AWR or SJW: Which Water Utility Stock Should You Invest in?

The Zacks Utility - Water Supply industry includes companies that are involved in providing drinking water and wastewater services to industrial, commercial and residential customer classes, along with numerous military bases across the country.

A continuous, uninterrupted supply of clean potable water and reliable sewer services are essential for healthy and hygienic living. Water utilities across the United States carry out this crucial task quietly every day to meet the increasing demand of millions of Americans.

Utility operators own storage tanks, treatment plants and desalination plants to supply uninterrupted potable water across customer classes. Water utility operators also own more than 2 million miles of pipelines that are getting old.

The water and wastewater infrastructure is aging and is gradually nearing the end of its effective service life. Per the U.S. Environmental Protection Agency, an estimated $744 billion investment is necessary to maintain and expand drinking water and wastewater services to meet demand over the next 20 years.

Given the current situation, investor-owned water utilities and the government are funding water and wastewater infrastructure projects to upgrade the necessary infrastructure.

In this article, we run a comparative analysis on two Utility – Water Supply companies — American States Water Company AWR and SJW Group SJW — to decide which stock is a better pick for your portfolio now.

Both stocks currently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Growth Projections

The Zacks Consensus Estimate for American States Water’s 2023 earnings per share and revenues is pegged at $2.96 and $0.58 billion, respectively. The top and bottom lines reflect year-over-year growth of 16.9% and 29.8%, respectively.

The Zacks Consensus Estimate for SJW Group’s 2023 earnings per share and revenues is pegged at $2.47 and $0.64 billion, respectively. The top and bottom lines reflect year-over-year growth of 4% and 2%, respectively.

Return on Equity (ROE)

ROE is a measure of a company’s efficiency in utilizing shareholders’ funds. ROE for the trailing 12 months for American States Water and SJW Group is 13.1% and 7.9%, respectively. American States Water’s ROE is better than the industry’s ROE of 8.98%.

Dividend Yield

Utility companies generally distribute dividends. Currently, the dividend yield of American States Water is 1.99%, while the same for SJW Group is 2.26%. The average dividend yield of the industry is 2.01%.

Debt to Capital & Solvency Ratio

Debt to capital is an essential indicator of a company’s financial position. The indicator shows how much debt is used to run the business. American States Water and SJW Group have a debt to capital of 52% and 56.3%, respectively compared with the industry’s 48.2%.

The times interest earned ratio (TIE) indicates the ability of a company to meet its interest on business debt obligations. At the end of second-quarter 2023, the TIE of American States Water was 5.4 and that of SJW Group was 2.5. The above ratio indicates that AWR generates 5.4 times higher income than its interest expense for the year compared with SJW’s 2.5 times.

Price Performance

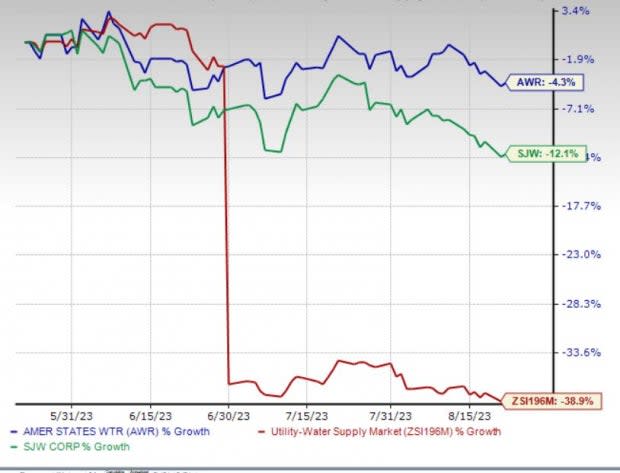

In the past three months, American States Water shares have lost 4.3% compared with the industry's decline of 38.9%. Shares of SJW Group have lost 12.1% in the same time frame.

Image Source: Zacks Investment Research

Outcome

Both companies efficiently provide water and wastewater services to their customers. They are evenly matched and are good picks for your portfolio. But our choice at this moment is American States Water, given its better earnings estimate revision, better return on equity level and lower debt to capital in comparison to SJW Group.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American States Water Company (AWR) : Free Stock Analysis Report

SJW Group (SJW) : Free Stock Analysis Report