Baillie Gifford Adjusts Position in Certara Inc

Overview of Baillie Gifford (Trades, Portfolio)'s Recent Stock Transaction

On December 1, 2023, Baillie Gifford (Trades, Portfolio), a renowned investment management firm, made a significant adjustment to its holdings in Certara Inc (NASDAQ:CERT), a key player in the biosimulation software and technology sector. The firm reduced its stake by 269,667 shares, which resulted in a 2.93% decrease in their holding, bringing the total number of shares owned to 8,921,463. This transaction had a negligible impact on Baillie Gifford (Trades, Portfolio)'s portfolio, with the trade executed at a price of $14.64 per share. Despite the reduction, Baillie Gifford (Trades, Portfolio) maintains a 5.58% position in Certara, reflecting a 0.12% ratio of the traded stock in the firm's overall portfolio.

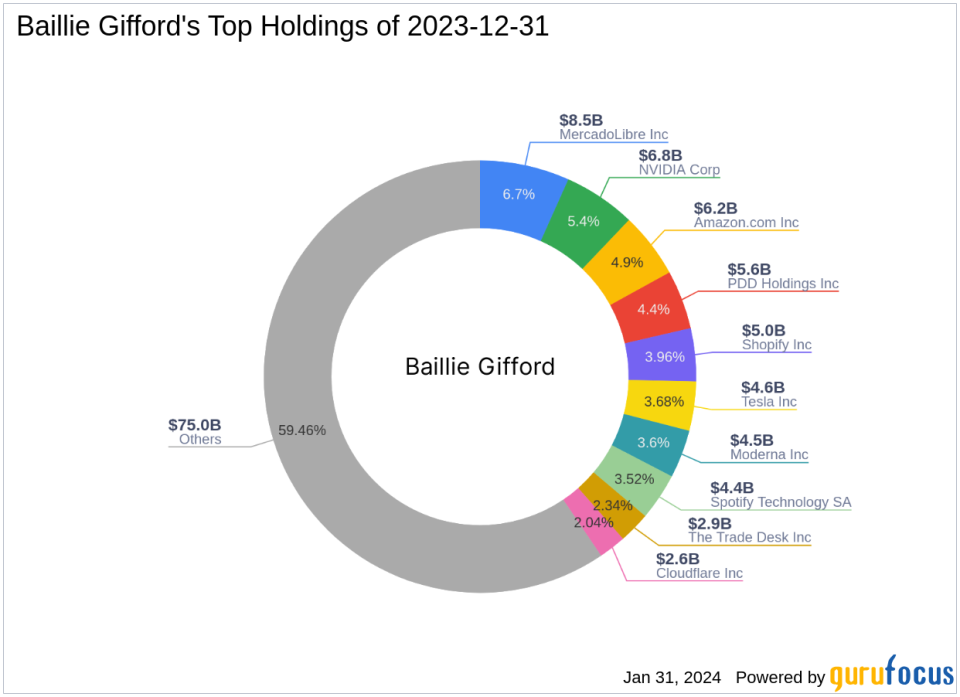

Investment Firm Profile: Baillie Gifford (Trades, Portfolio)

Baillie Gifford (Trades, Portfolio), with over a century of experience in investment management, has established itself as a partnership focused on the long-term interests of its clients. The firm is known for its commitment to professional excellence, managing assets for some of the world's largest professional investors. Baillie Gifford (Trades, Portfolio)'s investment philosophy is rooted in fundamental analysis and proprietary research, aiming to identify companies with the potential for sustainable, above-average growth over a typical horizon of five years or more. With a diverse international client base, the firm's top holdings include prominent names such as Amazon.com Inc (NASDAQ:AMZN), MercadoLibre Inc (NASDAQ:MELI), and NVIDIA Corp (NASDAQ:NVDA), predominantly in the Technology and Consumer Cyclical sectors.

Introduction to Certara Inc

Certara Inc specializes in accelerating the delivery of medicines to patients by leveraging its expertise in biosimulation software and technology. The company's offerings are designed to streamline drug discovery and development processes, reducing the need for extensive clinical trials and expediting regulatory approvals. With a strong market presence, particularly in the United States, Certara's services and software segments have become integral to the healthcare industry. The company's IPO took place on December 11, 2020, and since then, it has been actively contributing to the advancement of medical treatments.

Trade Impact Analysis

Baillie Gifford (Trades, Portfolio)'s decision to reduce its stake in Certara Inc may seem modest in terms of portfolio impact, but it is significant given the firm's investment philosophy. The trade size and position indicate a strategic move that aligns with Baillie Gifford (Trades, Portfolio)'s long-term investment approach. Although the trade did not substantially alter the firm's portfolio composition, it reflects Baillie Gifford (Trades, Portfolio)'s ongoing portfolio adjustments in response to changing market conditions or company performance.

