B. Riley Financial, Inc. Bolsters Position in Babcock & Wilcox Enterprises Inc

B. Riley Financial, Inc. (Trades, Portfolio), a prominent investment firm, has recently expanded its investment portfolio by adding shares of Babcock & Wilcox Enterprises Inc (NYSE:BW). On November 14, 2023, the firm acquired an additional 888,062 shares of BW at a trade price of $1.16 per share. This transaction has increased B. Riley Financial's total holdings in the company to 28,176,701 shares, marking a significant move in the firm's investment strategy.

Insight into B. Riley Financial, Inc. (Trades, Portfolio)

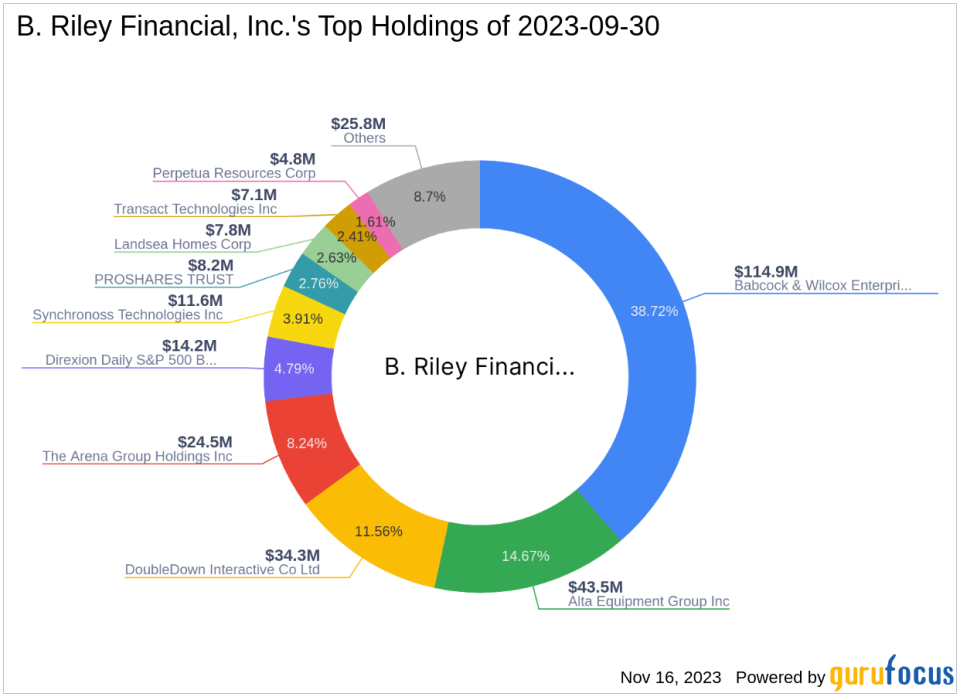

B. Riley Financial, Inc. (Trades, Portfolio) is recognized in the market for its expert financial services and strategic investment decisions. With a portfolio comprising 24 stocks, the firm's top holdings include Direxion Daily S&P 500 Bear -3X Shares (SPXS), Babcock & Wilcox Enterprises Inc (NYSE:BW), and others. B. Riley Financial operates with an equity of $297 million, with Industrials and Communication Services being its top sectors. The firm's investment philosophy is reflected in its diverse and strategic portfolio choices, aiming to deliver robust financial solutions to its clients.

Babcock & Wilcox Enterprises Inc at a Glance

Babcock & Wilcox Enterprises Inc, with a market capitalization of $136.738 million, is a key player in the power generation equipment industry. The company operates through three segments: B&W Renewable, B&W Environmental, and B&W Thermal. Predominantly serving the U.S., Canada, Denmark, and the United Kingdom, BW's primary focus is on steam generation products, sustainable power, and emissions control solutions. Despite its significant role in the industry, the company's stock performance has been under scrutiny, with a current stock price of $1.53 and a GF Value of $8.08, indicating a possible value trap scenario.

Trade Impact on B. Riley Financial's Portfolio

The recent acquisition of BW shares by B. Riley Financial, Inc. (Trades, Portfolio) has had a notable impact on the firm's portfolio. The trade has resulted in a 0.35% trade impact, with the position in BW now accounting for 10.98% of the firm's portfolio and 31.53% of the guru's holdings in the traded stock. This move signifies a strategic increase in B. Riley Financial's stake in Babcock & Wilcox Enterprises, reflecting confidence in the company's future prospects.

Market Performance and Valuation of BW

Since the trade, BW's stock has experienced a 31.9% gain, although it has seen a significant decline of 98.61% since its IPO in 2015. The year-to-date performance also shows a downward trend with a 72.73% decrease. The GF Value metrics suggest caution, labeling the stock as a possible value trap with a price to GF Value ratio of 0.19, indicating that the stock may be overvalued relative to its intrinsic value.

Financial Health and Growth Prospects

Babcock & Wilcox Enterprises' financial health and growth metrics present a mixed picture. The company has a GF Score of 52/100, indicating poor future performance potential. Its Financial Strength and Profitability Ranks are both at 3/10, while the Growth Rank is at a low 1/10. The GF Value Rank and Momentum Rank are 2/10 and 5/10, respectively. The Piotroski F-Score is at 2, and the Altman Z score is at -0.83, suggesting financial instability. The company's Cash to Debt ratio is 0.11, which is relatively low, indicating potential challenges in meeting its debt obligations.

Comparative Analysis with Largest Guru Shareholder

Keeley-Teton Advisors, LLC (Trades, Portfolio) is currently the largest guru shareholder in Babcock & Wilcox Enterprises Inc. While specific share percentage data is not provided, B. Riley Financial, Inc. (Trades, Portfolio)'s recent trade has solidified its position as a significant investor in BW. The comparison between the two firms' holdings could provide insights into their respective investment strategies and confidence in BW's market performance.

Conclusion

B. Riley Financial, Inc. (Trades, Portfolio)'s recent investment in Babcock & Wilcox Enterprises Inc represents a strategic move within its portfolio, despite the company's challenging financial and growth metrics. The firm's increased stake in BW suggests a belief in the company's long-term potential, even as current valuations and market performance advise caution. Investors and market watchers will be keen to observe how this investment decision unfolds in the context of BW's future business developments and financial health.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.