What Awaits Philip Morris (PM) as It Queues for Q3 Earnings?

Philip Morris International Inc. PM is likely to register top-and-bottom-line growth when it reports third-quarter 2023 earnings on Oct 19. The Zacks Consensus Estimate for revenues is pegged at $9.2 billion, suggesting a rise of 14.3% from the prior-year quarter’s reported figure.

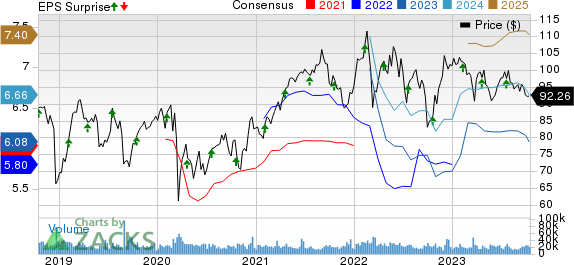

The consensus mark for quarterly earnings has risen by 1.3% in the past seven days to $1.61 per share, implying growth of 5.2% from the year-ago quarter’s reported figure. Philip Morris has a trailing four-quarter earnings surprise of 7.6%, on average.

Factors to Note

Philip Morris has been benefiting from its strong pricing power. Though higher pricing might lead to a possible decline in cigarette consumption, it is seen that smokers tend to absorb price increases due to the addictive quality of cigarettes. Higher pricing variance was an upside to the company’s performance (mainly due to increased combustible tobacco pricing) in the second quarter of 2023. Pricing is likely to have remained a driver in the quarter under review as well.

Philip Morris’ focus on a smoke-free future has been working well. The company is progressing well with its business transformation, with smoke-free products generating 35.4% of its net revenues in the second quarter of 2023. PM is well-placed to become a majority smoke-free company by 2025. Toward this end, the company’s IQOS, a heat-not-burn device, counts among one of the leading RRPs in the industry.

In the second quarter of 2023, revenues from smoke-free products (excluding Wellness and Healthcare) jumped 35.3% to $3,101 million (up 18.3% organically). Total IQOS users at the end of the second quarter were estimated at roughly 27.2 million (including nearly 19.4 million who switched to IQOS and stopped smoking).

For the third quarter, management expects heated tobacco unit (HTU) shipment volumes of 31-33 billion units. We expect smoke-free product revenues (excluding Wellness and Healthcare) to increase 26.1% in the third quarter. Further, our model suggests total HTU shipment volume growth of 17.9% to 32.4 billion units in the third quarter.

Philip Morris International Inc. Price, Consensus and EPS Surprise

Philip Morris International Inc. price-consensus-eps-surprise-chart | Philip Morris International Inc. Quote

However, PM has been battling cost-related headwinds for a while now. In the second quarter of 2023, the adjusted operating income was somewhat affected by global inflationary headwinds associated with direct materials, tobacco leaf, energy and wages. On its last earnings call, management highlighted intentions to make additional growth-oriented investments, including the commercialization of ILUMA. These may have impacted margins in the quarter under review. Our model suggests an adjusted operating margin contraction of 90 basis points for the third quarter.

Apart from this, soft cigarette shipment volumes have been a concern. Cigarette volumes, in general, have been affected by consumers’ rising health consciousness and a shift to low-risk tobacco alternatives. In the second quarter of 2023, cigarette shipment volumes dropped 0.4% to 157 billion units. Our model suggests a 2.1% decline in cigarette shipment volumes for the third quarter.

What the Zacks Model Unveils

Our proven model doesn’t conclusively predict an earnings beat for Philip Morris this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is not the case here.

Philip Morris carries a Zacks Rank #4 (Sell) and has an Earnings ESP of -0.31%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks With the Favorable Combination

Here are three companies worth considering as our model shows that these have the correct combination to beat on earnings this time:

The Boston Beer Company SAM currently has an Earnings ESP of +8.81% and sports a Zacks Rank #1. The company is likely to register bottom-line growth when it reports third-quarter 2023 numbers. The Zacks Consensus Estimate for The Boston Beer Company’s quarterly earnings per share of $4.25 suggests an increase of 11.3% from the year-ago quarter’s levels. You can see the complete list of today’s Zacks #1 Rank stocks here.

SAM has a trailing four-quarter negative earnings surprise of 74.9%, on average. The Zacks Consensus Estimate for The Boston Beer Company’s quarterly revenues is pegged at $592.8 million, indicating a drop of 0.6% from the figure reported in the prior-year quarter.

Colgate-Palmolive Company CL currently has an Earnings ESP of +0.37% and a Zacks Rank of 3. The company is likely to register increases in the top and bottom lines when it reports third-quarter 2023 results. The Zacks Consensus Estimate for Colgate-Palmolive’s quarterly revenues is pegged at $4.8 billion, suggesting growth of 8% from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for quarterly earnings has remained unchanged in the last 30 days at 80 cents per share, which indicates 8.1% growth from the year-ago quarter's reported number. CL delivered an earnings surprise of 1.7%, on average, in the trailing four quarters.

Hershey HSY currently has an Earnings ESP of +1.29% and a Zacks Rank #3. The company is likely to register a top-and-bottom-line increase when it reports third-quarter 2023 numbers. The Zacks Consensus Estimate for the quarterly earnings per share of $2.47 suggests a 13.8% rise from the figure reported in the year-ago quarter.

The Zacks Consensus Estimate for Hershey’s quarterly revenues is pegged at about $3 billion, calling for growth of nearly 9% from the figure reported in the prior-year quarter. HSY has a trailing four-quarter earnings surprise of 8.9%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hershey Company (The) (HSY) : Free Stock Analysis Report

Philip Morris International Inc. (PM) : Free Stock Analysis Report

Colgate-Palmolive Company (CL) : Free Stock Analysis Report

The Boston Beer Company, Inc. (SAM) : Free Stock Analysis Report