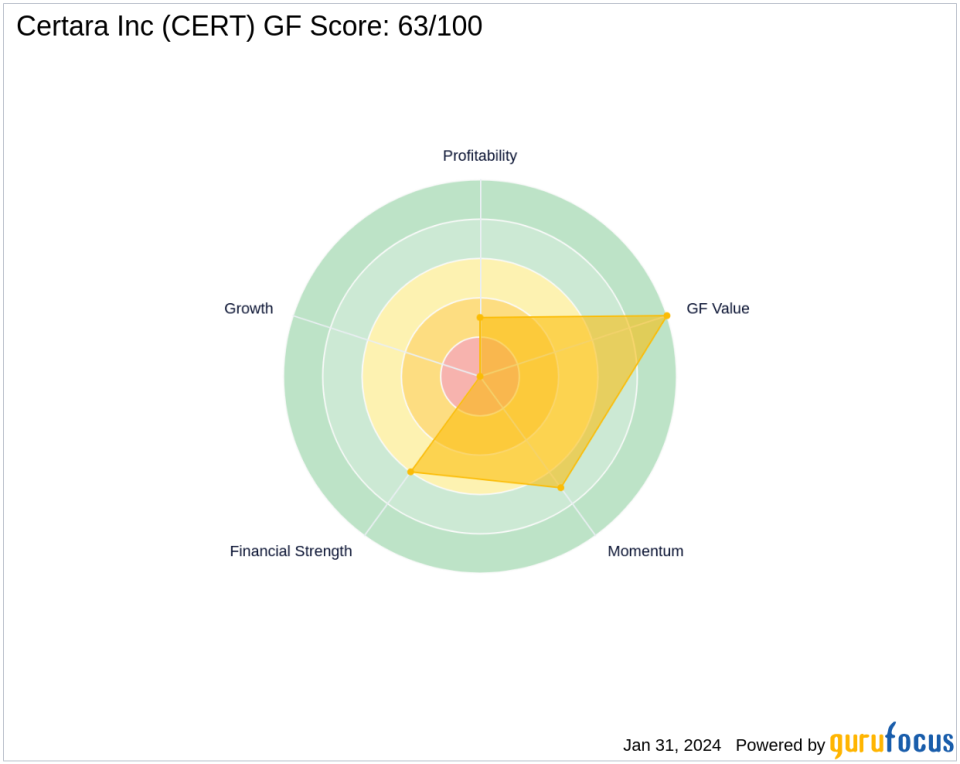

Certara Inc's Stock Performance and Valuation

Certara's stock price currently stands at $16.15, which, according to GuruFocus's exclusive method, is significantly undervalued with a GF Value of $24.89. The stock's price to GF Value ratio is 0.65, suggesting a considerable margin of safety for investors. Since Baillie Gifford (Trades, Portfolio)'s trade, the stock has gained 10.31%, although it has experienced a decline of 45.99% since its IPO. The year-to-date performance shows a decrease of 6.92%. Certara's GF Score is 63/100, indicating a potential for poor future performance. The company's financial strength and profitability are reflected in its Balance Sheet Rank of 6/10 and Profitability Rank of 3/10, respectively. However, its Growth Rank is not applicable, and it boasts a top GF Value Rank of 10/10 and a Momentum Rank of 7/10.

Market Context and Certara's Financial Health

With a market capitalization of $2.58 billion, Certara operates within the competitive Healthcare Providers & Services industry. The company's financial health can be assessed through various metrics, such as its Financial Strength, interest coverage of 1.16, and Altman Z score of 3.64. Certara's Piotroski F-Score is 6, indicating a relatively stable financial situation. However, the company's ROE and ROA are negative, at -3.14% and -2.18%, respectively, which may raise concerns about its profitability and asset utilization.

Other Notable Investors in Certara Inc

Baron Funds stands as the largest guru shareholder in Certara, although the exact share percentage is not disclosed. Other notable investors include industry veterans Joel Greenblatt (Trades, Portfolio) and Mario Gabelli (Trades, Portfolio), who also recognize the potential in Certara's business model and market position.

Conclusion

Baillie Gifford (Trades, Portfolio)'s recent transaction in Certara Inc is a strategic move that value investors should monitor closely. The firm's adjustment in its holdings reflects a calculated approach to portfolio management, considering both the company's valuation and market performance. As Certara continues to navigate the healthcare sector with its innovative solutions, investors will be watching to see how this trade decision unfolds in the context of Baillie Gifford (Trades, Portfolio)'s long-term investment strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.