting 58 cents from non-recurring items) surpassed the consensus mark by 3.6% but decreased 12.2% year over year. Total revenues of $968 million beat the consensus mark by 1% and increased 2.1% year over year on a reported basis. Revenues were up 3% on a constant-currency basis, mainly driven by strength in international markets.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

Gartner, Inc. (IT) : Free Stock Analysis Report

TransUnion (TRU) : Free Stock Analysis Report