Avnet (AVT) Gains 7% on Q4 Earnings Beat, Strong Q1 Guidance

Avnet AVT shares soared 7% on Wednesday’s extended trading session after the company reported better-than-expected results for the fourth quarter of fiscal 2023 and provided impressive guidance for the current quarter.

The company’s fiscal fourth-quarter non-GAAP earnings were $2.06 per share, which surpassed the Zacks Consensus Estimate of $1.63. However, the reported figure came a penny lower than the year-ago quarter’s non-GAAP earnings of $2.07 per share, mainly due to the negative impact of 39 cents from higher interest expenses.

Revenues advanced 2.9% year over year to $6.4 billion and beat the Zacks Consensus Estimate of $6.24 billion. On a constant-currency basis, fiscal fourth-quarter sales increased 2.9% year over year.

Avnet’s quarterly results benefited from better sales executions. Robust sales in the Americas and the EMEA bolstered revenues in the reported quarter.

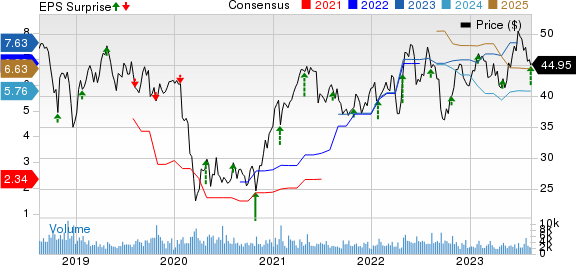

Avnet, Inc. Price, Consensus and EPS Surprise

Avnet, Inc. price-consensus-eps-surprise-chart | Avnet, Inc. Quote

Quarterly Details

The Electronic Components segment’s revenues were up 3% year over year to $6.11 billion on stellar growth across the Americas and EMEA regions. Our estimate for the Electronic Components segment’s revenues was pegged at $5.79 billion.

The Farnell segment’s revenues increased 0.7% to $445.4 million. Our estimate for the Farnell segment’s revenues was pegged at $432.7 million.

Revenues from America increased 7.1% year over year, while the EMEA registered sales growth of 18.7%. However, sales from the Asia region plunged 11.9% year over year.

Avnet reported a gross profit of $818 million, up from the year-ago quarter’s gross profit of $779.6 million. The gross margin improved 30 basis points (bps) year over year to 12.5%.

The adjusted operating income came in at $312.6 million, rising 8.7% year over year. The adjusted operating margin came in at 4.8%, up 26 bps.

Balance Sheet and Cash Flow

As of Jul 1, 2023, AVT had cash and cash equivalents of $288.2 million compared with the $185.9 million reported at the end of the previous quarter.

The long-term debt was $2.99 billion as of Jul 1, down from the $3.03 billion reported in the prior quarter. Avnet generated operating cash flow of $234.5 million in the fourth quarter while using cash worth $713.7 million for operational activities during the full-fiscal 2023.

The company repurchased shares worth $221.7 million and returned $106.3 million to shareholders through dividend payouts in fiscal 2023.

First-Quarter Fiscal 2024 Guidance

Avnet estimates first-quarter fiscal 2024 revenues in the range of $6.15-$6.45 billion (midpoint $6.30 billion). Non-GAAP earnings for the current quarter are anticipated in the range of $1.45-$1.55 per share (midpoint $1.50). The Zacks Consensus Estimate for first-quarter revenues and adjusted earnings is pegged at $5.90 billion and $1.34 per share, respectively.

Zacks Rank & Stocks to Consider

Currently, Avnet carries a Zacks Rank #4 (Sell). Shares of AVT have increased 8.1% year to date (YTD).

Some better-ranked stocks from the broader technology sector are NVIDIA NVDA, Airbnb ABNB and Salesforce CRM. NVIDIA sports a Zacks Rank #1 (Strong Buy), while Airbnb and Salesforce each carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for NVIDIA's second-quarter fiscal 2024 earnings has been revised upward by a couple of cents to $2.06 per share in the past 60 days. For fiscal 2024, earnings estimates have increased by 2 cents to $7.79 per share in the past 30 days.

NVIDIA’s earnings beat the Zacks Consensus Estimate twice in the preceding four quarters while missing the same on two occasions, the average surprise being 0.3%. Shares of NVDA have surged 197.6% YTD.

The Zacks Consensus Estimate for Airbnb’s third-quarter 2023 earnings has been revised 8 cents northward to $2.03 per share in the past 30 days. For 2023, earnings estimates have moved 18 cents upward to $3.66 per share in the past seven days.

Airbnb’s earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 52.6%. Shares of ABNB have rallied 50.7% YTD.

The Zacks Consensus Estimate for Salesforce's second-quarter fiscal 2024 earnings has remained unchanged at $1.90 per share in the past 60 days. For fiscal 2024, earnings estimates have remained unchanged at $7.44 per share in the past 60 days.

Salesforce's earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 15.5%. Shares of CRM have surged 56.1% YTD.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Salesforce Inc. (CRM) : Free Stock Analysis Report

Avnet, Inc. (AVT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Airbnb, Inc. (ABNB) : Free Stock Analysis Report