AVITA Medical Inc (RCEL) Reports Robust Revenue Growth in Q4 and Full-Year 2023

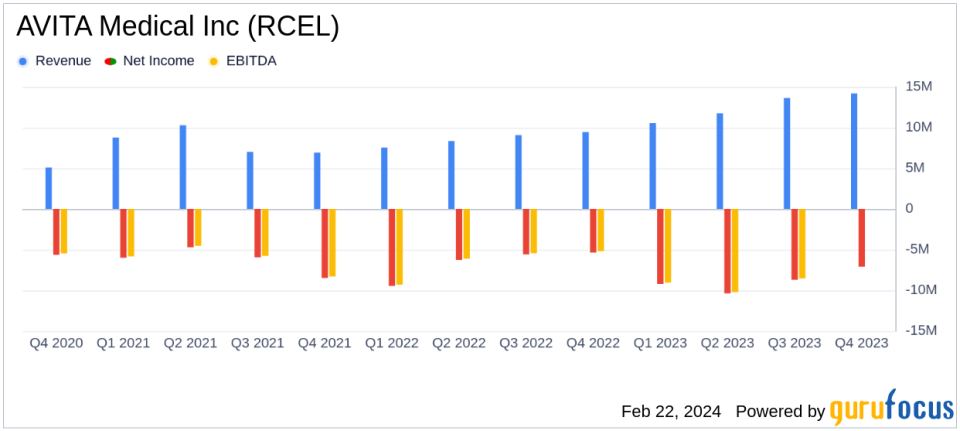

Q4 Commercial Revenue: Increased by approximately 50% to $14.1 million year-over-year.

Full-Year Commercial Revenue: Grew by approximately 46% to $49.8 million compared to 2022.

Gross Profit Margin: Improved to 87.3% in Q4 and 84.5% for the full year.

Net Loss: Q4 net loss widened to $7.1 million, full-year net loss increased to $35.4 million.

2024 Financial Guidance: Anticipates Q1 revenue between $14.8 to $15.6 million and full-year revenue between $78.5 to $84.5 million.

Cash Position: As of December 31, 2023, holds approximately $89.1 million in cash, cash equivalents, and marketable securities.

On February 22, 2024, AVITA Medical Inc (NASDAQ:RCEL) released its 8-K filing, detailing its financial results for the fourth quarter and full-year ended December 31, 2023. The company, known for its innovative RECELL systema device that creates Spray-on Skin Cells for treating burns and other skin defectshas reported significant revenue growth and provided optimistic financial guidance for 2024.

Company Overview

AVITA Medical is a regenerative medicine company with a primary focus on the U.S. market, where it is rolling out its RECELL system across approximately 136 burn centers. While the product is approved in various global markets, the company's current strategy is not to actively market outside the U.S. but to focus on the domestic region. Expansion plans are underway, with a launch expected in Japan through a distribution partner in the second half of fiscal 2022.

Financial Performance and Future Outlook

The company's financial highlights for the fourth quarter show a 50% increase in commercial revenue to $14.1 million, with a gross profit margin of 87.3%. For the full year, commercial revenue rose by 46% to $49.8 million, and the gross profit margin stood at 84.5%. AVITA Medical's cash reserves are robust, with approximately $89.1 million in cash, cash equivalents, and marketable securities as of year-end 2023.

CEO Jim Corbett commented on the company's progress, stating,

We ended the year with yet another quarter of significant growth, marking a year of extraordinary progress. In 2023, we successfully executed a series of strategic initiatives to transform our business."

These initiatives included expanding RECELL indications, doubling the commercial field organization, launching an expanded label for full-thickness skin defects, and establishing an international expansion plan.

Looking ahead, AVITA Medical plans to expand its field sales organization, integrate PermeaDerm Biosynthetic Wound Matrix into its portfolio, and expects FDA approval for RECELL GO with a commercial launch planned for May 31, 2024. The company also anticipates non-U.S. sales following the launch of RECELL in Germany, Austria, and Switzerland in January 2024.

Challenges and Achievements

Despite the growth, AVITA Medical faced an increase in net loss, reporting $7.1 million for Q4 and $35.4 million for the full year, attributed to higher operating expenses in sales and marketing, general and administrative, and research and development. These investments are part of the company's strategy to expand its commercial organization and advance its product pipeline.

The company's financial achievements, particularly the high gross profit margins, are significant in the Medical Devices & Instruments industry, indicating efficient production and strong pricing power. The expected revenue growth and move towards cash flow break-even and GAAP profitability by the third quarter of 2025 reflect the company's confidence in its business model and market strategy.

Financial Tables and Analysis

AVITA Medical's balance sheet remains solid, with an increase in total assets from $98.3 million in 2022 to $111.6 million in 2023. The company's investment in expanding its commercial team and infrastructure is evident in the increase in operating expenses, which is a strategic move to fuel future growth.

The company's guidance for 2024 is bullish, with expected commercial revenue for Q1 in the range of $14.8 to $15.6 million, and full-year revenue projected to be between $78.5 to $84.5 million. This guidance suggests a growth trajectory that could appeal to value investors looking for companies with strong growth potential.

For more detailed financial information and to participate in the upcoming conference call discussing these results and the 2024 revenue guidance, investors and interested parties can register using the link provided in the earnings release.

AVITA Medical's strategic focus on expanding its product indications and sales force, coupled with its robust financial performance, positions the company for sustained growth in the regenerative medicine space. Investors are encouraged to follow the company's progress as it works towards achieving profitability and expanding its global footprint.

For further information and to stay updated on AVITA Medical's financial developments, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from AVITA Medical Inc for further details.

This article first appeared on GuruFocus.