AXIS Capital (AXS) Q4 Earnings Beat, Revenues Decline Y/Y

AXIS Capital Holdings Limited AXS reported fourth-quarter 2019 operating income of 5 cents per share, which beat the Zacks Consensus Estimate by 150%. In the year-ago quarter, the company had incurred operating loss of $1.77 per share.

The quarter under review witnessed solid premium performance across Insurance and Reinsurance segments. Better investment results and lower expenses were tailwinds in the period.

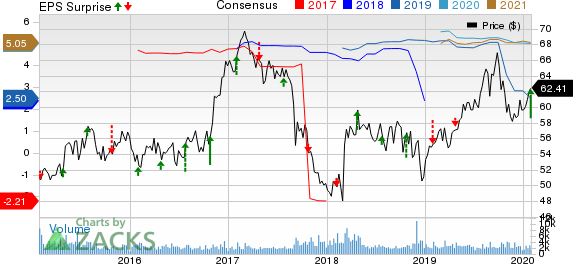

Axis Capital Holdings Limited Price, Consensus and EPS Surprise

Axis Capital Holdings Limited price-consensus-eps-surprise-chart | Axis Capital Holdings Limited Quote

Full-Year Highlights

In 2019, AXIS Capital delivered operating income of $2.52 per share, which beat the Zacks Consensus Estimate by 0.8%. Also, the bottom line improved 31.9% year over year.

Total operating revenues of $5.1 billion matched the Zacks Consensus Estimate but declined 3.1% year over year.

Operational Update

Fourth-quarter operating revenues amounted to nearly $1.29 billion, down 1.8% year over year.

Gross premiums written improved 7.6% year over year to $1.3 billion, largely driven by 4.4% and 19% increase in Insurance and Reinsurance segments, respectively.

Net investment income increased nearly 4% year over year to nearly $117.6 million.

Total expenses in the quarter under review declined 7.8% year over year to $1.3 billion, attributable to lower net losses and loss expenses, amortization of value of business acquired, amortization of intangible assets and reorganization expenses.

AXIS Capital incurred underwriting loss of $49.3 million, narrower than the prior-year quarter’s loss of $194.7 million. Combined ratio improved 1000 basis points (bps) to 107.9%.

Segment Results

Insurance: Gross premiums written improved 4.4% year over year to $961.6 million owing to strong performance in liability and professional lines, driven by new business and favorable rate changes, partially offset by a decrease in credit and political risk lines due to reduced business opportunities.

Net premiums earned decreased 5.2% year over year to $559.6 million.

Underwriting income was $29.7 million against year-ago quarter’s loss of $36.9 million. Combined ratio improved 1140 bps to 94.9%.

Reinsurance: Gross premiums written in the fourth quarter rose 19% year over year to $299.7 million, primarily attributable to increase in liability, property, and professional lines. These increases were partially offset by decreases in catastrophe lines due to lower reinstatement premiums and accident and health lines due to timing differences.

Net premiums earned dropped 1.9% year over year to $612 million.

Underwriting loss of $78.9 million was significantly narrower than the year-ago quarter’s loss of $157.7 million. Combined ratio improved 1050 bps year over year to 113.5%.

Financial Update

AXIS Capital exited the fourth quarter with cash and cash equivalents of $1.2 billion, up 0.7% over the level at 2018 end.

Book value per share increased 11.7% year over year to $55.79 as of Dec 31, 2019.

Operating return on equity totaled 0.4% at the end of the fourth quarter compared with (13.2%) in the year-ago period.

Dividend Update

The company announced a dividend of 41 cents per share in the fourth quarter of 2019.

Zacks Rank

AXIS Capital currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Insurers

Of the insurance industry players that have reported fourth-quarter results so far, RLI Corp. RLI, Brown & Brown, Inc. BRO and The Travelers Companies, Inc. TRV beat the respective Zacks Consensus Estimate for earnings.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

RLI Corp. (RLI) : Free Stock Analysis Report

The Travelers Companies, Inc. (TRV) : Free Stock Analysis Report

Axis Capital Holdings Limited (AXS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research