B2Gold (BTG) Gains on Solid Mine Performances Amid Cost Woes

B2Gold Corp. BTG is benefiting from improved mine performances and recent acquisitions.

However, inflationary costs, primarily fuel and labor, will hurt margins in the upcoming quarters. Nonetheless, B2Gold has a strong balance sheet and maintains a robust cash position.

Solid Mine Performance to Aid Results

B2Gold reported a total gold production of 242,838 ounces in the third quarter of 2023, an increase from the 227,016 ounces reported in the third quarter of 2022. This includes 17,786 ounces of attributable production from Calibre Mining Corp.

The Fekola mine produced 128,942 ounces in the quarter, lower than expected due to slower gold recovery and low mill feed grade. However, mining of the higher-quality ore in Fekola Phase 6 commenced in October 2023. The company expects the fourth-quarter production at the Fekola mine to be substantially higher. Total production at the Fekola mine is expected to be at the lower end of 580,000-610,000 ounces.

All of B2Gold's operations are on track to reach or surpass their annual production targets. The company’s 2023 total gold production guidance is between 10,00,000 and 10,80,000 ounces, backed by expectations of a solid delivery and a pick-up in mine performances. The total gold production in 2022 was 1,027,874 ounces.

The company intends to pursue additional internal growth through further exploration, development and expansion of existing projects.

Pick-Up in Gold Price Bodes Well

Throughout the majority of 2023, gold price was affected by a strong U.S. dollar and high interest rates. However, gold prices have picked up again, supported by declining U.S. inflation, raising hopes that the Federal Reserve has reached the end of its tightening cycle. The US central bank is expected to keep rates unchanged in December.

Traders see a potential that the Fed could begin lowering rates as early as March 2024. Currently, the gold price is around $2,042 per ounce. This pick-up in the price of gold is likely to improve B2Gold’s results in the upcoming quarters.

Effective Acquisitions to Support Growth

The company completed the acquisition of Oklo Resources Limited in September 2022. The acquisition provides B2Gold with an additional landholding of 1,405 square kilometers covering highly prospective greenstone belts in Mali, West Africa, including the Dandoko Project, which now forms part of the Fekola Complex.

With the acquisition of Oklo and its flagship Dandoko project, the company is continuing to evaluate its options for the timing and sourcing of material on a regional basis from all deposits within the Fekola Complex area (including Fekola, Cardinal, the Anaconda Area, Bakolobi and Dandoko).

On Feb 13, 2023, the company inked a deal worth C$1.1 billion ($820 million) to acquire Sabina Gold & Silver Corp. Per the deal, B2Gold will have its first mining assets in Canada and receive the full ownership of Sabina’s Back River Gold District, including five mineral claims spanning 80 kilometers.

Among these, the Goose project is the most advanced, and is fully permitted and construction-ready. It has been de-risked with substantial infrastructure. BTG intends to increase production in the first five years of the mine life by accelerating the Goose project's underground mine development.

This will boost operational and geographic diversification by combining B2Gold's stable production base with a high-grade, advanced development asset in a Tier-1 mining jurisdiction.

Elevated Costs Remain Headwinds

B2Gold is witnessing cost inflation pressure across all sites, which is impacting input prices, including reagents, fuel and consumables. For 2023, cash operating costs are projected between $670 and $730 per ounce. AISC is expected to be $1,195-$1,255 per ounce. Both are likely to be higher than the 2022 reported levels.

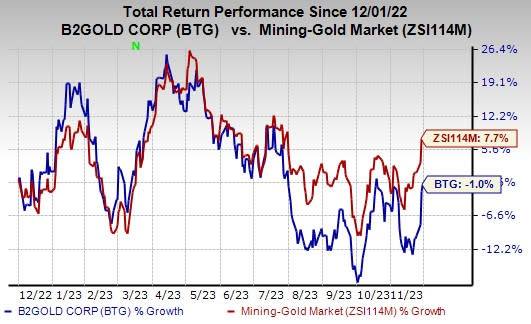

Price Performance

B2Gold’s shares have lost 1% in the past year against the industry’s growth of 7.7%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

The company currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Axalta Coating Systems Ltd. AXTA, Universal Stainless & Alloy Products, Inc. USAP and The Andersons Inc. ANDE. AXTA sports a Zacks Rank #1 (Strong Buy), and USAP and ANDE each carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Axalta Coating’s 2023 earnings is pegged at 44 cents per share. The consensus estimate for 2023 earnings has moved 23% north in the past 60 days. Its shares have gained 16% in a year.

Universal Stainless & Alloy Products has an average trailing four-quarter earnings surprise of 44.4%. The Zacks Consensus Estimate for USAP’s 2023 earnings is pegged at 27 cents per share. Earnings estimates have been unchanged in the past 60 days. USAP’s shares gained 136.2% in the last year.

The consensus estimate for ANDE's current-year earnings has been revised 3.3% upward over the past 60 days. Andersons beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 64.4%, on average. ANDE shares have rallied around 35.5% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

Universal Stainless & Alloy Products, Inc. (USAP) : Free Stock Analysis Report

B2Gold Corp (BTG) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report