What Awaits SBA Communications (SBAC) This Earnings Season?

SBA Communications Corporation SBAC is scheduled to report second-quarter 2022 results on Aug 1, after market close. Results are expected to reflect year-over-year growth in quarterly revenues and funds from operations (FFO) per share.

This Boca Raton, FL-based communications tower REIT delivered a surprise of 2.78% in terms of adjusted FFO (AFFO) per share in the last reported quarter. Results reflected a robust operating performance in the site-leasing and development businesses, both on the domestic and international front. SBA Communications continued to benefit from the addition of sites to its portfolio.

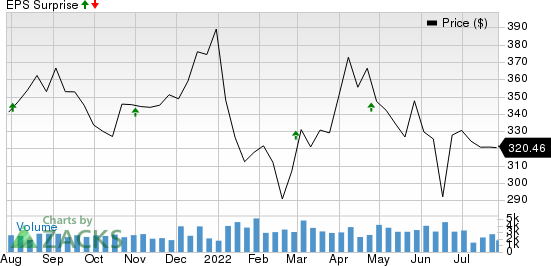

Over the preceding four quarters, SBAC’s AFFO per share surpassed the Zacks Consensus Estimate on each occasion, the average beat being 1.92%. The graph below depicts this surprise history:

SBA Communications Corporation Price and EPS Surprise

SBA Communications Corporation price-eps-surprise | SBA Communications Corporation Quote

Factors at Play

The advancement in 5G mobile technology and the rapid growth of bandwidth-intensive applications have increased mobile data usage globally. Wireless connectivity usage has significantly risen in the recent past owing to the advent of next-generation technologies, rampant usage of network-intensive applications for video conferencing and cloud services and the present flexible-working environment. As a result, to address the growing demand, wireless service providers and carriers are likely to have continued spending on network deployments to harness spectrum abilities and improve and densify their network capacity and coverage.

SBA Communications is likely to have capitalized on the rising demand for its tower sites during the second quarter from carriers seeking network expansion and densification amid the growing mobile data scenario.

Moreover, SBA Communications is known to have a resilient and stable site-leasing business model and generates most of its revenues from long-term (typically 5-10 year) tower leases that have built-in rent escalators. This is expected to have played a key role in SBAC’s second-quarter site-leasing revenue growth.

The consensus estimate for second-quarter site-leasing revenues, which account for the lion’s share of total revenues, is pegged at $565 million, suggesting growth from $559 million reported in the prior quarter and a substantial increase from the year-ago quarter’s tally of $524 million.

SBAC is also expected to have continued with its asset base expansion through acquisitions and developments and the addition of sites to its portfolio during the to-be-reported quarter.

The Zacks Consensus Estimate for second-quarter site-development revenues is pegged at $57 million. This suggests growth from $51 million reported in the year-ago period but a decline from $60 million reported in the prior quarter.

The Zacks Consensus Estimate for second-quarter total revenues is pegged at $625.45 million, implying year-over-year growth of 8.7%.

SBA Communications’ activities during the quarter were adequate to gain analysts’ confidence. The Zacks Consensus Estimate for quarterly FFO per share has been revised a cent upward to $2.98 over the past month. Also, it suggests year-over-year growth of 12.9%.

Earning Whispers

SBA Communications has the right combination of two key ingredients — a positive Earnings ESP and a Zacks Rank #3 (Hold) or higher — for increasing the odds of an earnings beat.

Earnings ESP: SBAC has an Earnings ESP of +0.95 %. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: SBA Communications currently carries a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Stocks That Warrant a Look

Here are some other stocks that are worth considering from the REIT sector, as our model shows that these have the right combination of elements to deliver a surprise this reporting cycle:

Host Hotels & Resorts HST is scheduled to report quarterly figures on Aug 3. HST has an Earnings ESP of +9.18% and a Zacks Rank of 2 (Buy) currently.

Life Storage LSI is scheduled to report quarterly figures on Aug 3. LSI has an Earnings ESP of +0.09% and a Zacks Rank of 3 presently.

Public Storage PSA is slated to report quarterly numbers on Aug 4. PSA has an Earnings ESP of +0.31% and carries a Zacks Rank of 3.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Host Hotels & Resorts, Inc. (HST) : Free Stock Analysis Report

Public Storage (PSA) : Free Stock Analysis Report

Life Storage, Inc. (LSI) : Free Stock Analysis Report

SBA Communications Corporation (SBAC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research