Badger Meter (BMI) Q3 Earnings & Revenues Beat Estimates

Badger Meter, Inc BMI reported earnings per share (EPS) of 88 cents for third-quarter 2023, beating the Zacks Consensus Estimate by 15.8%. Also, the bottom line compared favorably with the year-ago quarter’s EPS of 61 cents.

Net earnings in the reported quarter were $26 million compared with $17.9 million in the year-ago period. The year-over-year improvement can be primarily attributed to higher revenues.

Quarterly net sales increased to $186.2 million from $148 million in the year-ago quarter. The 25.8% rise was primarily driven by robust demand for smart water solutions and improving operating environment. Also, the top line beat the consensus mark by 7.8%.

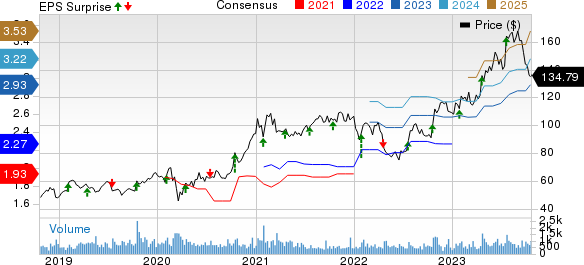

Badger Meter, Inc. Price, Consensus and EPS Surprise

Badger Meter, Inc. price-consensus-eps-surprise-chart | Badger Meter, Inc. Quote

Segmental Performance

In the quarter under review, utility water sales rose 31% due to strong demand momentum. Higher E-Series volume, cellular AMI solution, ORION Cellular endpoint sales and higher BEACON Software-as-a-Service revenues acted as major tailwinds.

Flow instrumentation sales increased 2% year over year, driven by continued strong order trends across most of the water-focused end market.

Other Details

In the third quarter, gross profit was $72.7 million, up 26.4% year over year. Structural positive sales mix and higher volumes resulted in this upside. The gross margin was 39.1%, up 20 basis points from the prior-year quarter. Operating earnings were $31.4 million or 16.9% of sales compared with $23.9 million or 16.1% of sales in the year-ago quarter.

Selling, engineering and administration expenses were $41.3 million or 22.2% of sales compared with $33.7 million or 22.7% of sales in the prior-year quarter. The increase in expenses was mainly due to higher personnel costs, R&D expenses and the acquisition of Syrinix.

Cash Flow & Liquidity

In the third quarter of 2023, Badger Meter generated $31.4 million of net cash from operating activities compared with $23.8 million a year ago.

As of Sep 30, 2023, the company had $162.9 million of cash and cash equivalents and $128.8 million of total current liabilities compared with the respective figures of $128.4 million and $115.8 million as of Jun 30, 2023.

Zacks Rank

Badger Meter currently has a Zacks Rank #3 (Hold)

Stocks to Consider

Some better-ranked stocks in the broader technology space are Asure Software ASUR, Synopsys SNPS and Wix.com WIX. Each stock presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Asure Software’s 2023 EPS has increased 5.9% in the past 60 days to 54 cents.

Asure Software’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 676.4%. Shares of ASUR have surged 55.9% in the past year.

The Zacks Consensus Estimate for Synopsys’ 2023 EPS has gained 2.5% in the past 60 days to $11.09. SNPS’ long-term earnings growth rate is 16.4%. Shares of SNPS have surged 62.7% in the past year.

The Zacks Consensus Estimate for Wix’s 2023 EPS has remained unchanged in the past 60 days to $3.35.

Watts Water’s earnings beat estimates in all the trailing four quarters, delivering an average surprise of 319.3%. Shares of WIX have rallied 5.3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

Wix.com Ltd. (WIX) : Free Stock Analysis Report