Avis Budget Group Inc (CAR) Posts Record Annual Revenue Amidst Market Challenges

Annual Revenue: Achieved a record $12.0 billion in 2023, despite a challenging market environment.

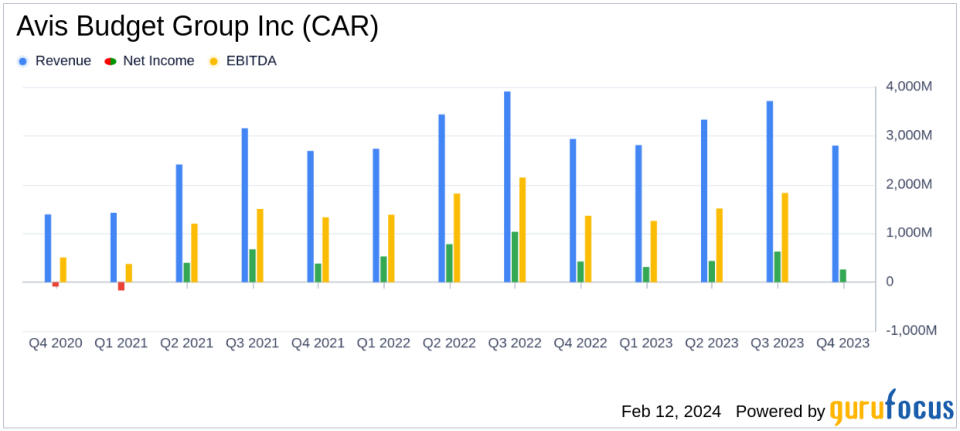

Net Income: Reported $260 million for Q4 and $1.6 billion for the full year, marking robust profitability.

Adjusted EBITDA: Delivered $311 million in Q4 and $2.5 billion for the full year, showcasing strong operational efficiency.

Shareholder Returns: Paid a one-time special cash dividend of $10 per share and repurchased shares worth $889 million in 2023.

Liquidity and Debt Management: Maintained a solid liquidity position with over $800 million in cash and managed corporate debt effectively with no significant maturities until 2026.

On February 12, 2024, Avis Budget Group Inc (NASDAQ:CAR) released its 8-K filing, disclosing its financial results for the fourth quarter and the full year ended December 31, 2023. The company, a leading global provider of mobility solutions, including the well-known Avis, Budget, and Zipcar brands, reported a record annual revenue of $12.0 billion, underscoring its resilience in a challenging market.

Avis Budget Group Inc (NASDAQ:CAR) operates approximately 10,250 rental locations in around 180 countries, with a significant presence in the Americas, Europe, and Australasia. The company's brands cater to various segments of the travel industry, with Avis targeting premium commercial and leisure segments, Budget focusing on value-conscious customers, and Zipcar offering car-sharing services.

The company's performance in 2023 was notable for its record revenue, which was the highest in its history, and the second-best Adjusted EBITDA, amounting to $2.5 billion. Despite a competitive and volatile market, Avis Budget Group Inc (NASDAQ:CAR) managed to achieve these results through improved demand, seasonally adjusted pricing above historical levels, and cost reduction strategies.

However, the company did face challenges, including a decrease in net income and Adjusted EBITDA compared to the previous year. Net income for the fourth quarter was $260 million, a 39% decrease from the same period in 2022, and the full year net income was $1.6 billion, a 41% decrease year-over-year. Adjusted EBITDA also saw a decline, with a 53% decrease in the fourth quarter and a 40% decrease for the full year compared to 2022. These declines highlight the importance of the company's strategic financial management in navigating a difficult economic landscape.

Despite these challenges, Avis Budget Group Inc (NASDAQ:CAR) demonstrated financial strength through its shareholder returns, paying a one-time special cash dividend of $10 per share and repurchasing shares worth $889 million in 2023. The company also maintained a solid liquidity position with over $800 million in cash and approximately an additional $900 million of fleet funding capacity. This financial prudence is crucial for the company's stability and future growth prospects.

Key financial metrics from the income statement include a year-end revenue of $12.0 billion and net income of $1.6 billion. The balance sheet shows a cash and cash equivalents balance of $555 million, with net vehicles valued at $21.24 billion. The company's debt under vehicle programs stood at $18.937 billion, with corporate debt at $4.823 billion. Stockholders' equity attributable to Avis Budget Group Inc (NASDAQ:CAR) improved to $(349) million from $(703) million the previous year.

Joe Ferraro, Avis Budget Group Chief Executive Officer, commented on the results:

"We concluded the year with record revenue and the second-best Adjusted EBITDA in our Companys history. We achieved this through continued demand improvement, seasonally adjusted price well above historical levels, and reducing the costs in our control."

These financial achievements are significant for Avis Budget Group Inc (NASDAQ:CAR) and the broader Business Services industry, as they demonstrate the company's ability to generate revenue and manage costs effectively, even in a challenging economic environment.

In conclusion, Avis Budget Group Inc (NASDAQ:CAR)'s 2023 performance, characterized by record revenue and strategic financial management, reflects the company's resilience and adaptability. While the company faced headwinds that impacted its net income and Adjusted EBITDA, its strong liquidity position, shareholder returns, and proactive debt management position it well for continued success in the future.

Explore the complete 8-K earnings release (here) from Avis Budget Group Inc for further details.

This article first appeared on GuruFocus.