Axcelis (ACLS) Jumps 106% YTD: Will the Uptrend Continue?

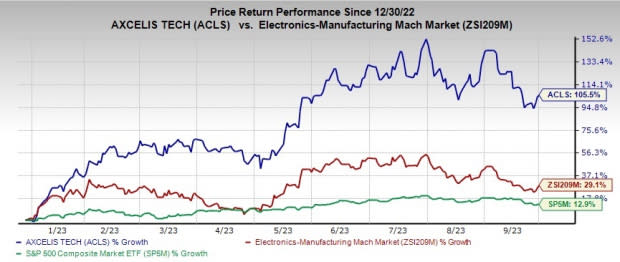

Axcelis Technologies ACLS is witnessing strong momentum, with shares having soared 105.5% year to date compared with 29.1% and 12.9% growth of the sub-industry and S&P Composite, respectively.

With healthy fundamentals and strong growth opportunities, this Zacks Rank #1 (Strong Buy) stock appears to be a solid investment option at the moment.

ACLS’ earnings per share are indicated to increase 28.4% and 16% on a year-over-year basis to $7.01 and $8.13 in 2023 and 2024, respectively. Revenues for 2023 and 2024 are projected to rise 19.7% and 11.1% to $1.1 billion and $1.22 billion, respectively.

The Zacks Consensus Estimate for 2023 and 2024 earnings has risen 7.5% and 9.3%, respectively, in the past 60 days, reflecting analysts’ optimism.

Image Source: Zacks Investment Research

Factors Driving Growth

Axcelis is a leading producer of ion implantation equipment used in the fabrication of semiconductors. The company’s top-line performance is being driven by robust customer demand for Purion suite of product, especially in the silicon-carbide power market. In the second quarter of 2023, ACLS reported revenues of $274 million, up 23.9% year over year.

The transition to electric vehicles is driving the silicon-carbide power device market. This, in turn, is boosting demand for Purion products, especially PurionH200 silicon carbide, Purion XE silicon carbide systems and Purion M silicon carbide tool. The power device market segment represented 39% of the company’s shipped systems revenues in 2022.

Per a report from Mordor Intelligence, the global power electronics market is expected to be valued at $37.72 billion by 2028, registering a CAGR of 4.53% from 2023 to 2038. This augurs well for Axcelis.

In July 2023, the company shipped Purion H200 SiC ion implant system to Wolfspeed, to boost the production of power devices for EV applications. Wolfspeed is a leading silicon carbide technology and production company, which provides solutions for energy consumption.

Driven by solid growth of Purion Power Series product line, management now anticipates revenues for 2023 to be greater than $1.1 billion, up nearly 20% year over year. For the third quarter, Axcelis expects revenues of $280 million.

However, ACLS’ performance is likely to be affected due to volatile supply-chain dynamics and global macroeconomic weakness. Increasing expenses toward research and development, and infrastructure are likely to be headwinds.

Other Key Picks

Some other top-ranked stocks in the broader technology space are Asure Software ASUR, Aspen Technology AZPN and Badger Meter BMI. Asure Software and Aspen Technology presently sport a Zacks Rank #1 each, whereas Badger Meter carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Asure Software’s 2023 EPS has increased 35% in the past 60 days to 54 cents.

Asure Software’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average surprise being 676.4%. Shares of ASUR have surged 76.2% in the past year.

The Zacks Consensus Estimate for Aspen Technology’s fiscal 2024 EPS has gained 6.8% in the past 60 days to $6.58.

Aspen Technology’s long-term earnings growth rate is 17.1%. Shares of AZPN have declined 16% in the past year.

The Zacks Consensus Estimate for Badger Meter’s 2023 EPS has improved 1.4% in the past 60 days to $2.86.

Badger Meter’s earnings outpaced the Zacks Consensus Estimate in all the last four quarters, the average surprise being 6.7%. Shares of BMI have jumped 51.2% in the past year

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Axcelis Technologies, Inc. (ACLS) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

Aspen Technology, Inc. (AZPN) : Free Stock Analysis Report