Axsome (AXSM) Q2 Earnings Beat, Stock Dips on Pipeline Updates

Axsome Therapeutics, Inc. AXSM incurred an adjusted loss $1.00 per share in the second quarter of 2023, narrower than the Zacks Consensus Estimate of a loss of $1.24. The loss has been adjusted for stock-based compensation expense, loss/gain in fair value of contingent consideration and intangible asset amortization.

Adjusting for loss/ gain in fair value of contingent consideration and intangible asset amortization, AXSM had reported an adjusted loss of 1.05 cents per share in the year-ago period.

The company’s total revenues of $46.7 million beat the Zacks Consensus Estimate of $40 million. It recorded revenues of $8.8 million in the year-ago period.

Quarter in Detail

Total revenues consist of product revenues from Sunosi (sleep drug), Auvelity (major depressive disorder drug) and royalty revenues.

Net product revenues were $46 million in the quarter compared with $8.8 million in the year-ago period. The figure beat our model estimate of $37.1 million.

Auvelity recorded sales of $27.6 million, up 76% from the previous quarter’s level, reflecting growth in prescription demand. There were no Auvelity sales in the comparable period of 2022. The top line beat our model estimate of $23 million.

Auvelity is Axsome’s first drug, approved for major depressive disorder by the FDA in August 2021 and launched in October 2022.

Sunosi’s net product sales were $18.4 million, up 117% from the year-ago quarter’s level. Total prescriptions for Sunosi grew 15% year over year and 8% sequentially.

Axsome acquired the U.S. rights to Sunosi, a commercialized drug targeting narcolepsy, from Jazz Pharmaceuticals JAZZ in May 2022. It began selling Sunosi in the U.S. market in May 2022 and in certain international markets in November 2022.

In February 2023, Axsome out-licensed its ex-U.S. marketing rights of Sunosi to Pharmanovia. Jazz received approval for Sunosi as a treatment for narcolepsy in 2019. JAZZ is entitled to receive high single-digit royalty on net sales of Sunosi in the United States.

Royalty revenues totaled $0.7 million for the quarter, reflecting Sunosi sales in the out-licensed territories.

Research and development expenses (including stock-based compensation) amounted to $20.6 million, up 30.4% from the year-ago quarter’s level. The increase was due to higher costs associated with clinical studies, personnel and post-marketing commitments for Sunosi and Auvelity.

Selling, general and administrative expenses (including stock-based compensation) totaled $78.9 million, up 153% year over year. The significant increase was due to higher commercial activities for Sunosi and Auvelity.

As of Jun 30, 2023, Axsome had cash and cash equivalents worth $437.1 million compared with $246.5 million as of Mar 31, 2023.

2023 Guidance

Management believes that its cash balance of $437.1 million (as of June 2023 end) is enough to fund future operations into cash flow positivity.

Pipeline Updates

Several label expansion studies on Auvelity are underway for the treatment of other central nervous system (CNS) disorders. Axsome is evaluating Auvelity in a phase III study, ACCORD, for treating agitation associated with Alzheimer’s Disease. It plans to start a pivotal phase II/III study of Auvelity for smoking cessation by the fourth quarter of 2023 or by the first quarter of 2024.

Axsome’s key pipeline candidates, including AXS-07, AXS-12 and AXS-14, target multiple central nervous system indications.

The lead candidate, AXS-07, is being developed for the acute treatment of migraine. In April 2022, Axsome received a complete response letter for a new drug application (NDA) seeking approval for AXS-07 for the acute treatment of the disease.

Axsome now intends to resubmit its NDA in the first half of 2024 (earlier anticipated in the second half of 2023). The FDA has not requested any additional safety or efficacy data for the candidate in light of the NDA resubmission.

The company’s shares were down almost 3.5% on Aug 7, probably due to a delay in the NDA resubmission date for AXS-07. The completion of necessary work for application resubmission progressed slower than initially anticipated, leading to an adjusted timeline for resubmission in the first half of 2024.

Shares of Axsome have lost 7.8% in the year-to-date period compared with the industry’s 13.1% decline.

Image Source: Zacks Investment Research

In the reported quarter, the company initiated a label expansion study of Sunosi in a phase III FOCUS study. The study evaluates the efficacy and safety of Sunosi for the treatment of attention deficit hyperactivity disorder. Top-line data from the study is expected by the second half of 2024.

The company is also planning to submit an NDA by 2023-end or by the first quarter of 2024 to seek approval for AXS-14 in treating fibromyalgia.

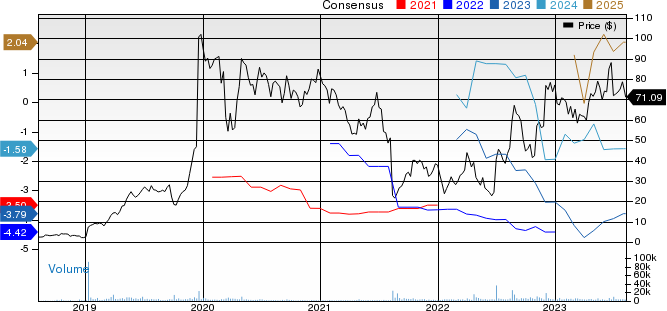

Axsome Therapeutics, Inc. Price and Consensus

Axsome Therapeutics, Inc. price-consensus-chart | Axsome Therapeutics, Inc. Quote

Zacks Rank & Other Stocks to Consider

Currently, Axsome carries a Zacks Rank #2 (Buy).

A couple of other top-ranked stocks in the same industry are ADC Therapeutics ADCT and ImmunoGen IMGN, both carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 90 days, the Zacks Consensus Estimate for ADC Therapeutics has widened from a loss of $2.60 per share to a loss of $2.61 for 2023. The consensus estimate has narrowed from a loss of $2.75 per share to a loss of $2.55 for 2024 during the same time frame. Shares of the company have lost 60.9% year to date.

ADCT’s earnings beat estimates in three of the trailing four quarters and missed the mark in one, delivering an average surprise of 10.70%.

In the past 90 days, the Zacks Consensus Estimate for ImmunoGen has narrowed from a loss of 56 cents per share to a loss of 21 cents for 2023. The consensus estimate has improved from a loss of 30 cents per share to a profit of 3 cents for 2024 during the same time frame. Shares of the company have rallied 234.1% year to date.

IMGN’s earnings beat estimates in three of the trailing four quarters and missed the mark in one, delivering an average surprise of 31.24%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ADC Therapeutics SA (ADCT) : Free Stock Analysis Report

Jazz Pharmaceuticals PLC (JAZZ) : Free Stock Analysis Report

ImmunoGen, Inc. (IMGN) : Free Stock Analysis Report

Axsome Therapeutics, Inc. (AXSM) : Free Stock Analysis Report