Axcelis Technologies Inc (ACLS) Reports Record Revenue and Profit for Full Year 2023

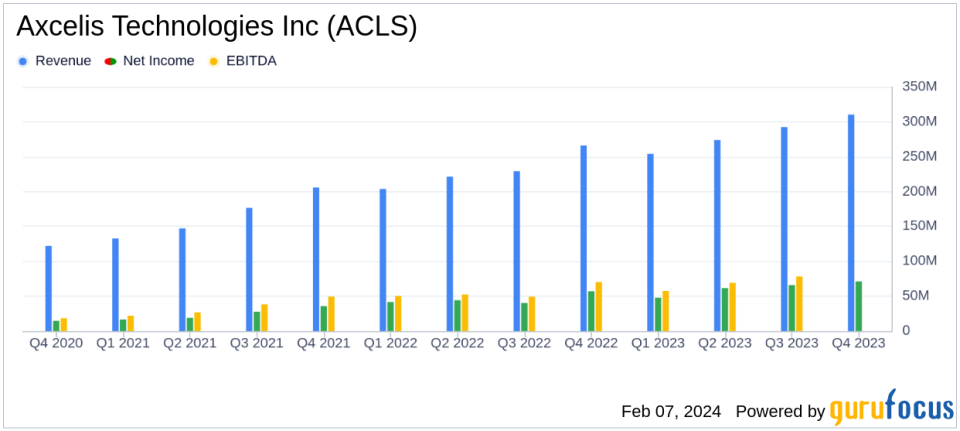

Revenue: Full year 2023 revenue reached a record $1.13 billion, a 23% increase from $920 million in 2022.

Net Income: Net income soared to $246.3 million, up 35% from the previous year, with diluted EPS of $7.43.

Gross Margin: Maintained a strong gross margin of 43.5% for the year, slightly down from 43.7% in 2022.

Q4 Performance: Fourth quarter revenue was $310.3 million with net income of $71.1 million, or $2.15 per diluted share.

Bookings and Backlog: Ended Q4 with bookings of $235.5 million and a systems backlog of $1.2 billion.

2024 Outlook: Expects Q1 revenues of approximately $242 million with an operating profit of around $45 million.

Axcelis Technologies Inc (NASDAQ:ACLS) released its 8-K filing on February 7, 2024, revealing a year of record financial achievements despite a broader industry downturn. The company, known for designing, manufacturing, and servicing ion implantation equipment crucial for semiconductor chip fabrication, has demonstrated resilience and growth in a challenging market environment.

Financial Highlights and Company Resilience

For the full year 2023, ACLS reported an impressive revenue increase to $1.13 billion, up from $920 million in the previous year. This 23% growth is particularly noteworthy as it was achieved during a period when the semiconductor industry faced significant headwinds. The company's systems revenue also saw a substantial rise, reaching $883.6 million, a 28% increase from 2022. Operating profit followed suit, climbing to $265.8 million, marking a 25% increase and setting another company record.

ACLS's net income for the year stood at $246.3 million, with diluted earnings per share (EPS) of $7.43, compared to a net income of $183.1 million and an EPS of $5.46 in 2022, representing a 35% net income year-over-year increase. The gross margin remained robust at 43.5%, although it experienced a slight dip from 43.7% in the previous year.

Fourth Quarter Surge and Executive Insights

The fourth quarter continued the trend of strong performance, with revenue reaching $310.3 million, an increase from the third quarter's $292.3 million. Operating profit for the quarter was $79.1 million, and net income was $71.1 million, or $2.15 per diluted share. The gross margin for the quarter stood firm at 44.4%, consistent with the previous quarter's performance.

"2023 was another outstanding year for Axcelis. As a result of strong execution by the Axcelis team and robust demand for the Purion Power Series product family, we achieved 23% year-over-year revenue growth during an industry downturn," said President and CEO Russell Low. "We believe that the mature process technology and memory segments, two markets in which Axcelis is well-positioned, will recover in the second half of the year, enabling strong growth in 2025."

"We are extremely pleased with our 2023 results, and excited about our future growth. Our revenue and earnings per share finished above our revised guidance, and we ended the quarter with robust cash flow and a strong balance sheet," stated Executive Vice President and Chief Financial Officer Jamie Coogan. "As we look to 2024, we will continue to make investments in R&D while managing expenses, setting us up to achieve our $1.3 billion revenue model in 2025."

Looking Ahead

For the first quarter ending March 31, 2024, Axcelis expects revenues to be approximately $242 million with an operating profit forecast of around $45 million and earnings per diluted share of $1.22. The company anticipates a gross margin of approximately 43.5% for the first quarter and expects it to improve year-over-year, although it may fluctuate quarterly. Full year 2024 revenue is projected to be similar to 2023, with the revenue weighted toward the second half of the year.

ACLS's performance in 2023, highlighted by record revenue and profit, demonstrates the company's ability to navigate industry challenges and capitalize on opportunities. With a strong backlog and a positive outlook for the coming year, Axcelis Technologies Inc (NASDAQ:ACLS) is well-positioned to continue its growth trajectory and deliver value to its shareholders.

Explore the complete 8-K earnings release (here) from Axcelis Technologies Inc for further details.

This article first appeared on GuruFocus.