Axon Enterprise Inc (AXON) Reports Strong Revenue Growth and Expanding Margins in 2023

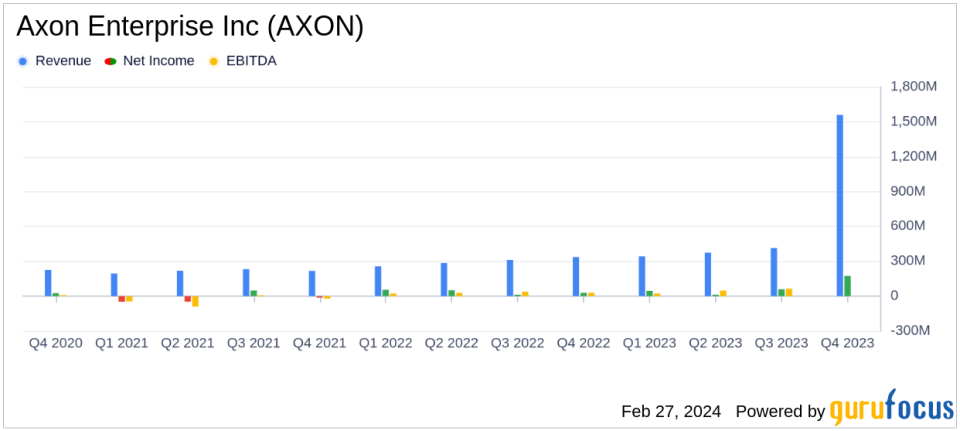

Annual Revenue: Grew by 31% to $1.56 billion in 2023.

Net Income: Achieved $174 million, translating to an 11.1% net income margin.

Adjusted EBITDA: Recorded $329 million, a 21.1% margin.

Product Innovation: Launched TASER 10 and Axon Body 4, contributing to product ecosystem expansion.

Customer Vertical Expansion: Gained traction in U.S. federal, international, justice, corrections, and enterprise sectors.

Strategic Investments: Acquisitions of Sky-Hero and Fusus to enhance ecosystem and expand total addressable market (TAM).

2024 Outlook: Expects annual revenue between $1.88 billion to $1.94 billion and Adjusted EBITDA of $410 million to $430 million.

On February 27, 2024, Axon Enterprise Inc (NASDAQ:AXON) released its 8-K filing, announcing a year of record performance with significant revenue growth and solid profitability. The company, known for its conducted energy devices and cloud-based digital evidence management software, operates in two segments: Taser and software & sensors. These products are designed for law enforcement, corrections, military forces, private security personnel, and private individuals for personal defense.

Financial Performance and Challenges

Axon's 2023 fiscal year was marked by a 31% increase in annual revenue, reaching $1.56 billion, and an 11.1% net income margin, with net income at $174 million. The Adjusted EBITDA margin stood at 21.1%, amounting to $329 million. These results underscore the company's ability to deliver profitable growth at scale, with operating expenses as a percentage of revenue primarily driven by leverage on sales, general, and administrative (SG&A) expenses.

Despite these achievements, Axon continues to face the challenges of a competitive market and the need for continuous product innovation. The company's strategic investments, such as the acquisitions of Sky-Hero and Fusus, aim to enhance its ecosystem and expand its TAM, which is critical for sustaining long-term growth in the Aerospace & Defense industry.

Key Financial Metrics

Important metrics from the financial statements include:

"Annual recurring revenue (ARR) reached $697 million, with a net revenue retention rate of 122%. Total company future contracted revenue stands at $7.14 billion."

ARR is a crucial indicator of the company's predictable and recurring revenue streams, while the net revenue retention rate reflects the company's success in selling new premium features to existing customers. The total future contracted revenue represents the company's backlog and provides visibility into future revenue.

Analysis of Company's Performance

Axon's performance in 2023 was driven by strong product demand, particularly for the TASER 10 and Axon Body 4. The company's focus on product innovation and customer vertical expansion has paid off, with significant growth in emerging customer verticals. Axon's forward-looking statements for 2024 suggest confidence in continued revenue growth and margin expansion, reinforcing the company's position in the market.

The company's commitment to its mission of protecting life and its strategic investments to enhance its product ecosystem are expected to contribute to its long-term success. Axon's ability to innovate and diversify its offerings while realizing efficiencies as the business scales positions it well for future growth.

For a more detailed analysis and insights into Axon Enterprise Inc's financial performance, readers are encouraged to view the full 8-K filing.

Explore the complete 8-K earnings release (here) from Axon Enterprise Inc for further details.

This article first appeared on GuruFocus.