B. Riley Financial, Inc. Bolsters Portfolio with Synchronoss Technologies Inc Acquisition

Introduction to the Transaction

B. Riley Financial, Inc. (Trades, Portfolio) has recently expanded its investment portfolio by adding a significant number of shares in Synchronoss Technologies Inc (NASDAQ:SNCR). This move, executed on November 13, 2023, reflects the firm's strategic approach to investing and highlights its confidence in the future of Synchronoss Technologies Inc. The transaction details reveal a substantial increase in B. Riley Financial's stake in the company, which is poised to have a notable impact on its investment portfolio.

Profile of B. Riley Financial, Inc. (Trades, Portfolio)

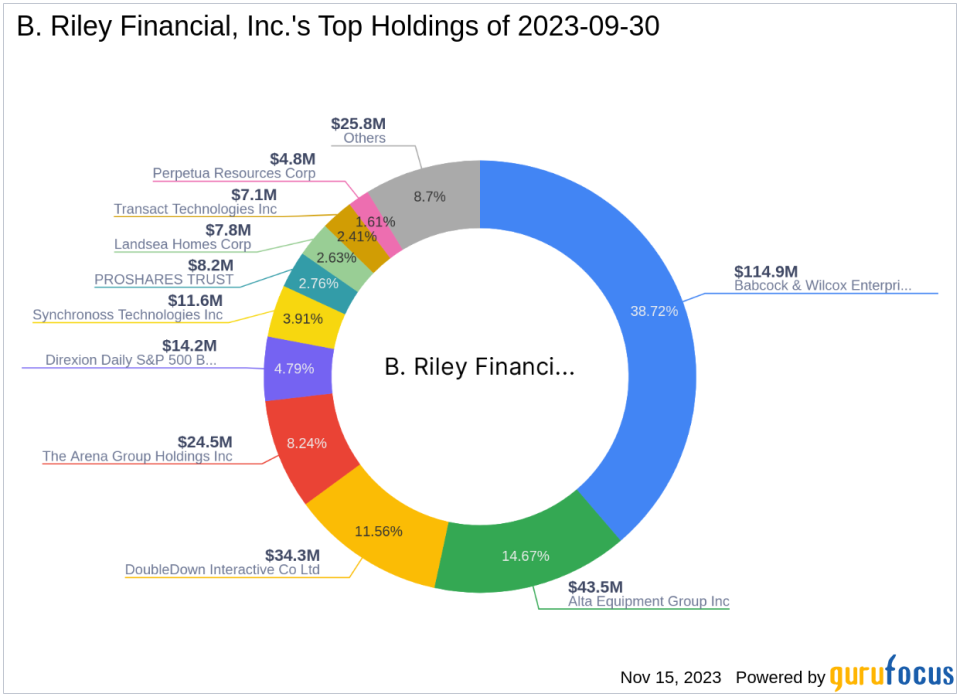

As a prominent investment firm, B. Riley Financial, Inc. (Trades, Portfolio) operates with a distinct investment philosophy that guides its portfolio decisions. With a focus on value investing, the firm seeks opportunities that promise long-term growth and stability. B. Riley Financial's top holdings, which include positions in Direxion Daily S&P 500 Bear -3X Shares (SPXS), Babcock & Wilcox Enterprises Inc (NYSE:BW), and others, reflect a diversified approach with a strong emphasis on industrials and communication services sectors. The firm manages an equity portfolio valued at approximately $297 million, showcasing its significant presence in the investment landscape.

Synchronoss Technologies Inc Company Overview

Synchronoss Technologies Inc, a provider of cloud and software-based activation solutions, operates primarily within the mobile carrier and OEM space. Since its IPO on June 15, 2006, the company has developed a suite of services that include cloud-based sync, backup, and content engagement capabilities. With a market capitalization of $45.268 million, Synchronoss Technologies Inc offers a range of services across license, professional, subscription, and transaction segments. The company's financial health and market segments suggest a nuanced performance in a competitive industry.

Transaction Details

The recent transaction by B. Riley Financial, Inc. (Trades, Portfolio) involved the acquisition of 1,493,574 shares of Synchronoss Technologies Inc at a trade price of $0.45 per share. This addition has increased the firm's total shareholding to 13,574,073, accounting for a 14.54% stake in the company. The trade has a moderate impact of 0.23% on B. Riley Financial's portfolio, with the position now representing 2.05% of its total investments.

