Axcelis (ACLS) Increases Q4 Guidance, Eyes Strong Growth Ahead

Axcelis Technologies ACLS has revised its financial outlook for the fourth quarter of 2023 and reiterated its expectations for 2023. The company is scheduled to report fourth-quarter results on Feb 7, 2024.

The company anticipates fourth-quarter revenues to surpass $300 million, exceeding the earlier estimate of approximately $295 million and reiterates its expectation for 2023 revenues to exceed $1.1 billion. Earnings per diluted share for the same quarter are now projected to exceed $2.05, up from the previous estimate of around $2.00.

The company attributes its impressive financial performance to the adept execution of Axcelis employees and its leading position in the expanding power device market. The company is also optimistic about the sustained health of the power device market in 2024, owing to a robust year-end backlog and strong fourth-quarter bookings.

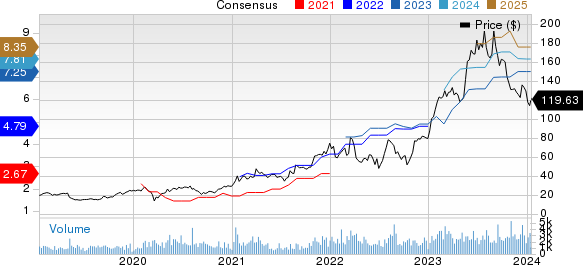

Axcelis Technologies, Inc. Price and Consensus

Axcelis Technologies, Inc. price-consensus-chart | Axcelis Technologies, Inc. Quote

Apart from this, the company anticipates a recovery in the mature process technology and memory segments, which is likely to lead to substantial growth in 2025. The company is likely to achieve its $1.3 billion revenue target in 2025 owing to rising demand for the Purion product family, robust booking strength, and a backlog extending into 2025.

As part of this strategy, it recently set up a new logistics center in Beverly, MA, to boost logistics and warehouse operations. The state-of-the-art facility is designed to provide flexibility for the company's manufacturing operations, expand its customer base, and drive growth in the long haul.

Axcelis is a leading producer of ion implantation equipment used in the fabrication of semiconductors. The top-line performance is being driven by robust customer demand for Purion’s suite of products, especially in the silicon-carbide power market. The silicon-carbide power device market is being driven by the transition to electric vehicles.

ACLS’ performance is likely to be affected by volatile supply-chain dynamics and global macroeconomic weakness. Increasing expenses toward research and development and infrastructure are likely to be headwinds.

ACLS currently carries a Zacks Rank #4 (Sell).

Stocks to Consider

Some better-ranked stocks worth considering in the broader technology space are Blackbaud BLKB, NETGEAR NTGR and Watts Water Technologies WTS. NETGEAR and Blackbaud sport a Zacks Rank #1 (Strong Buy), while Watts Water Technologies carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Blackbaud’s 2023 earnings per share (EPS) has inched up 1.8% in the past 60 days to $3.86. BLKB’s long-term earnings growth rate is 23.4%.

Blackbaud’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 10.6%. Shares of BLKB have gained 31% in the past year.

The Zacks Consensus Estimate for 2023 is pegged at a loss of 9 cents per share for NETGEAR, which remained unchanged in the past 30 days.

NTGR’s earnings outpaced the Zacks Consensus Estimate in three of the last four quarters while missing once. The average surprise being 127.5%. Shares of NTGR have lost 29.5% in the past year.

The Zacks Consensus Estimate for Watts Water Technologies 2023 EPS has improved 3.9% in the past 60 days to $8.08.

WTS’ earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 11.8%. Shares of WTS have soared 23.2% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NETGEAR, Inc. (NTGR) : Free Stock Analysis Report

Axcelis Technologies, Inc. (ACLS) : Free Stock Analysis Report

Blackbaud, Inc. (BLKB) : Free Stock Analysis Report

Watts Water Technologies, Inc. (WTS) : Free Stock Analysis Report