B2Gold (BTG) Earnings Miss Estimates in Q3, Increase Y/Y

B2Gold Corp BTG reported adjusted earnings per share (EPS) of 5 cents for third-quarter 2023, missing the Zacks Consensus Estimate of 7 cents. The company posted an adjusted EPS of 3 cents in the prior-year quarter.

Including one-time items, BTG reported a loss of 3 cents per share compared with the prior-year quarter’s loss of 2 cents.

B2Gold generated revenues of $478 million in third-quarter 2023 compared with the prior-year quarter’s $393 million. The top line surpassed the Zacks Consensus Estimate of $474 million. The upside resulted from a 12.2% increase in average realized gold prices and an 8.5% rise in gold ounces sold.

In the September-end quarter, B2Gold recorded a consolidated gold production of 225,052 ounces, up 5% year over year. The total gold production (including 17,786 ounces of attributable production from Calibre) in the quarter was 242,838 ounces.

The company reported total consolidated cash operating costs of $755 per ounce in the reported quarter, down 7.4% year over year. Total consolidated all-in sustaining costs (AISC) of $1,272 per ounce were 8.8% higher than the prior-year quarter’s levels.

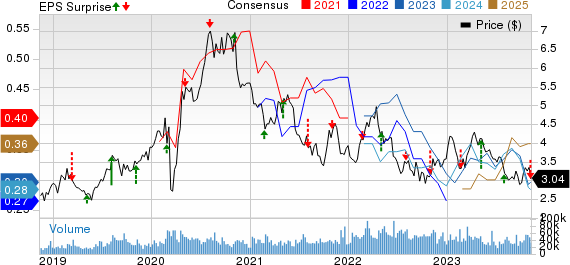

B2Gold Corp Price, Consensus and EPS Surprise

B2Gold Corp price-consensus-eps-surprise-chart | B2Gold Corp Quote

During the July-September quarter, the cost of sales was $307 million, up 0.3% year over year. The gross profit improved 98.3% year over year to $170 million. The gross margin expanded to 35.7% in the reported quarter from the prior-year quarter’s 21.9%.

The operating income in the reported quarter was $27.5 million compared with the prior-year quarter’s $54.5 million. The operating margin declined to 5.8% from the year-ago quarter’s 13.9%.

Financial Position

B2Gold’s cash and cash equivalents were $310 million at the end of the third quarter compared with $652 million at the end of 2022. The company generated $110 million in cash from operating activities in the June-end quarter compared with $93 million in the year-ago quarter.

BTG’s long-term debt was $34 million at the end of the third quarter compared with $42 million at the end of 2022.

Outlook

B2Gold reaffirms the financial guidance for the current year. It expects the 2023 total gold production guidance between 1,000,000 and 1,080,000 ounces, which includes 60,000-70,000 attributable ounces from Calibre. Total consolidated cash operating costs are projected to be $670-$730 per ounce. Total consolidated AISC is anticipated to be $1,195-$1,255 per ounce.

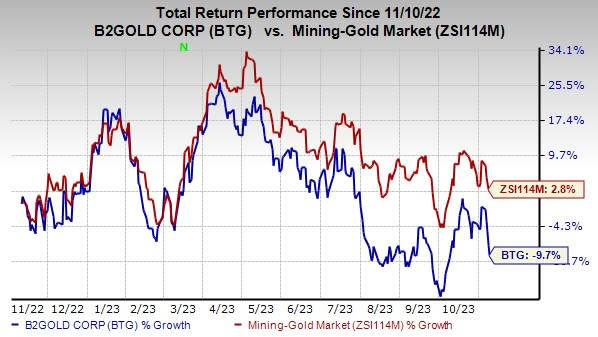

Price Performance

In the past year, B2Gold’s shares have lost 9.7% against the industry’s growth of 2.8%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

B2Gold currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Carpenter Technology Corporation CRS, The Andersons Inc. ANDE and Universal Stainless & Alloy Products, Inc. USAP. CRS and ANDE sport a Zacks Rank #1 (Strong Buy) at present, and USAP carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Carpenter Technology has an average trailing four-quarter earnings surprise of 14.3%. The Zacks Consensus Estimate for CRS’ fiscal 2024 earnings is pegged at $3.57 per share. The consensus estimate for 2024 earnings has moved 3% north in the past 60 days. Its shares gained 62% in the last year.

Andersons has an average trailing four-quarter earnings surprise of 64.4%. The Zacks Consensus Estimate for ANDE’s 2023 earnings is pegged at 52 cents per share. The consensus estimate for 2023 earnings has been unchanged in the past 60 days. Its shares gained 25% in the last year.

Universal Stainless & Alloy Products has an average trailing four-quarter earnings surprise of 44.4%. The Zacks Consensus Estimate for USAP’s 2023 earnings is pegged at 27 cents per share. Earnings estimates have been unchanged in the past 60 days. USAP’s shares gained 89% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Universal Stainless & Alloy Products, Inc. (USAP) : Free Stock Analysis Report

B2Gold Corp (BTG) : Free Stock Analysis Report