B3 SA - Brasil Bolsa Balcao's Dividend Analysis

An In-depth Look at B3 SA - Brasil Bolsa Balcao's Dividend Performance and Sustainability

B3 SA - Brasil Bolsa Balcao (BOLSY) recently announced a dividend of $0.03 per share, payable on 2024-04-22, with the ex-dividend date set for 2024-03-28. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's delve into B3 SA - Brasil Bolsa Balcao's dividend performance and assess its potential for long-term sustainability.

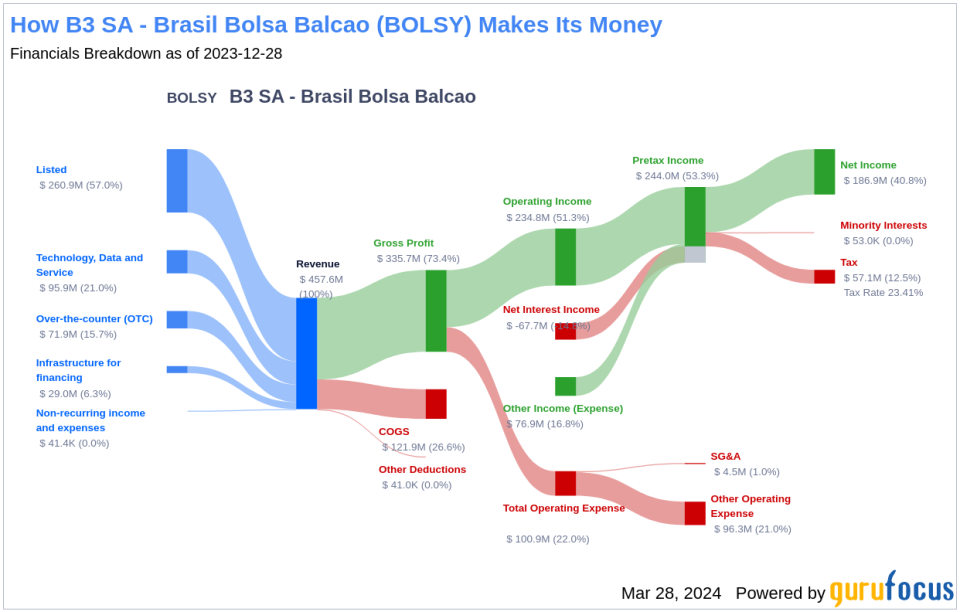

What Does B3 SA - Brasil Bolsa Balcao Do?

Warning! GuruFocus has detected 15 Warning Signs with TNABF.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

B3 SA - Brasil Bolsa Balcao is a prominent financial market infrastructure provider in Brazil, offering a broad spectrum of trading, clearing, and post-trade services. The company is integral to the financial markets, facilitating transactions in securities, foreign exchange, and securities custody. Leveraging cutting-edge technology, B3 SA - Brasil Bolsa Balcao ensures efficient and reliable services to its clients.

A Glimpse at B3 SA - Brasil Bolsa Balcao's Dividend History

Since 2021, B3 SA - Brasil Bolsa Balcao has been consistent in its dividend payments, opting for a quarterly distribution model. This consistency is a positive signal for investors seeking regular income streams. The following chart offers a visual representation of the company's annual Dividends Per Share to help track historical trends.

