Baillie Gifford Adjusts Position in Sweetgreen Inc

Overview of Baillie Gifford (Trades, Portfolio)'s Recent Trade Action

Baillie Gifford (Trades, Portfolio), a renowned investment management firm, has recently made a significant adjustment to its holdings in Sweetgreen Inc (NYSE:SG). On December 1, 2023, the firm reduced its position in the company by selling 417,392 shares at a trade price of $9.96. Following this transaction, Baillie Gifford (Trades, Portfolio)'s total share count in Sweetgreen stands at 11,592,537, which represents an 11.66% ownership stake in the company and a 0.11% position in the firm's portfolio. Despite the sizeable share change, the trade impact on Baillie Gifford (Trades, Portfolio)'s portfolio is currently marked as 0.

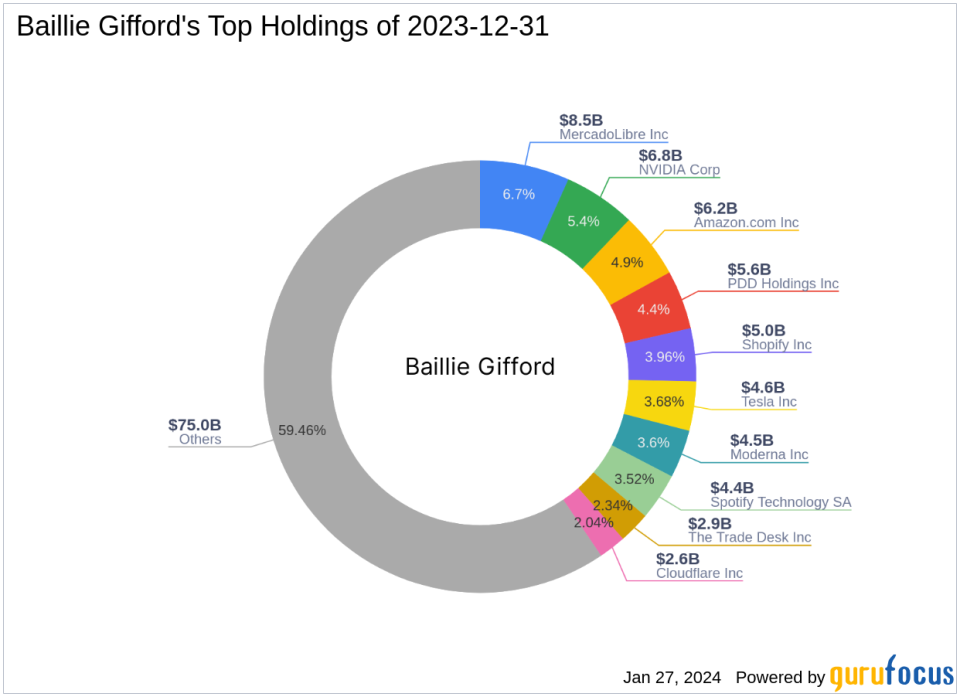

Investment Philosophy of Baillie Gifford (Trades, Portfolio)

Baillie Gifford (Trades, Portfolio) has established itself as a prominent investment management partnership with over a century of history. The firm is committed to prioritizing existing clients' interests and maintaining the integrity of its strategies through a rigorous process of fundamental analysis and proprietary research. Baillie Gifford (Trades, Portfolio)'s investment approach is characterized by long-term, bottom-up investing, focusing on identifying companies with the potential for sustainable, above-average growth. The firm's portfolio includes top holdings such as Amazon.com Inc (NASDAQ:AMZN), MercadoLibre Inc (NASDAQ:MELI), NVIDIA Corp (NASDAQ:NVDA), Shopify Inc (NYSE:SHOP), and PDD Holdings Inc (NASDAQ:PDD), with a strong emphasis on the technology and consumer cyclical sectors.

Sweetgreen Inc: A Fresh Take on Fast Casual Dining

Sweetgreen Inc is a next-generation restaurant and lifestyle brand that has been redefining the fast-casual dining experience with its focus on healthy, sustainable, and locally sourced food. Since its IPO on November 18, 2021, Sweetgreen has been committed to creating plant-forward, seasonal meals that resonate with a growing consumer base seeking earth-friendly dining options. The company's business model emphasizes the importance of fresh ingredients and organic, regenerative farming practices.

Trade Impact and Portfolio Context

The recent reduction in Baillie Gifford (Trades, Portfolio)'s stake in Sweetgreen Inc has not shown a significant immediate impact on the firm's portfolio, as indicated by the trade impact data. However, this move may reflect a strategic adjustment within Baillie Gifford (Trades, Portfolio)'s investment approach or a response to market conditions. The firm's portfolio remains diverse, with Sweetgreen constituting a small but notable part of its investment landscape.

