Axsome Triumphs Over Major Depressive Disorder With Auvelity

Axsome Therapeutics Inc. (NASDAQ:AXSM) is a fast-growing pharmaceutical company headquartered in New York.

Investment thesis

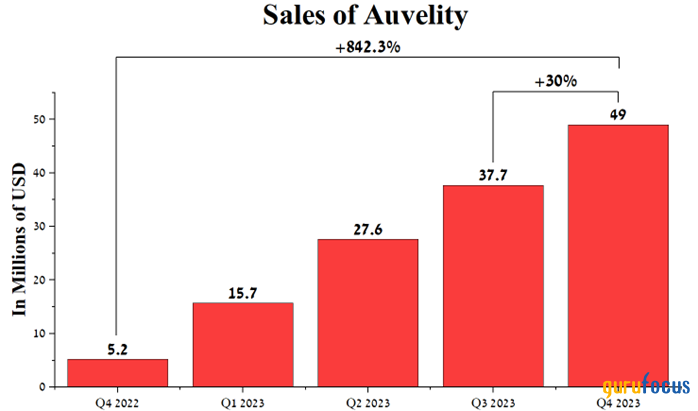

On Feb. 20, the company released financial results for the fourth quarter of 2023, which pleasantly surprised us mainly due to the progress made in developing its pipeline of experimental drugs, as well as the significant year-over-year increase in Auvelity sales. Auvelity(dextromethorphan/bupropion) is a medication that is used to treat adults with a major depressive disorder.

According to the National Institute of Mental Health, the mental disorder affects more than 21 million Americans over the age of 18, thereby opening up significant commercial opportunities.

Since Auvelity consists of two active ingredients, its mechanism of action is complex and is based on both the inhibition of the reuptake of norepinephrine and dopamine and also, thanks to dextromethorphan, the level of glutamate and serotonin in the body of patients increases.

Its sales were $49 million for the three months ended Dec. 31, an increase of 30% from the prior quarter, primarily due to increased sales force headcount, expanded payer coverage and its competitive advantages relative to Wellbutrin, Pfizer's (NYSE:PFE) Zoloft, Prozac and Takeda Pharmaceutical's (NYSE:TAK) Trintellix.

Source: Author's elaboration, based on quarterly securities reports.

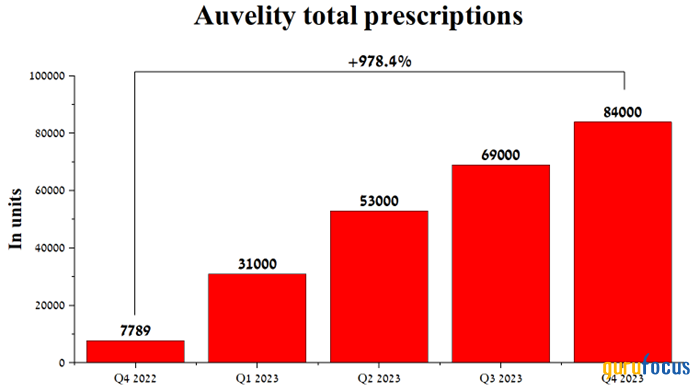

Moreover, in the fourth quarter of 2023, approximately 84,000 prescriptions for Axsome's flagship drug were written, an increase of 978.40% compared to the previous year, indicating a very positive experience from its use by patients, as well as high satisfaction among doctors with its therapeutic effect.

Source: Author's elaboration, based on quarterly securities reports.

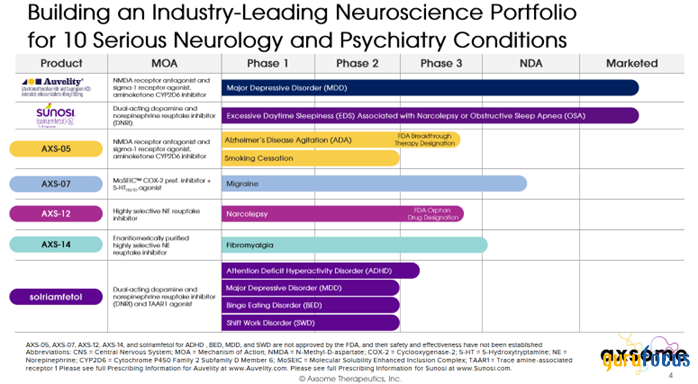

The second investment thesis we highlight is the company's rich portfolio of product candidates that are in the final stages of development and are being developed for the treatment of such common diseases of the central nervous system as migraines, attention deficit hyperactivity disorder and Alzheimer's disease agitation.

