B. Riley Financial, Inc. Reduces Stake in Alta Equipment Group Inc.

On August 4, 2023, B. Riley Financial, Inc. (Trades, Portfolio), a renowned investment firm, executed a significant transaction involving Alta Equipment Group Inc. (NYSE:ALTG). The firm reduced its holdings in Alta Equipment Group Inc., a leading integrated equipment dealership platform in the U.S. This article provides an in-depth analysis of the transaction, the profiles of both entities, and the potential implications of this move.

Details of the Transaction

The transaction saw B. Riley Financial, Inc. (Trades, Portfolio) reduce its stake in Alta Equipment Group Inc. by 330,000 shares, a change of -7.22%. The shares were traded at a price of $16.25 each. Following the transaction, B. Riley Financial, Inc. (Trades, Portfolio) now holds 4,238,607 shares in Alta Equipment Group Inc., representing 18.29% of its portfolio and 13.09% of Alta Equipment Group Inc.'s total shares. The transaction had a -1.4% impact on the guru's portfolio.

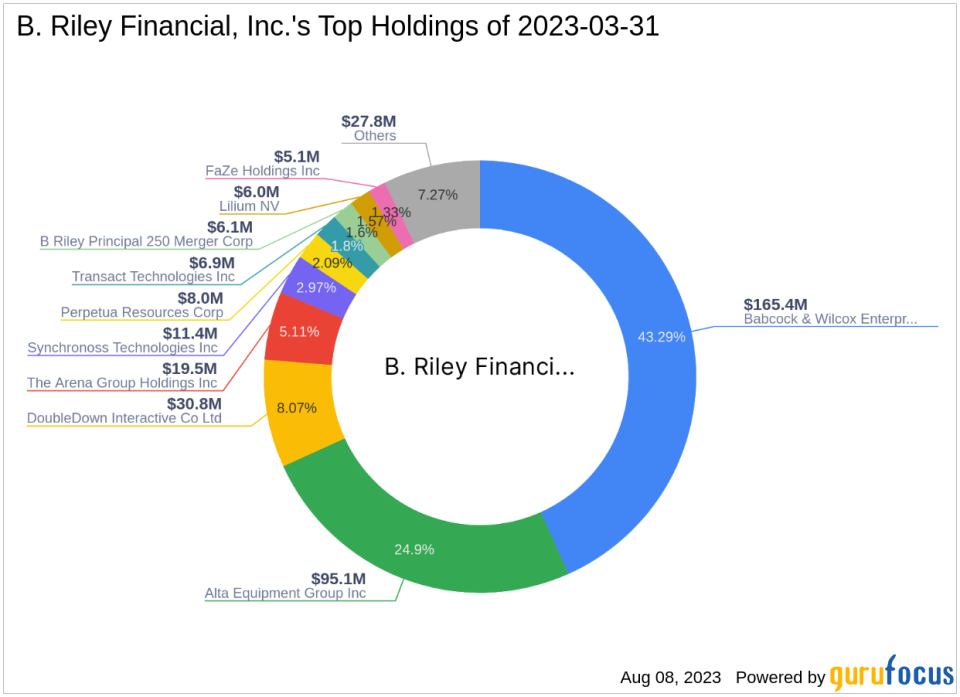

Profile of B. Riley Financial, Inc. (Trades, Portfolio)

B. Riley Financial, Inc. (Trades, Portfolio), located at 21860 Burbank Blvd., Woodland Hills, CA, is a prominent investment firm with a diverse portfolio. The firm currently holds 46 stocks, with a total equity of $382 million. Its top holdings include Synchronoss Technologies Inc (NASDAQ:SNCR), Babcock & Wilcox Enterprises Inc (NYSE:BW), The Arena Group Holdings Inc (AREN), Alta Equipment Group Inc (NYSE:ALTG), and DoubleDown Interactive Co Ltd (NASDAQ:DDI). The firm's top sectors are Industrials and Communication Services.

Overview of Alta Equipment Group Inc.

Alta Equipment Group Inc., based in the USA, is a leading integrated equipment dealership platform. The company operates in several segments, including Construction Equipment, Material Handling, Corporate and Other, and Master Distribution. As of August 8, 2023, the company has a market capitalization of $566.766 million and a current stock price of $17.51.

