AVROBIO (AVRO) to Explore Strategic Options, Stock Rises 46%

AVROBIO AVRO announced completing a review of its business encompassing the status of its programs, resources and capabilities as part of its reprioritization efforts. To this extent, the company has decided to halt the development programs of its investigational gene therapy candidates.

Per AVROBIO, the potential strategic alternatives may include, but are not limited to, an acquisition, merger, business combination or other transaction under its evaluation process. In the event of AVROBIO pursuing a transaction, the company refrained from giving its shareholders any assurance that such transaction will be completed on attractive terms.

AVRO has not provided any anticipated date of completion of its evaluation process. Additionally, the company is reluctant to disclose further developments unless and until it is determined that further disclosure is appropriate or necessary.

The stock of the company surged 46% on Wednesday in response to the news. Year to date, shares of AVROBIO have shot up 100.6% against the industry’s 10.5% decline.

Image Source: Zacks Investment Research

We would also like to remind the investors that last month, the company closed the sale of its investigational hematopoietic stem cell (HSC) gene therapy program for cystinosis to Swedish pharma goliath, Novartis NVS. Per the terms of the agreement, Novartis made an upfront payment of $87.5 million in cash to AVROBIO in consideration for the sale and transfer of the latter’s asset.

However, AVRO will reportedly retain full rights to its remaining portfolio of first-in-class HSC gene therapies for Gaucher disease type 1 and type 3, Hunter syndrome and Pompe disease. Additionally, the company has granted Novartis exclusive licenses tocertain other assets, know-how and other intellectual property related to its gene therapy platform for use in cystinosis. AVROBIO also has a separate agreement with Novartis, which will provide certain transition, knowledge transfer and other related services to the latter, playing its part in aiding a smooth transition program.

Management believes that the influx of cash from the asset sale agreement will extend the company’s cash runway into the fourth quarter of 2024.

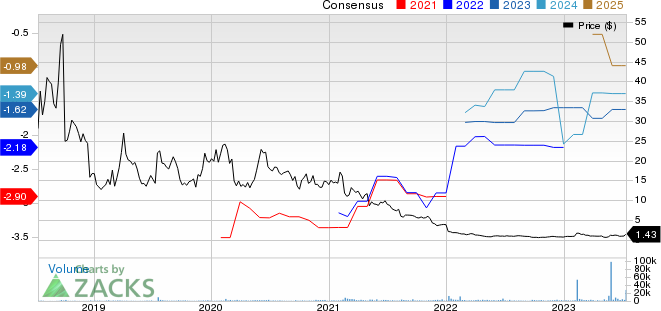

AVROBIO, Inc. Price and Consensus

AVROBIO, Inc. price-consensus-chart | AVROBIO, Inc. Quote

Zacks Rank and Stocks to Consider

AVROBIO currently has a Zacks Rank #3 (Hold).

A couple of better-ranked stocks in the same industry are ADC Therapeutics ADCT and Anixa Biosciences ANIX, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 90 days, the Zacks Consensus Estimate for ADC Therapeutics’ 2023 loss per share has widened from $2.58 to $2.63. During the same period, the estimate for ADC Therapeutics’ 2024 loss per share narrowed from $2.72 to $2.49. Year-to-date, shares of ADCT have lost 60.7%.

ADCT beat estimates in three of the trailing four quarters, missing the mark on one occasion, delivering an average earnings surprise of 10.70%.

In the past 90 days, the Zacks Consensus Estimate for Anixa Biosciences’ 2023 loss per share has narrowed from 43 cents to 33 cents. The estimate for Anixa Biosciences’ 2024 loss per share is currently pegged at 38 cents. Year-to-date, shares of ANIX have lost 26.6%.

ANIX beat estimates in each of the trailing four quarters, delivering an average earnings surprise of 31.21%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novartis AG (NVS) : Free Stock Analysis Report

ADC Therapeutics SA (ADCT) : Free Stock Analysis Report

AVROBIO, Inc. (AVRO) : Free Stock Analysis Report

ANIXA BIOSCIENCES INC (ANIX) : Free Stock Analysis Report