Source: Axsome Therapeutics presentation.

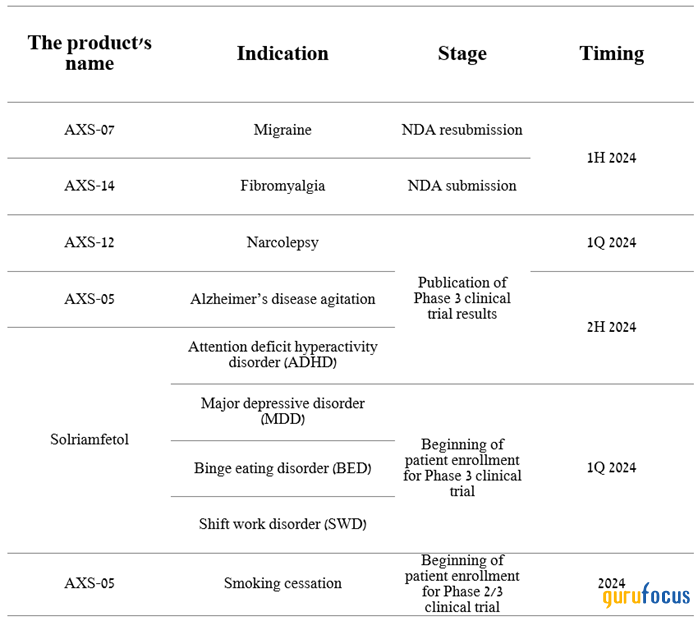

2024 will see a flurry of activity, ranging from the publication of results of multiple Phase 3 clinical trials to the company's submission of two New Drug Applications, with the ultimate goal of gaining Food and Drug Administration approval for AXS-07 and AXS-14.

Source: Author's elaboration, based on Axsome Therapeutics press release.

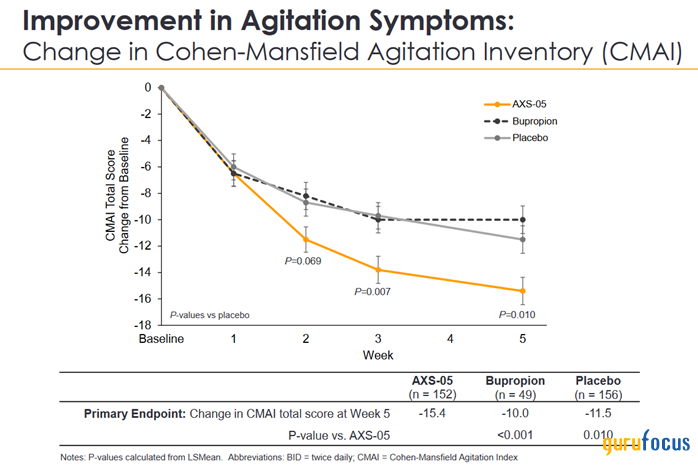

We highlight AXS-05 (dextromethorphan/bupropion) as Axsome's most interesting experimental drug being developed to treat Alzheimer's disease agitation, which affects about 4 million people. Currently, only Rexulti (brexpiprazole) is FDA-approved for this indication.

We believe the Phase 3 clinical trial will achieve primary and secondary endpoints due in part to its unique mechanism of action, as well as the results of the Phase 2/3 clinical trial published in late April 2020, which demonstrated AXS-05's ability to improve symptoms of agitation starting from the second week of treatment.

Source: Axsome Therapeutics presentation.

We initiate our coverage of Axsome Therapeutics with an outperform rating for the next 12 months.

The current financial position and outlook of Axsome Therapeutics

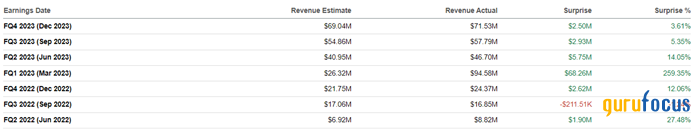

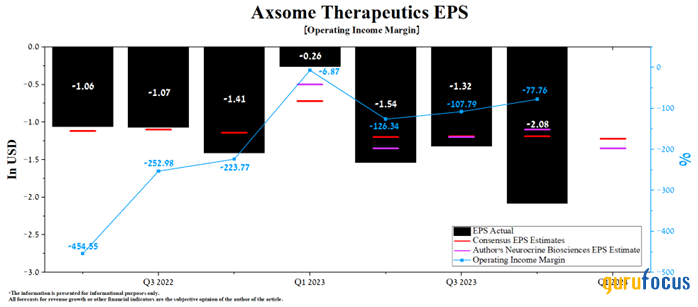

Axsome's revenue for the three months ended Dec. 31 stood at $71.50 million, exceeding our expectations by about $3.50 million and, just as importantly, up 193.50% year over year.