Analysis of Alta Equipment Group Inc.'s Stock

Alta Equipment Group Inc.'s stock has a PE percentage of 62.54. According to GuruFocus, the stock is fairly valued with a GF Value of $19.33 and a Price to GF Value of 0.91. Since the transaction, the stock has gained 7.75%. Since its IPO on April 25, 2019, the stock has increased by 80.52%. The stock has also seen a year-to-date increase of 31.65%.

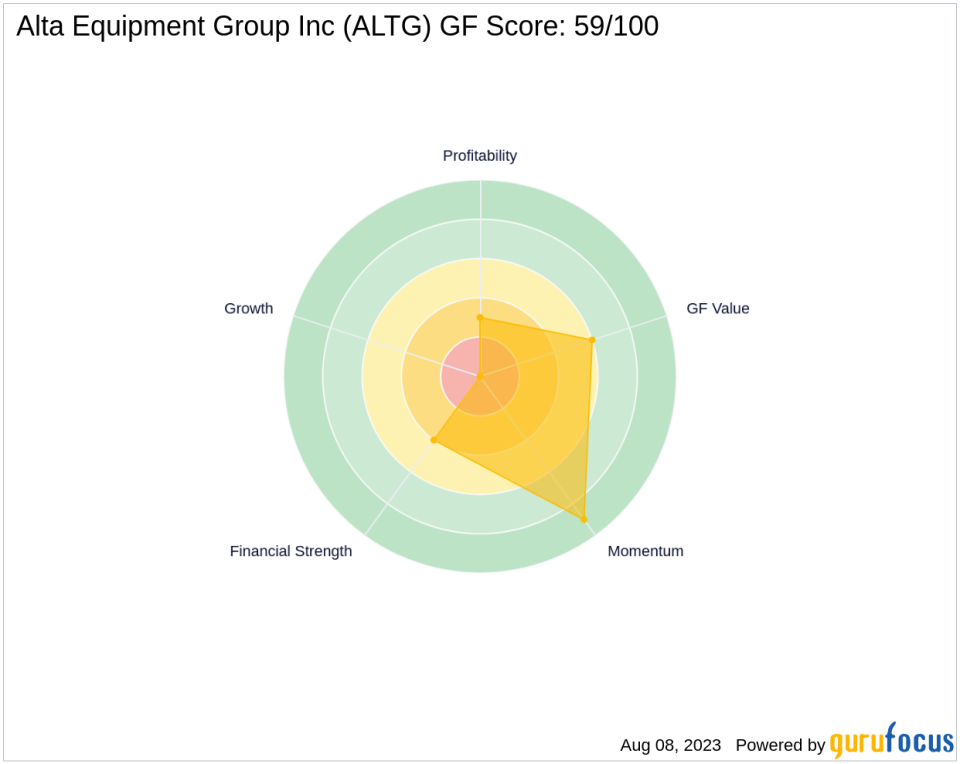

Evaluation of Alta Equipment Group Inc.'s Performance

Alta Equipment Group Inc. has a GF Score of 59/100, indicating average future performance potential. The company's Financial Strength is ranked 4/10, while its Profitability Rank is 3/10. The company's Growth Rank is not available due to not enough growth data. The company's Piotroski F-Score is 6, and its Altman Z score is 1.70, indicating financial stability.

Alta Equipment Group Inc.'s Industry Position

Alta Equipment Group Inc. operates in the Business Services industry. The company's interest coverage is 1.28, ranking 741 in its industry. The company's ROE is 8.32, and its ROA is 0.97, ranking 512 and 726 in its industry, respectively. The company's gross margin of 28.83% underperforms over 60% of global competitors.

Conclusion

In conclusion, B. Riley Financial, Inc. (Trades, Portfolio)'s recent transaction has slightly reduced its stake in Alta Equipment Group Inc. but still maintains a significant position. The transaction's impact on the guru's portfolio was minimal, and the stock's performance remains stable. As of August 8, 2023, all data and rankings are accurate and based on the provided relative data.

This article first appeared on GuruFocus.