B2Gold (BTG) Earnings Miss Estimates in Q4, Revenues Dip Y/Y

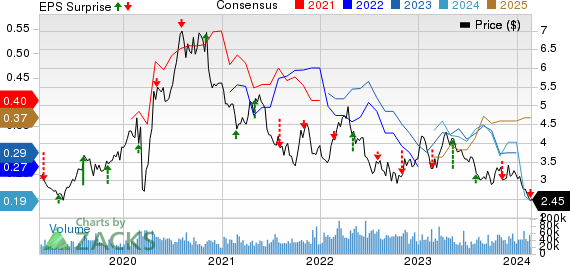

B2Gold Corp. BTG reported adjusted earnings per share (EPS) of 7 cents for fourth-quarter 2023, missing the Zacks Consensus Estimate of 8 cents. The bottom line fell 36% year over year.

Including one-time items, the company reported a loss of 9 cents per share against the prior-year quarter’s earnings of 15 cents.

B2Gold generated revenues of $512 million in fourth-quarter 2023, reflecting a year-over-year decline of 13.6%.

In the December-end quarter, B2Gold recorded a consolidated gold production of 270,611 ounces, down 23.3% year over year. The total consolidated gold production for fourth-quarter 2023 was 288,665 ounces (including 18,054 ounces of attributable production from Calibre Mining Corp), down 21.5% from the prior-year quarter.

The company reported consolidated cash operating costs of $611 per ounce in the reported quarter, up 38.9% year over year. The consolidated all-in-sustaining costs (AISC) of $1,264 per ounce rose 44.3% from the prior-year quarter.

B2Gold Corp Price, Consensus and EPS Surprise

B2Gold Corp price-consensus-eps-surprise-chart | B2Gold Corp Quote

For the October-December quarter, the total cost of sales was $306 million, up 7.7% year over year. The gross profit decreased 7.7% year over year to $206 million. The gross margin contracted to 40.2% in the reported quarter from the prior-year quarter’s 44%.

The operating loss in the reported quarter was $35 million against the prior-year quarter’s operating profit of $232 million.

Financial Position

B2Gold’s cash and cash equivalents were $307 million at the end of 2023 compared with $652 million witnessed at the end of 2022. The company generated $714 million in cash from operating activities in 2023 compared with $596 million in 2022. Its long-term debt was $176 million at the end of 2023, up from $42 million at the end of 2022.

2023 Performance

B2Gold reported an adjusted EPS of 28 cents in 2023 compared with 25 cents in the prior year. Earnings missed the Zacks Consensus Estimate of 30 cents. Including one-time items, the bottom line was 1 cent per share, down from 24 cents in 2022.

Sales rose 11.6% year over year to $1.93 billion. The top line surpassed the Zacks Consensus Estimate of $1.92 billion.

2024 Guidance

B2Gold expects total gold production of 860,000-940,000 ounces for 2024, including 40,000-50,000 ounces of attributable production from Calibre. The company expects total consolidated cash operating costs to be higher in 2024, and between $835 and $895 per gold ounce.

The company expects a total consolidated all-in sustaining costs of $1,360-$1,420 per gold ounce.

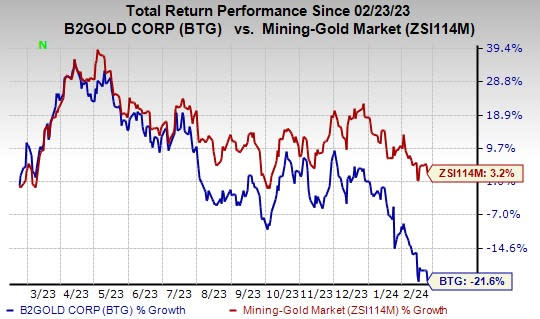

Price Performance

B2Gold’s shares have lost 21.6% in the past year against the industry’s growth of 3.2%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

B2Gold currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Carpenter Technology Corporation CRS, Ecolab Inc. ECL and Alpha Metallurgical Resources, Inc. AMR. These three companies currently sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Carpenter Technology’s 2024 earnings is pegged at $3.96 per share. The consensus estimate for 2024 earnings has moved 11% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 14.3%. CRS shares have gained 29.8% in a year.

The Zacks Consensus Estimate for Ecolab’s 2024 earnings is pegged at $6.39 per share, indicating an increase of 22.7% from the prior year’s reported number. It has an average trailing four-quarter earnings surprise of 1.7%. ECL shares have gained 34.3% in a year.

Alpha Metallurgical Resources has an average trailing four-quarter earnings surprise of 9.6%. The Zacks Consensus Estimate for AMR’s 2024 earnings is pegged at $43.05 per share. Earnings estimates have moved 48% north in the past 60 days. AMR shares rallied 132% last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Alpha Metallurgical Resources, Inc. (AMR) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

B2Gold Corp (BTG) : Free Stock Analysis Report