Moreover, the company's actual revenue beat analysts' consensus estimates in six of the last seven quarters, indicating continued conservative sentiment among financial market participants regarding the commercial prospects of Auvelity and Sunosi, as well as its experimental drugs.

Source: Author's elaboration, based on analyst projections.

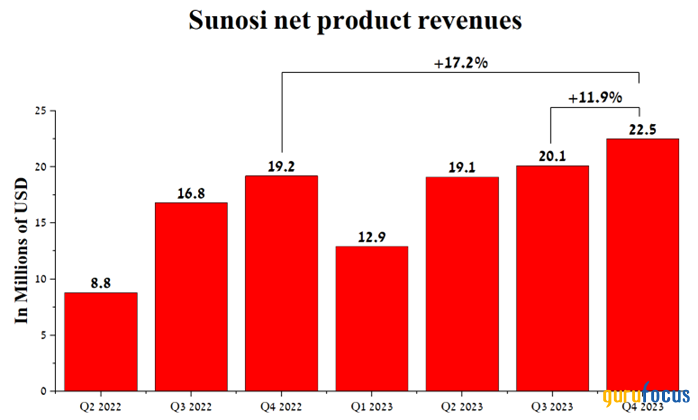

Besides Auvelity and product candidates with significant commercial potential, we believe an additional contributor to Axsome's expected considerable revenue growth is Sunosi (solriamfetol), which acts as a dopamine and norepinephrine reuptake inhibitor.

On March 28, 2022, Jazz Pharmaceuticals (NASDAQ:JAZZ) announced an agreement to sell this drug to Axsome. Under the terms of the deal, Axsome would pay an upfront payment of $54 million and be obligated to pay royalties on Sunosi's net sales.

It was approved by regulators in 2019 for the treatment of excessive sleepiness in patients who have been diagnosed with obstructive sleep apnea or narcolepsy.

According to the National Organization for Rare Disorders, the incidence of narcolepsy is approximately 1 in 2,000 in the general population. Additionally, according to a study published in the Lancet, about 936 million people suffer from obstructive sleep apnea, which is one of the premises indicating the substantial commercial potential of Sunosi.

Its sales were $22.50 million for the fourth quarter of 2023, an increase of 17.20% year over year, driven primarily by new patients and the release of additional data at the ASCP Annual Meeting that demonstrated Sunosi's ability to significantly improve cognitive function in adults with excessive daytime sleepiness.

Source: Author's elaboration, based on quarterly securities reports.

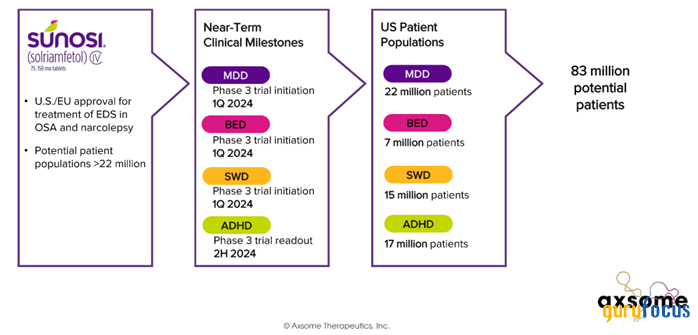

Due to Sunosi's universal mechanism of action, the company plans to conduct pivotal clinical trials to evaluate its efficacy in the treatment of such common neurological disorders as binge eating disorder, major depressive disorder and shift work disorder.

Source: Axsome Therapeutics.

Moreover, on the earnings call, CEO Herriot Tabuteau announced the timing of the release of results from a phase 3 study that assessed the efficacy and safety profile of solriamfetol in treating adult patients with ADHD. He said:

"In December, we held an Investor Day event where physician experts provided the scientific and clinical rationale underlying the exploration of solriamfetol in new target indications including major depressive disorder, binge eating disorder, and shift work disorder. We expect to initiate Phase 3 trials in each of these indications in the first quarter. These new trials complement the ongoing Phase 3 FOCUS trial of solriamfetol in adults with ADHD. FOCUS is tracking for top-line results in the second half of 2024."

Based on the results of a small clinical trial led by researchers at Massachusetts General Hospital, as well as Sunosi's unique mechanism of action, we believe the FOCUS phase 3 trial will meet its primary endpoint, potentially leading to a label expansion for this drug as early as next year.

