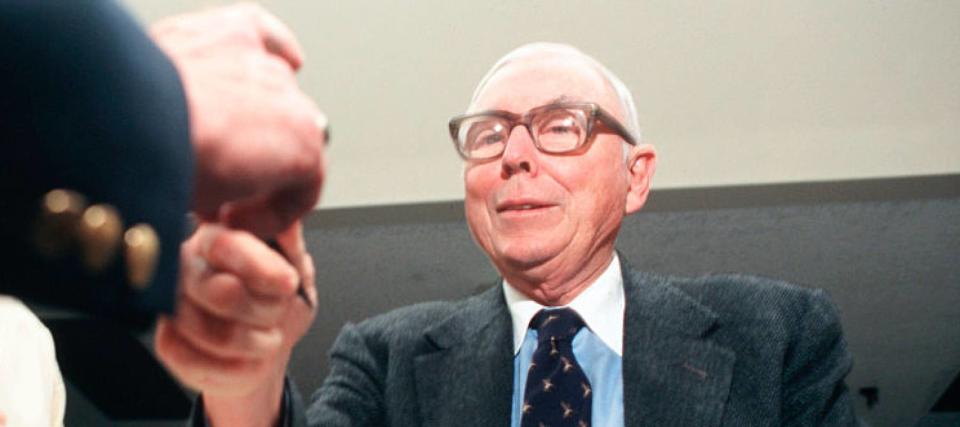

'You gotta do it': the late Charlie Munger once said your first $100K is the toughest to earn — but most crucial for building wealth. Here are 5 ways to reach that magical milestone

Charlie Munger, the billionaire investor, Berkshire Hathaway's vice-chairman and Warren Buffett's right-hand man, died at age 99 on Nov. 28, 2023, leaving behind a personal fortune that was estimated at well over $2 billion.

“Berkshire Hathaway could not have been built to its present status without Charlie’s inspiration, wisdom and participation,” Buffett said in a statement.

Don’t miss

Commercial real estate has outperformed the S&P 500 over 25 years. Here's how to diversify your portfolio without the headache of being a landlord

Worried about the economy? Here are the best shock-proof assets for your portfolio. (They’re all outside of the stock market.)

'A natural way to diversify': Janet Yellen now says Americans should expect a decline in the USD as the world's reserve currency — 3 ways you can prepare

Over many decades of success in business, law, philanthropy and, above all, investing, Munger made many memorable public statements and offered countless pearls of wisdom.

One of his most famous and colorful pieces of investing advice, offered more than two decades ago to an audience member at an annual meeting of Berkshire Hathaway shareholders, was that amassing your first $100,000 is a critical early milestone on the path to long-term wealth.

“It’s a b—-, but you gotta do it,” Munger said. “I don’t care what you have to do — if it means walking everywhere and not eating anything that wasn’t purchased with a coupon, find a way to get your hands on $100,000.”

Here are five money moves that can help you reach that magical milestone as soon as possible.

Why $100K matters so much

Why is that figure so important — especially when you consider that for many investors and savers, the goal is often much higher?

After all, $100,000 in 2023 dollars has the same purchasing power as about $60,000 20 years ago. And with inflation in the U.S. still high, that sum doesn’t go as far as when Munger delivered his cheeky take.

Then again, Munger didn’t elaborate on just how much that first $100,000 could grow over time, even if left alone. Invested at a modest 5% return, you wouldn’t have needed to add a single penny over 21 years to see that stash grow to $278,596, per compound interest calculators like this one.

The lesson? What comes before — and after — that first $100,000 makes all the difference.

Read more: Save big on your holiday shopping with an app that’s already saved Americans $160 million

Consider this example: Debbie, a young worker who diligently saves and invests $10,000 a year through her employer’s 401(k) plan and nets an annual return of 7%, would need slightly less than eight years to reach a net worth of $100,000.

This is where things get interesting: The same annual investment, at the same rate of return, would produce Debbie’s next $100,000 in only about five years. Reaching the next uptick on that sixth digit would take even less time.

As a result, Debbie learns that consistent saving — fueled by compound interest — can get you to that $100,000 level and rocket your net worth if you stay the course.

It’s fair to wonder: What’s so important about $100,000 versus, say, $90,000 or $95,000? Besides the literal extra $5,000 or $10,000, there’s plenty of hustle and psychology at play.

Here’s what Munger and others stress.

Working for it

People love round numbers; maybe you do, too. Of course there’s no tangible trigger at which $100,000 becomes a more meaningful driver of wealth than $99,999. But there’s also no denying the satisfying psychological metric of $100,000. It’s six figures versus five, making it a desired milestone for salary or other accumulations of monetary worth.

Getting to $100,000, especially in one’s younger years, isn’t easy. Most of us can’t get there quickly from a standstill. Reaching it usually means earning promotions and salary bumps at work; significantly underspending your income; or good old-fashioned side hustling like driving for a ride-hailing service or taking on freelance assignments.

But if wealth accumulation begins with more income and less expenses, compound interest does the heavy, heavy lifting.

What to read next

Rich young Americans have lost confidence in the stock market — and are betting on these 3 assets instead. Get in now for strong long-term tailwinds

Here's how much the typical baby boomer has saved for retirement — how do you stack up right now?

Jeff Bezos and Oprah Winfrey invest in this asset to keep their wealth safe — you may want to do the same in 2024

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.