B&G Foods (BGS) Benefits From Pricing, Portfolio Strength

B&G Foods, Inc. BGS appears in good shape due to its pricing strategy and gains from past acquisitions. The company’s focus on business transition also bodes well. These upsides have been working well for this shelf-stable and frozen food and household product company.

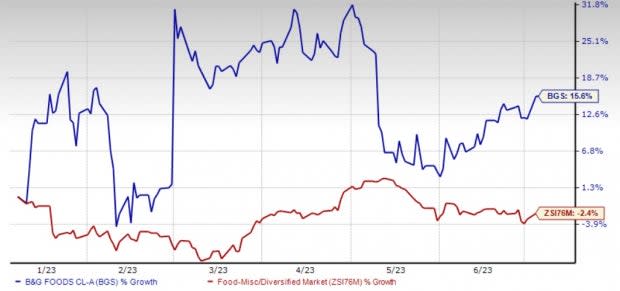

Shares of this Zacks Rank #2 (Buy) company have rallied 15.6% in the past six months against the industry’s decline of 2.4%. Let’s take a closer look.

Efficient Pricing

In the first quarter of fiscal 2023, B&G Foods benefited from higher pricing. In the said period, net pricing and the impact of the product mix contributed $63.2 million or 12.2% to base business net sales.

The company stated that its pricing actions managed to fully catch up with input cost inflation during the quarter. It expects to realize some reductions in key soybean and other commodities. For fiscal 2023, management anticipates net sales in the band of $2.13-$2.17 billion. Management’s guidance includes expectations of pricing gains throughout the year.

Image Source: Zacks Investment Research

Gains From Buyouts

B&G Foods has a successful track record of acquisition-led growth as it has integrated more than 50 brands into its portfolio since its establishment. The company acquired the frozen vegetable manufacturing operations of Growers Express, LLC, which works well for the operations of its Green Giant brand.

B&G Foods acquired the Crisco brand from J.M. Smucker in December 2020. Prior to this, the company acquired Farmwise (in February 2020). It also acquired an integrated retail baking powder maker, Clabber Girl (acquired in May 2019).

Apart from this, BGS acquired notable brands, such as Green Giants, Victoria, TrueNorth, McCann’s and Ortega. The company’s focus on reshaping its portfolio is also evident from its prudent divestitures. To this end, B&G Foods sold the Back to Nature brand in January 2023 to exit the small fragmented lower-margin snacks portfolio. Management is analyzing other divestiture possibilities to enhance portfolio focus and reduce debt.

Focus on Enhancing the Business Structure

On its first-quarter earnings call, management stated that it remains on track with its transition to four business units. These include spices and seasonings, meals, frozen, and vegetables and specialty. This business structure is likely to enhance B&G Foods’ performance by helping the company sharpen its focus on individual areas.Wrapping Up

The abovementioned factors are likely to keep BGS on the growth path. For fiscal 2023, the company anticipates adjusted EBITDA in the range of $310-$330 million compared with $301 million reported in fiscal 2022. Adjusted earnings per share (EPS) in fiscal 2023 are envisioned to be 95 cents to $1.15. In fiscal 2022, the company posted an adjusted EPS of $1.08.

Other Solid Staple Stocks

Some other top-ranked consumer staple stocks are Nomad Foods NOMD, Celsius Holdings CELH and Lamb Weston LW.

Nomad Foods, a frozen food product company, currently sports a Zacks Rank #1 (Strong Buy). NOMD has a trailing four-quarter earnings surprise of 8.5%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Nomad Foods’ current fiscal-year sales suggests growth of around 8% from the year-ago reported figures.

Celsius Holdings, which offers functional drinks and liquid supplements, currently sports a Zacks Rank #1. CELH delivered an earnings surprise of 81.8% in the last reported quarter.

The Zacks Consensus Estimate for Celsius Holdings’ current fiscal-year sales and earnings suggests growth of 69.6% and 154.4%, respectively, from the year-ago reported numbers.

Lamb Weston, which is a frozen potato product company, currently carries a Zacks Rank #2. LW has a trailing four-quarter earnings surprise of 47.6%, on average.

The Zacks Consensus Estimate for Lamb Weston’s current fiscal-year sales and earnings suggests growth of 30% and 117.3%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

B&G Foods, Inc. (BGS) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report

Nomad Foods Limited (NOMD) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report