Stock Performance and Valuation

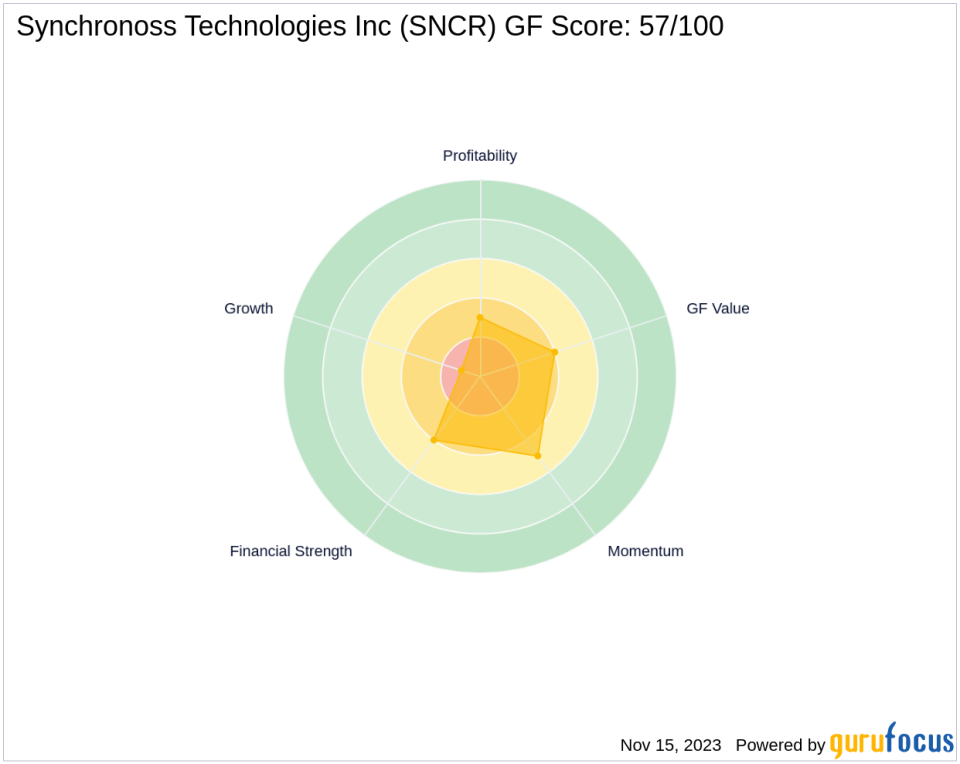

At the time of the transaction, Synchronoss Technologies Inc's stock was trading at $0.45, which has since increased by 7.78% to a current price of $0.485. Despite this recent uptick, the stock's performance has been underwhelming, with a year-to-date decline of 20.49% and a significant drop of 94.61% since its IPO. The GF Score of 57/100 indicates a potential for poor future performance, while the GF Value suggests the stock may be a possible value trap, warranting caution from investors.

B. Riley Financial, Inc. (Trades, Portfolio)'s Position in SNCR

With the latest acquisition, B. Riley Financial, Inc. (Trades, Portfolio) has solidified its position as a key shareholder in Synchronoss Technologies Inc. The firm's 14.54% holding in SNCR is a testament to its investment strategy and belief in the company's prospects. While the largest guru shareholder's details are not provided, B. Riley Financial's stake is substantial and indicative of its influence on the company's shareholder base.

Market Reaction and Future Outlook

Since B. Riley Financial's investment, Synchronoss Technologies Inc's stock has shown a slight increase, which may reflect a positive market reaction to the firm's confidence in SNCR. However, given the stock's overall downward trend and the cautious GF Valuation, investors should closely monitor the company's performance and future potential based on GuruFocus ranks and scores.

Conclusion

The recent trade by B. Riley Financial, Inc. (Trades, Portfolio) marks a significant addition to its portfolio and underscores the firm's strategic investment approach. While Synchronoss Technologies Inc faces challenges, as indicated by various GuruFocus metrics, B. Riley Financial's increased stake could signal a belief in the company's turnaround or undervalued status. Investors will be watching closely to see how this position plays out in the firm's broader portfolio strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.