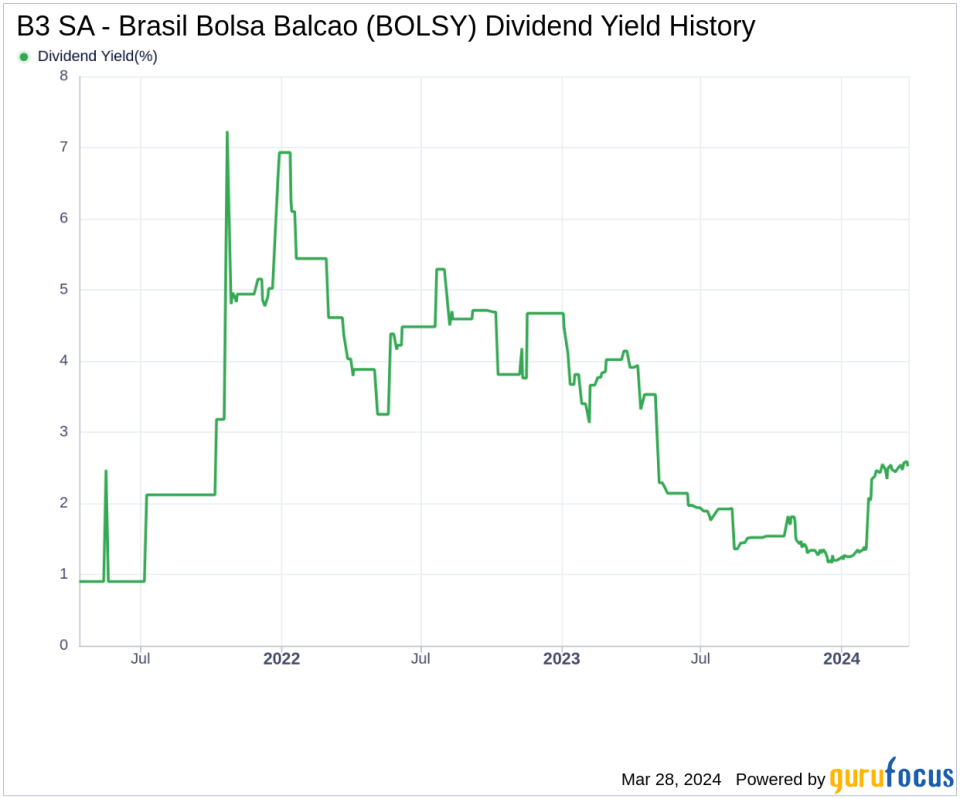

Breaking Down B3 SA - Brasil Bolsa Balcao's Dividend Yield and Growth

The current 12-month trailing dividend yield for B3 SA - Brasil Bolsa Balcao stands at 3.12%, while the forward dividend yield is projected at 2.62%, indicating an anticipated decrease in dividend payments over the next year. Over the past three years, the annual dividend growth rate has been -11.50%, but a longer-term perspective reveals a 5.80% increase per year over five years and an impressive 15.80% growth rate over the past decade. Consequently, the 5-year yield on cost for B3 SA - Brasil Bolsa Balcao stock is approximately 4.14%.

The Sustainability Question: Payout Ratio and Profitability

An essential factor in assessing dividend sustainability is the payout ratio. B3 SA - Brasil Bolsa Balcao's dividend payout ratio is currently 0.81, which may raise concerns about the long-term viability of its dividend payments. However, the company's profitability rank of 9 out of 10, as of 2023-12-31, indicates robust profitability compared to its peers. With a decade-long track record of positive net income, B3 SA - Brasil Bolsa Balcao's financial health seems promising.

Growth Metrics: The Future Outlook

For dividend sustainability, growth is crucial. B3 SA - Brasil Bolsa Balcao's impressive growth rank of 9 out of 10 signals a strong competitive stance. However, its 5.70% average annual revenue growth rate lags behind approximately 50.22% of global peers. The 3-year EPS growth rate shows an average annual decrease of -7.20%, underperforming 70.88% of global competitors. Additionally, the 5-year EBITDA growth rate of 11.60% also falls short when compared to 47.06% of global peers, suggesting mixed growth performance.

Engaging Conclusion: Dividend Prospects Amidst Growth Challenges

B3 SA - Brasil Bolsa Balcao's dividend payments and growth rates present a nuanced picture. While the company has a strong profitability rank and a history of consistent dividend payments, the payout ratio and mixed growth metrics warrant a closer examination by investors. The future sustainability of dividends will likely hinge on the company's ability to navigate growth challenges and maintain its profitability. Investors seeking to diversify their portfolio with high-dividend yield stocks may consider using the High Dividend Yield Screener available to GuruFocus Premium users.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.