B. Riley Financial Inc (RILY) Reports Preliminary Unaudited Q4 and Full Year 2023 Results

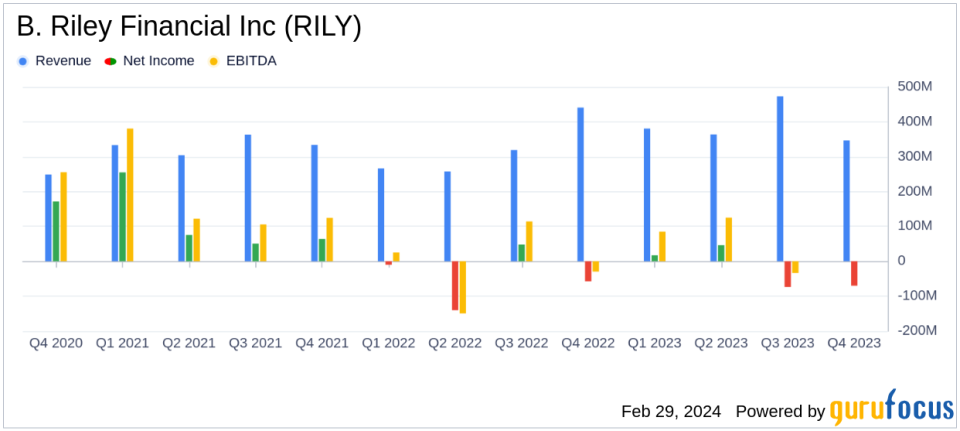

Net Loss: Reported a net loss available to common shareholders of $70.04 million for Q4 and $86.37 million for the full year.

Operating Revenues: Q4 operating revenues were $395.03 million, with full-year revenues reaching $1.63 billion.

Adjusted EBITDA: Q4 saw a total adjusted EBITDA of negative $22.97 million, while the full year adjusted EBITDA stood at $239.88 million.

Dividend: Declared a quarterly dividend of $0.50 per share, payable on March 22, 2024.

Strategic Review: Engaged Moelis & Company to review strategic alternatives for the appraisal and asset disposition businesses.

Balance Sheet: Cash and investments totaled $1.90 billion, with a net debt position of $457 million after accounting for cash and investments.

B. Riley Financial Inc (NASDAQ:RILY) released its 8-K filing on February 29, 2024, detailing its preliminary unaudited financial results for the fourth quarter and full year ending December 31, 2023. The diversified financial services company, which provides a broad range of services including investment banking, financial consulting, and wealth management, faced challenges that led to a net loss for both the quarter and the full year. Despite these challenges, the company's core businesses showed resilience, with financial consulting revenues and operating income growing significantly.

Performance Overview

B. Riley's performance in the fourth quarter was marked by a net loss available to common shareholders of $70.04 million, or $2.32 per basic and diluted share, compared to a net loss of $59.45 million, or $2.08 per share, in the same period of the prior year. For the full year, the net loss was $86.37 million, or $2.95 per share, compared to a net loss of $167.84 million, or $5.95 per share, in the previous year. Operating revenues for the fourth quarter stood at $395.03 million, a decrease from the $448.83 million reported in the same quarter of the previous year. The full-year operating revenues, however, increased to $1.63 billion from $1.31 billion in the prior year.

Financial Highlights and Challenges

The company's financial consulting segment saw a 36% increase in revenues and an 86% increase in operating income for the year, while the communications portfolio segment income rose by 15%. The wealth management business returned to profitability. However, non-cash investment losses and an impairment charge affected the overall financial results, masking the strong performance of the core businesses.

Chairman and Co-CEO Bryant Riley emphasized the company's strategic investments in its platform to support client success, particularly in small caps, and the decision to reduce the dividend by 50% to focus on investing in the business. Co-CEO Tom Kelleher highlighted the progress across subsidiaries and the diversification efforts that have enhanced the performance of the core financial services businesses.

Strategic Moves and Dividend Declaration

The Board of Directors declared a quarterly dividend of $0.50 per common share, signaling a strategic shift to conserve capital for investment opportunities. Additionally, the company announced a review of strategic alternatives for its appraisal and asset disposition businesses, indicating a potential reorganization or sale that could unlock value for shareholders.

Balance Sheet and Segment Performance

As of December 31, 2023, B. Riley's balance sheet showed $1.90 billion in cash and investments, with a net debt position of $457 million after accounting for cash and investments. The total debt stood at $2.36 billion. Segment-wise, the Capital Markets and Wealth Management segments experienced revenue growth, while the Auction and Liquidation segment saw a decrease in segment income.

Forward Outlook

Despite the challenges faced in 2023, B. Riley Financial Inc (NASDAQ:RILY) is focused on leveraging its diversified platform to drive future growth. The company's strategic review of its appraisal and asset disposition businesses and the realignment of its segment reporting reflect a proactive approach to optimizing its operations and capital allocation. With a strong balance sheet and a commitment to investing in its core businesses, B. Riley is positioning itself to capitalize on market opportunities and enhance shareholder value.

Investors and interested parties can access the live audio webcast and archived recording of the investor call discussing the financial results and business outlook on the company's investor relations website.

For a detailed understanding of B. Riley Financial Inc (NASDAQ:RILY)'s financials and strategic direction, readers are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from B. Riley Financial Inc for further details.

This article first appeared on GuruFocus.