Axsome Therapeutics is anticipated to release financial results for the first quarter of 2024 on May 6. According to analysts, its revenue is expected to be between $65.7 million and $88 million, up 4.60% from the previous quarter.

Source: Author's elaboration, based on GuruFocus data.

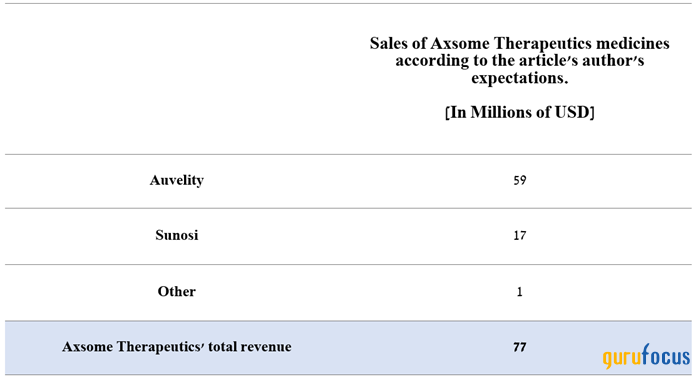

However, our model projects the company's total revenue to reach $77 million in the first three months of 2024, which is about $2.20 million above the median of the above range, mainly due to more optimistic expectations for Auvelity, which continues to capture share in the major depressive disorder treatment market actively.

Source: created by Author.

Axsome's operating income margin was approximately -77.80% for the fourth quarter of 2023. Although this financial metric remains negative, it continues to grow rapidly in recent quarters as demand for its medicines increases.

We estimate the company's operating profit margin will reach -35.6% in 2024 and increase to 1.50% by 2025, mainly driven by increased sales of Auvelity and Sunosi, optimization of marketing and general expenses as well as the potential commercial launch of AXS-07 in the U.S. and Europe at the beginning of 2025.

Furthermore, analysts forecast that Axsome's first-quarter earnings per share will be in the range of -$1.39 to -94 cents, up 41.35% from the previous quarter. According to our model, the company's earnings will be 13 cents below the median of this range and reach -$1.35 due to higher research and development expenses caused by an increase in the number of expensive pivotal clinical trials.

Source: Author's elaboration, based on GuruFocus data.

However, Axsome's trailing 12-month non-GAAP price-earnings ratio remains negative, indicating it trades at a significant premium to the health care sector. However, it is a growth stock with strong revenue growth and an extensive pipeline of experimental drugs being developed to combat Alzheimer's disease agitation, acute migraine, narcolepsy, fibromyalgia, ADHD and more.

On a broader scale, its operating income growth rate is expected to accelerate sharply from 2025, causing its price-earnings ratio to drop to 6.64 by 2028.

Source: Author's elaboration, based on analyst projections.

As a result, we believe Axsome is an attractive asset for investors seeking undervalued pharmaceutical companies whose portfolios consist of FDA-approved medicines and product candidates in late-stage clinical development.

Conclusion

In conclusion, we would like to highlight the key risks that may negatively affect Axsome's investment attractiveness. These risks include increased competition in the global acute migraine treatment market, possible failures in the development of innovative experimental drugs to treat various CNS diseases and a slower growth rate for Sunosi.

However, despite the risks described above, the company has a rich portfolio of product candidates that demonstrate high effectiveness in the treatment of neurological diseases, and Auvelity sales for the fourth quarter of 2023 increased by 842.3% compared to the previous year.

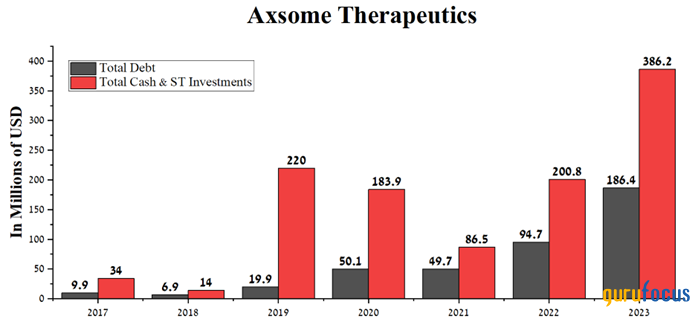

In addition, total cash and short-term investments amounted to about $386 million at the end of 2023, more than two times higher than the company's total debt, allowing it to pursue an aggressive research and development policy.

Source: Author's elaboration, based on GuruFocus data.

We initiate our coverage of Axsome Therapeutics with an outperform rating for the next 12 months.

This article first appeared on GuruFocus.