B&G Foods Inc (BGS) Reports Mixed Fiscal 2023 Results Amidst Strategic Divestitures

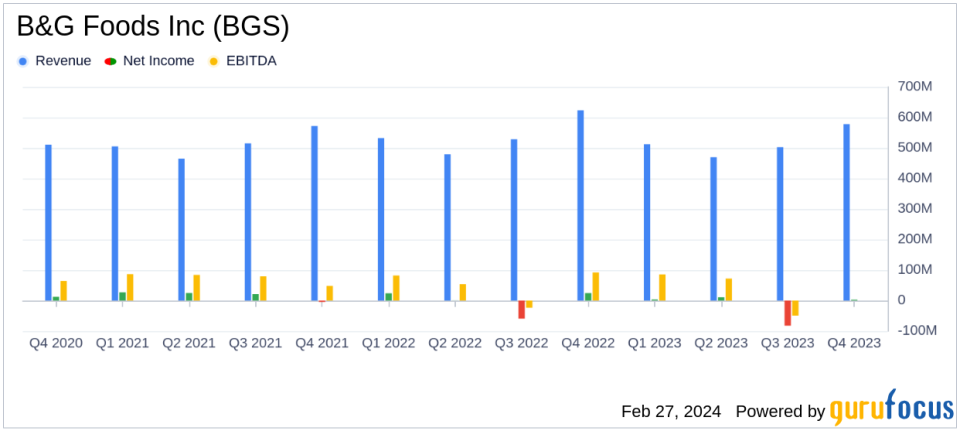

Net Sales: Decreased by 4.7% to $2,062.3 million in FY 2023.

Adjusted EBITDA: Increased by 5.7% to $318.0 million in FY 2023.

Net Income (Loss): Reported a net loss of $66.2 million in FY 2023.

Diluted EPS: Decreased to $(0.89) in FY 2023 from $(0.16) in FY 2022.

Debt Reduction: Reduced long-term debt principal by $340.1 million in FY 2023.

Operating Cash Flow: Increased by $241.8 million in FY 2023.

Divestitures: Completed the sale of Green Giant U.S. shelf-stable and Back to Nature brands.

On February 27, 2024, B&G Foods Inc (NYSE:BGS) released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full year of 2023. The year was marked by strategic divestitures, including the sale of the Green Giant U.S. shelf-stable product line and Back to Nature, which impacted net sales and net income figures. Despite these divestitures, the company saw an increase in adjusted EBITDA, signaling improved operational efficiency.

B&G Foods Inc, a prominent American packaged-food manufacturer, operates a portfolio of well-known brands such as Green Giant, Crisco, and Cream of Wheat. The company's products are distributed across supermarkets, wholesalers, and food service distributors in North America.

Financial Performance and Challenges

The company's net sales for FY 2023 decreased by 4.7% to $2,062.3 million, compared to $2,163.0 million in the previous year. This decline was primarily due to the divestitures and a decrease in unit volume, partially offset by an increase in net pricing. The net loss for the year stood at $66.2 million, or $(0.89) per diluted share, compared to a net loss of $11.4 million, or $(0.16) per diluted share, in FY 2022. The loss was primarily attributable to impairment charges and the loss on sale of assets related to the Green Giant U.S. shelf-stable product line.

Despite these challenges, B&G Foods achieved a significant increase in adjusted EBITDA, which rose by 5.7% to $318.0 million for FY 2023. This improvement reflects the company's ability to manage costs and improve operational efficiency, which is crucial for success in the competitive Consumer Packaged Goods industry.

Financial Achievements and Importance

One of the key financial achievements for B&G Foods in FY 2023 was the substantial reduction in the principal amount of long-term debt by $340.1 million. This debt reduction is a positive step towards improving the company's balance sheet and reducing interest expenses, which increased by 21.1% to $151.3 million for the year. Additionally, the net cash provided by operating activities increased significantly by $241.8 million, showcasing the company's strong cash flow generation capabilities.

Key Financial Metrics

Important metrics from the financial statements include a gross profit margin of 22.1% for FY 2023, up from 18.9% in the previous year. This margin improvement was driven by an increase in net pricing relative to input costs and the moderation of input cost inflation. Selling, general, and administrative expenses as a percentage of net sales increased slightly to 9.5% for FY 2023, compared to 8.8% for FY 2022.

"B&G Foods fourth quarter and fiscal 2023 results demonstrated strong progress, with improved margins, stabilizing volumes, stronger cash flows, and a reduction in leverage," said Casey Keller, President and Chief Executive Officer of B&G Foods.

Analysis of Company's Performance

The company's performance in FY 2023 was a mix of strategic realignment and financial discipline. The divestitures allowed B&G Foods to streamline its portfolio and focus on its core brands. The increase in adjusted EBITDA and the reduction in long-term debt are indicative of the company's commitment to financial stability and operational efficiency. However, the net sales decline and net loss highlight the challenges faced in a year of transition.

For FY 2024, B&G Foods expects net sales to be between $1.975 billion and $2.020 billion, with adjusted EBITDA projected to be between $305 million and $325 million, and adjusted diluted earnings per share between $0.80 and $1.00. These forward-looking statements reflect the company's cautious optimism about its future performance.

Investors and potential members of GuruFocus.com interested in the Consumer Packaged Goods sector may find B&G Foods Inc (NYSE:BGS) a noteworthy company to follow, given its recent strategic moves and financial resilience.

Explore the complete 8-K earnings release (here) from B&G Foods Inc for further details.

This article first appeared on GuruFocus.