Market Performance and Valuation of Sweetgreen Inc

Sweetgreen Inc currently holds a market capitalization of $1.18 billion, with a stock price of $10.49. The company's stock has experienced a 5.32% price increase since the trade date, although it has seen a significant decline of 79.83% since its IPO. Year-to-date, the stock has decreased by 5.24%. Due to the company's lack of profitability, as indicated by a PE percentage of 0.00, the GF Value and price to GF Value cannot be evaluated.

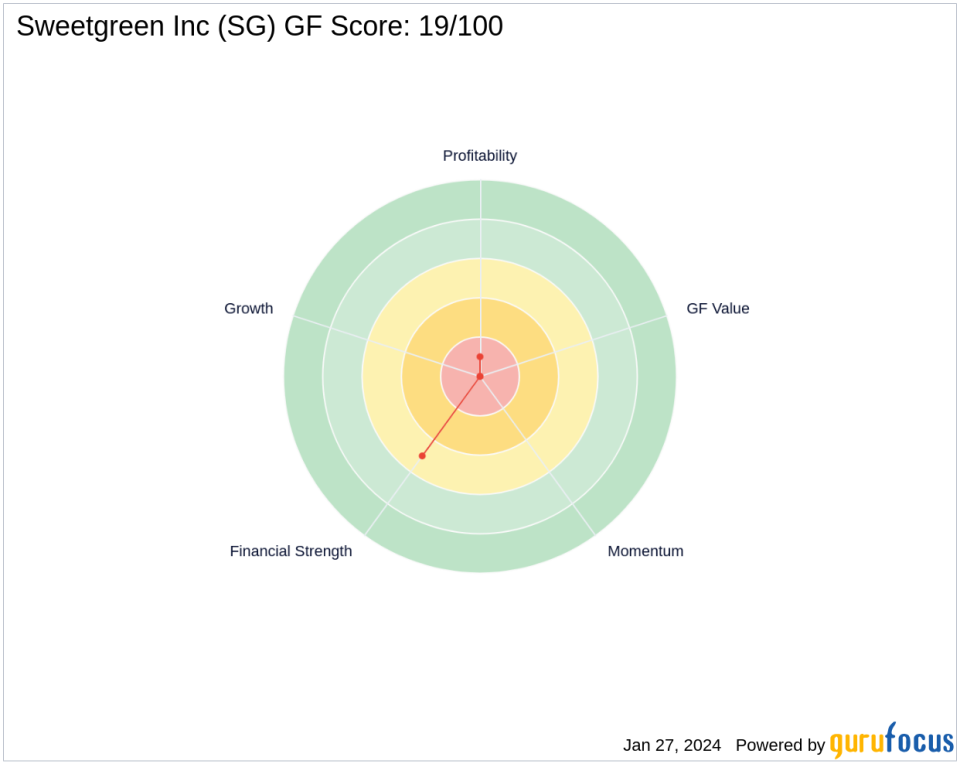

Financial Health and Growth Prospects of Sweetgreen Inc

Sweetgreen's financial health is a mixed picture, with a Financial Strength rank of 5/10 and a Profitability Rank of 1/10. The company's Piotroski F-Score is 4, and its Altman Z score is 1.07, which suggests financial stability concerns. However, Sweetgreen's cash to debt ratio of 0.91 is commendable, ranking 99th in its sector. The company's growth metrics, such as revenue growth over three years at 10.90%, contrast with negative EBITDA and earnings growth over the same period.

Industry Position and Future Outlook for Sweetgreen Inc

In the competitive restaurant industry, Sweetgreen Inc stands out for its innovative approach to fast-casual dining. However, the company's GF Score of 19/100 indicates potential challenges in future performance. Sweetgreen's industry position will depend on its ability to navigate financial headwinds and capitalize on its unique brand proposition to drive growth and profitability.

Conclusion: Baillie Gifford (Trades, Portfolio)'s Strategic Move

Baillie Gifford (Trades, Portfolio)'s recent reduction in Sweetgreen Inc shares may be a tactical decision reflecting the firm's investment strategy and market outlook. While the trade has not significantly impacted Baillie Gifford (Trades, Portfolio)'s portfolio, it underscores the importance of monitoring portfolio adjustments by seasoned investment firms. Investors will be watching closely to see how this trade aligns with Baillie Gifford (Trades, Portfolio)'s long-term investment philosophy and the evolving landscape of the restaurant industry.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.