AZEK Co Inc (AZEK) Posts Robust Q1 Fiscal 2024 Results; Upgrades Full-Year Outlook

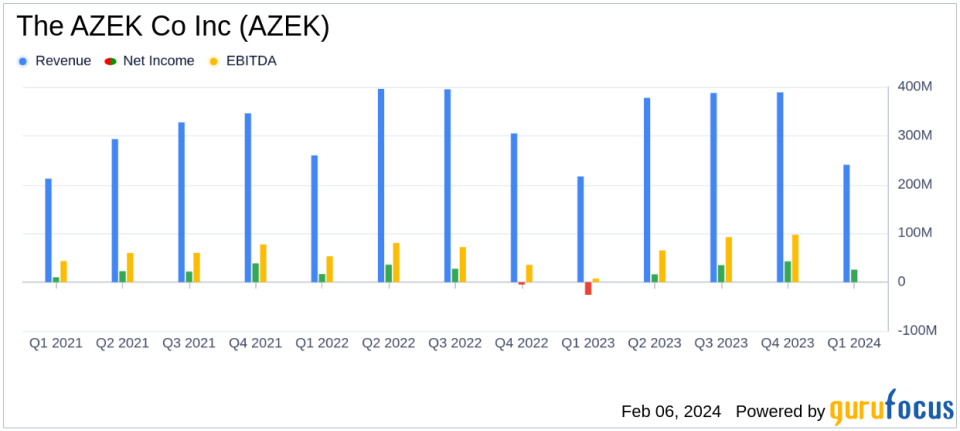

Net Sales Growth: Consolidated Net Sales rose by 11% year-over-year to $240.4 million.

Net Income Surge: Net Income soared to $25.7 million, a significant increase from the previous year.

Profit Margin Expansion: Net profit margin expanded impressively to 10.7%.

EBITDA Growth: Adjusted EBITDA increased by a remarkable 269% year-over-year.

Earnings Per Share: EPS grew to $0.17, reflecting a substantial year-over-year increase.

Outlook Raised: Full-year fiscal 2024 Net Sales and Adjusted EBITDA outlook raised, indicating strong performance and confidence.

The AZEK Co Inc (NYSE:AZEK), a leading designer and manufacturer of high-quality, low-maintenance, and environmentally sustainable outdoor living products, has released its 8-K filing on February 6, 2024, showcasing a strong start to fiscal 2024. The company's portfolio, which includes brands like TimberTech, AZEK, Versatex, Ultralox, StruXure, and Intex, primarily caters to the Residential segment, which has been a significant revenue driver this quarter.

Performance and Challenges

AZEK's performance this quarter was marked by an 11% increase in consolidated net sales year-over-year, reaching $240.4 million, with the Residential Segment contributing a 24% increase to $223.0 million. The company's net income increased to $25.7 million, inclusive of a $38.5 million gain from the sale of Vycom. Excluding this gain, the adjusted net income still showed a robust increase of $29.5 million year-over-year. The net profit margin expanded significantly to 10.7%, and the Adjusted EBITDA Margin grew to 23.2%, indicating strong operational efficiency and cost management.

Despite these achievements, the company faces challenges such as managing the balance between production and inventory levels to maintain high service levels and navigating the uncertainties of the building season. These challenges, if not addressed, could impact the company's ability to sustain its growth trajectory.

Financial Achievements and Industry Impact

The company's financial achievements, particularly the expansion of net profit margins and Adjusted EBITDA, are critical in the construction industry where cost management and operational efficiency are key to maintaining competitiveness. AZEK's focus on margin expansion initiatives and its ability to drive double-digit Residential sell-through growth demonstrate its strong position in the fast-growing Outdoor Living market.

Financial Metrics and Importance

Key financial metrics from the Income Statement, Balance Sheet, and Cash Flow Statement underscore the company's financial health. The Adjusted EBITDA increase to $55.7 million and the Adjusted EBITDA Margin expansion are particularly important as they reflect the company's ability to generate profits from its core operations. The balance sheet shows a healthy cash and cash equivalents position of $274.8 million, providing the company with financial flexibility. However, Free Cash Flow decreased to $(34.0) million, which could be a point of focus for future improvement.

"The AZEK team delivered strong results ahead of plan this quarter... Our Residential segment grew net sales 24% year-over-year driven by strong underlying sell-through growth," said Jesse Singh, CEO of The AZEK Company. "We are raising our full-year 2024 outlook driven by our first quarter results as well as our increased visibility and confidence in our margin drivers."

Analysis of Company's Performance

AZEK's performance this quarter reflects the company's strategic initiatives, including material conversion, channel expansion, and new product innovations. The company's ability to execute these initiatives has led to significant growth in net sales and profitability. The raised outlook for fiscal 2024 further indicates management's confidence in the company's continued growth and margin expansion.

The company's focus on sustainability and its recognition in Newsweeks 2024 list of Most Responsible Companies and Real Leaders 2024 list of Top Impact Companies for the second consecutive year also highlight its commitment to environmental and social responsibility, which is increasingly important to investors and consumers alike.

For a detailed analysis of AZEK's financials and future prospects, investors and interested parties are encouraged to visit GuruFocus.com for comprehensive investment insights and tools.

Investor Relations Contact: Eric Robinson, 312-809-1093, ir@azekco.com

Media Contact: Amanda Cimaglia, 312-809-1093, media@azekco.com

Source: The AZEK Company Inc.

Explore the complete 8-K earnings release (here) from The AZEK Co Inc for further details.

This article first appeared on GuruFocus.