B. Riley Financial, Inc. Acquires Additional Shares in The Arena Group Holdings Inc.

On August 14, 2023, B. Riley Financial, Inc. (Trades, Portfolio), a prominent investment firm, added 1,194,680 shares of The Arena Group Holdings Inc. (AREN) to its portfolio. This article provides an in-depth analysis of this transaction, the profiles of both entities, and the potential implications for value investors.

Details of the Transaction

The acquisition of additional shares in The Arena Group Holdings Inc. by B. Riley Financial, Inc. (Trades, Portfolio) on August 14, 2023, resulted in a 21.40% change in the firm's holdings. The transaction was executed at a price of $3.38 per share, bringing the total number of shares held by the firm to 6,776,000. This transaction had a 1.04% impact on the firm's portfolio and increased its position in The Arena Group Holdings Inc. to 30.80%.

Profile of B. Riley Financial, Inc. (Trades, Portfolio)

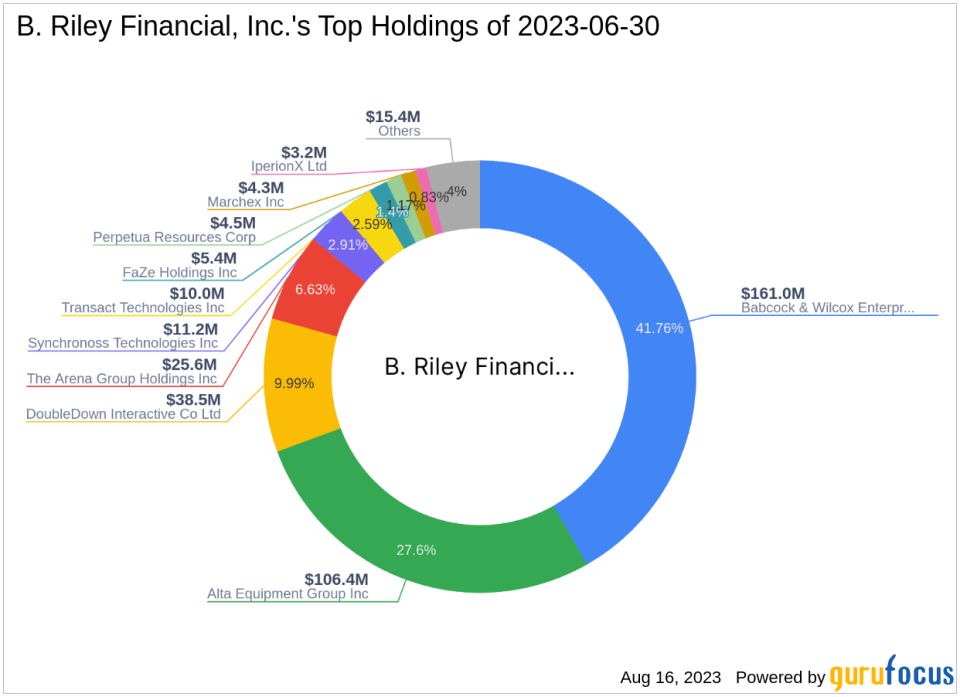

B. Riley Financial, Inc. (Trades, Portfolio), located at 21860 Burbank Blvd., Woodland Hills, CA, is a renowned investment firm with a diverse portfolio. The firm's top holdings include Synchronoss Technologies Inc (NASDAQ:SNCR), Babcock & Wilcox Enterprises Inc (NYSE:BW), The Arena Group Holdings Inc (AREN), Alta Equipment Group Inc (NYSE:ALTG), and DoubleDown Interactive Co Ltd (NASDAQ:DDI). The firm's equity stands at $386 million, with the industrials and communication services sectors being the most dominant in its portfolio.

Overview of The Arena Group Holdings Inc.

The Arena Group Holdings Inc., a tech-powered media company based in the USA, operates in the interactive media industry. The company, which went public on November 21, 1996, reaches over 120 million users each month through its robust digital destinations. The company's market capitalization stands at $82.497 million, with a current stock price of $3.75. Despite a PE percentage of 0.00, indicating a loss, the company's stock is fairly valued according to the GF Value Rank, with a GF Value of 4.04.

