Axalta Coating Systems Ltd (AXTA) Reports Solid Growth in Q4 and Full Year 2023 Earnings

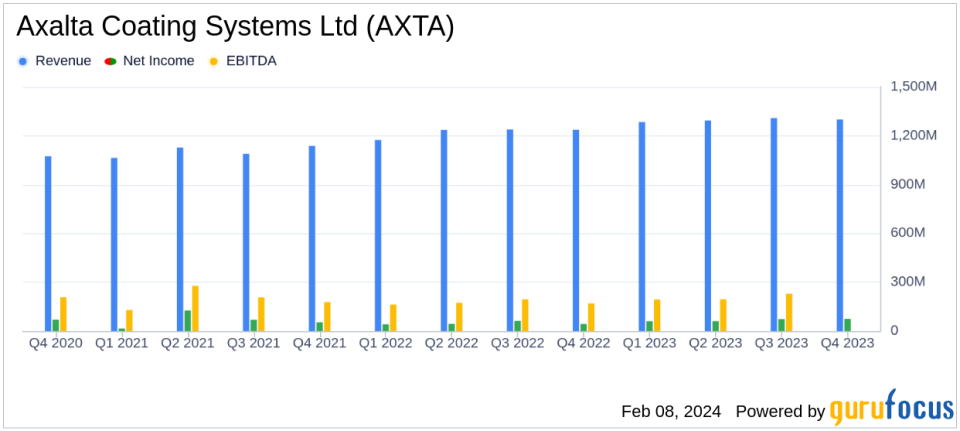

Net Sales: Grew by 4.9% in Q4 and 6.1% for the full year, reaching $1.3 billion and $5.2 billion respectively.

Net Income: Increased significantly to $74 million in Q4, up from $44 million in the same period last year.

Adjusted EBITDA: Improved to $251 million in Q4, marking a $43 million increase year-over-year.

Free Cash Flow: Demonstrated strong performance with $254 million in Q4, an increase from $206 million in the prior year.

Net Leverage Ratio: Achieved the lowest in company history at year-end, standing at 2.9x.

On February 8, 2024, Axalta Coating Systems Ltd (NYSE:AXTA), a leading global coatings company, released its 8-K filing, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its high-performance coatings systems, operates in two segments: Performance Coatings and Mobility Coatings, serving a diverse range of markets including refinish, industrial, and original equipment manufacturers of light and commercial vehicles.

Performance Highlights and Challenges

Axalta's performance in the fourth quarter and the full year of 2023 reflects a resilient business model capable of navigating economic challenges. The company's net sales increase was attributed to a combination of foreign exchange benefits, volume improvements, and price-mix growth. The significant rise in net income was driven by pricing actions, positive mix impacts, and variable cost deflation, which were partially offset by higher productivity investments and increased variable labor expenses.

Despite these positive results, Axalta faced challenges such as soft macroeconomic conditions in North America, particularly in the construction markets, which affected the Industrial volumes in the Performance Coatings segment. Additionally, the company made strategic investments in productivity that increased costs but are expected to yield long-term benefits.

Financial Achievements and Their Importance

The company's financial achievements in 2023, including record sales and Adjusted EBITDA, are particularly important as they demonstrate Axalta's ability to offset inflationary pressures and improve its financial leverage. The lowest net leverage ratio in the company's history signifies a stronger balance sheet and enhanced financial flexibility, which is crucial for sustaining growth and pursuing strategic initiatives in the competitive chemicals industry.

Key Financial Metrics

Axalta's financial strength is further underscored by its solid cash flow performance, with operating activities providing $286 million in the fourth quarter, driven primarily by working capital benefits. The company's liquidity position remains robust, with cash and cash equivalents totaling $700 million and total liquidity of $1.2 billion at year-end.

Adjusted EBITDA margin improvement is another critical metric, reflecting operational efficiency and the company's ability to manage costs effectively. The margin expanded by 250 basis points year-over-year in the fourth quarter, indicating a strong operational performance.

"We finished the year out strong and intend to build on this momentum in 2024," said Chris Villavarayan, Axaltas CEO and President. "2023 was a transformative year. We took decisive action to fully offset lingering inflationary headwinds and as a result achieved record sales and Adjusted EBITDA. We believe we are only just beginning to unlock the potential of this enterprise."

Analysis of Company's Performance

Axalta's strategic actions throughout 2023, including pricing initiatives and cost management, have positioned the company for continued success. The company's focus on offsetting inflationary pressures and improving its product mix has yielded tangible results, as evidenced by the strong growth in net sales and net income. The reduction in gross debt and the improvement in the net leverage ratio demonstrate Axalta's commitment to maintaining a solid financial foundation.

Looking ahead, Axalta provided guidance for the first quarter of 2024, projecting flat net sales year-over-year and an Adjusted EBITDA of approximately $240 million. For the full year 2024, the company anticipates net sales growth in the low-single-digit percentage range, Adjusted EBITDA between $1,010 million and $1,050 million, and Adjusted Diluted EPS between $1.80 and $1.95.

Value investors and potential GuruFocus.com members may find Axalta's disciplined approach to financial management and its strategic positioning in the coatings industry to be compelling reasons to consider the company as a potential investment opportunity.

For more detailed financial information and future updates on Axalta Coating Systems Ltd (NYSE:AXTA), stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Axalta Coating Systems Ltd for further details.

This article first appeared on GuruFocus.