Axsome (AXSM) Stock Rises on Stellar Q4 Preliminary Results

Shares of Axsome Therapeutics, Inc. AXSM were up 7.7% on Jan 4 after the company announced robust preliminary results for the fourth quarter and full-year 2023. Axsome also provided regulatory updates on its pipeline candidates while anticipating several top-line data readouts in 2024.

Q4 & Full-Year 2023 Preliminary Results

Preliminary net product revenues are expected to be around $71 million and $204 million for the fourth quarter and full-year 2023, respectively.

For the fourth quarter and full year, AXSM expects Auvelity (AXS-05) net product sales to be around $49 million and $130 million, respectively.

The company anticipates Sunosi (solriamfetol) net product sales to be $22 million and $74 million for the fourth quarter and full-year 2023, respectively.

The net product revenues exclude $66 million in license revenues, which were recognized by Axsome in the first quarter of 2023.

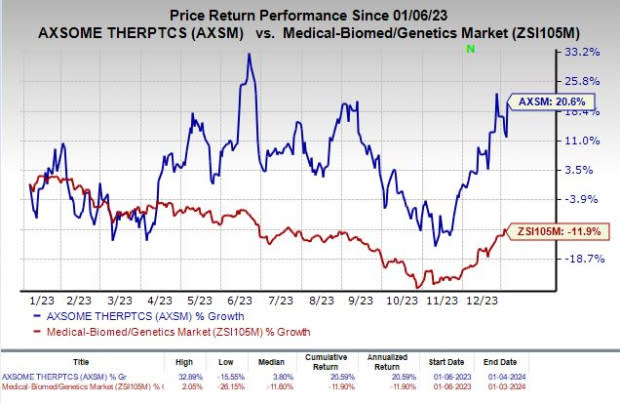

Shares of Axsome have rallied 20.6% in the past year against the industry’s decline of 11.9%.

Image Source: Zacks Investment Research

Axsome currently has two marketed products in its portfolio — Auvelity for major depressive disorder and Sunosi for narcolepsy.

Axsome acquired the U.S. rights to Sunosi from Jazz Pharmaceuticals JAZZ in May 2022. The company began selling Sunosi in the U.S. market in May 2022 and in certain international markets in November 2022.

In February 2023, Axsome out-licensed its ex-U.S. marketing rights of Sunosi to Pharmanovia. JAZZ is entitled to receive high single-digit royalty on net sales of Sunosi in the United States.

Axsome’s top line mainly comprises product revenues from Sunosi and Auvelity sales as well as royalty revenues.

2024 Pipeline Updates

Axsome is evaluating Auvelity in several label expansion studies that are underway for the treatment of other central nervous system (“CNS”) disorders. The phase III ADVANCE-2 study is ongoing for agitation associated with Alzheimer’s Disease. Top-line data from the study is expected in the first half of 2024.

The company also plans to start a pivotal phase II/III study on Auvelity for smoking cessation later in 2024.

Axsome’s other pipeline candidates include AXS-07, AXS-12 and AXS-14, which are being studied for multiple CNS indications.

AXS-07 is being developed for the acute treatment of migraine. The FDA issued a complete response letter to the company’s new drug application (NDA) seeking approval for AXS-07 for the acute treatment of the disease in 2022.

The company plans to resubmit its NDA in the first half of 2024.

AXS-12 is being evaluated in the phase III SYMPHONY study for the treatment of narcolepsy, with top-line data from the same expected in the first quarter of 2024.

AXSM plans to submit an NDA to the FDA to seek approval of AXS-14 for the treatment of fibromyalgia in the first quarter of 2024.

The company is also evaluating Sunosi in several label expansion studies. The phase III FOCUS study is investigating Sunosi for treating attention deficit hyperactivity disorder in adults. Top-line data from the same is expected in the second half of 2024.

Also, the company plans to initiate multiple phase III studies on Sunosi for treating major depressive disorder, binge eating disorder and shift work disorder. All these studies are expected to begin in the first quarter of 2024.

Zacks Rank & Stocks to Consider

Axsome currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the biotech sector are Dynavax Technologies Corporation DVAX and Puma Biotechnology, Inc. PBYI, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for Dynavax Technologies’ 2024 earnings per share have improved from 12 cents to 18 cents. In the past year, shares of DVAX have surged 42.1%.

Earnings of Dynavax Technologies beat estimates in two of the last four quarters while missing the same on the remaining two occasions. DVAX delivered a four-quarter earnings surprise of 293.21%, on average.

In the past 60 days, estimates for Puma Biotechnology’s 2024 earnings per share have improved from 62 cents to 69 cents. In the past year, shares of PBYI have lost 11%.

Earnings of Puma Biotechnology beat estimates in three of the last four quarters while missing the same on the remaining occasion. PBYI delivered a four-quarter average earnings surprise of 76.55%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dynavax Technologies Corporation (DVAX) : Free Stock Analysis Report

Jazz Pharmaceuticals PLC (JAZZ) : Free Stock Analysis Report

Puma Biotechnology, Inc. (PBYI) : Free Stock Analysis Report

Axsome Therapeutics, Inc. (AXSM) : Free Stock Analysis Report