Performance of The Arena Group Holdings Inc.'s Stock

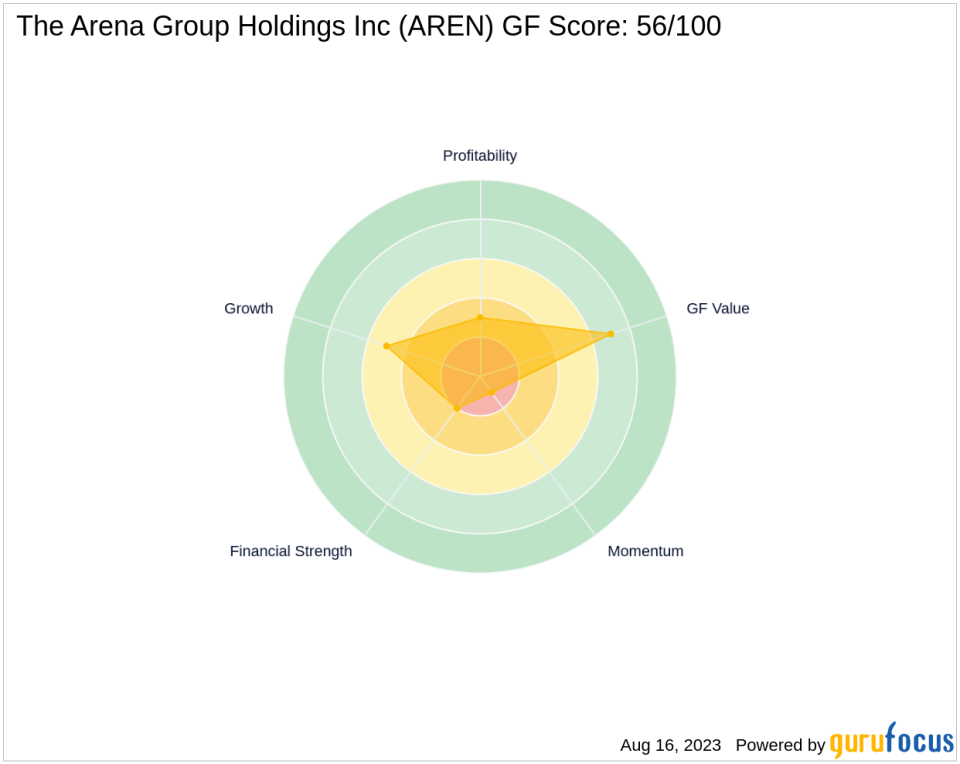

Since its IPO, The Arena Group Holdings Inc.'s stock has experienced a significant decrease of 99.68%. The year-to-date price change ratio stands at -62.54%. However, since the transaction, the stock has gained 10.95%. The stock's GF Score is 56/100, indicating a poor future performance potential. The company's balance sheet rank, profitability rank, and growth rank are 2/10, 3/10, and 5/10, respectively.

Financial Health of The Arena Group Holdings Inc.

The Arena Group Holdings Inc.'s financial health is a mixed bag. The company's cash to debt ratio is 0.14, indicating a high level of debt. The company's ROA is -38.44, suggesting inefficiency in generating profit from its assets. Over the past three years, the company's revenue growth has declined by 26.60%, while its EBITDA and earning growth have increased by 57.30% and 44.90%, respectively.

Momentum and Predictability of The Arena Group Holdings Inc.'s Stock

The Arena Group Holdings Inc.'s stock has an RSI 5 Day of 64.35, RSI 9 Day of 52.39, and RSI 14 Day of 48.45. The stock's momentum index 6 - 1 month and momentum index 12 - 1 month are -54.02 and -58.81, respectively. However, the stock's predictability rank is not available.

Conclusion

The recent acquisition of additional shares in The Arena Group Holdings Inc. by B. Riley Financial, Inc. (Trades, Portfolio) has significantly increased the firm's position in the company. Despite the stock's poor performance since its IPO and year-to-date, the transaction has resulted in a gain of 10.95%. While the company's financial health and stock predictability raise concerns, its growth in EBITDA and earnings over the past three years may present potential opportunities for value investors.

This article first appeared on GuruFocus.