Baillie Gifford Adjusts Stake in AbCellera Biologics Inc

Overview of Baillie Gifford (Trades, Portfolio)'s Recent Stock Transaction

Baillie Gifford (Trades, Portfolio), a renowned investment management firm, has recently altered its investment in AbCellera Biologics Inc (NASDAQ:ABCL), a Canadian biotechnology company. On December 1, 2023, the firm executed a reduction in its holdings, signaling a strategic shift in its portfolio. This transaction involved the sale of 2,159,853 shares at a price of $4.83 per share, which has impacted Baillie Gifford (Trades, Portfolio)'s stake in the company and its overall investment strategy.

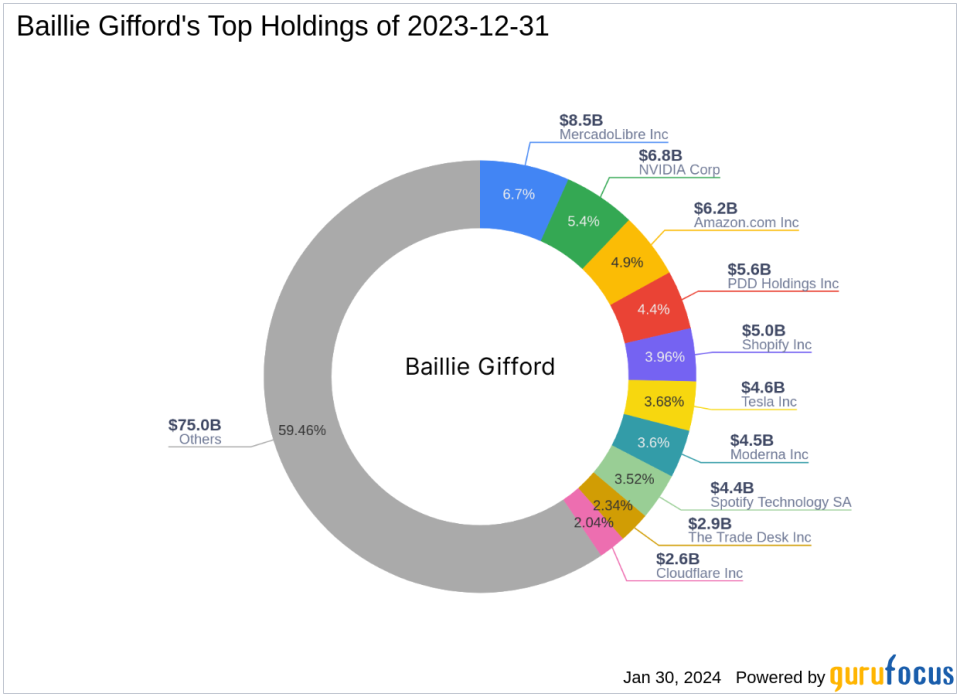

Profile of Baillie Gifford (Trades, Portfolio)

With over a century of experience, Baillie Gifford (Trades, Portfolio) has established itself as a leading investment management partnership, prioritizing the interests of its clients. The firm is known for its commitment to professional excellence and managing investments for some of the world's largest professional investors. Baillie Gifford (Trades, Portfolio)'s investment philosophy is rooted in a rigorous process of fundamental analysis and proprietary research, focusing on identifying companies with the potential for sustainable, long-term growth.

Details of the Trade Action

The trade action taken by Baillie Gifford (Trades, Portfolio) on December 1, 2023, was a reduction in its holdings of AbCellera Biologics Inc. The sale of 2,159,853 shares resulted in a -8.24% change in the firm's shareholding, with a minor impact of -0.01% on its portfolio. The transaction left Baillie Gifford (Trades, Portfolio) with a total of 24,044,796 shares in AbCellera, representing a 0.11% position in its portfolio and an 8.29% holding in the biotech company.

Introduction to AbCellera Biologics Inc

AbCellera Biologics Inc operates as an antibody discovery and development engine, designed to overcome the limitations of conventional discovery methods. The company's integrated platform and strategic partnerships aim to accelerate the development of effective antibodies, ultimately benefiting patients sooner. AbCellera's revenue streams include licensing revenue, research fees, and milestone payments.

Financial and Market Analysis of AbCellera Biologics Inc

As of the latest data, AbCellera Biologics Inc has a market capitalization of $1.52 billion, with a current stock price of $5.25. The company is currently not profitable, indicated by a PE Percentage of 0.00. According to GuruFocus, the stock is significantly overvalued with a GF Value of $1.58 and a price to GF Value ratio of 3.32. Despite the recent trade, the stock has seen an 8.7% gain since the transaction date.

Baillie Gifford (Trades, Portfolio)'s Position in AbCellera Post-Transaction

Following the recent transaction, Baillie Gifford (Trades, Portfolio) holds 24,044,796 shares in AbCellera Biologics Inc. This position accounts for a 0.11% ratio of the traded stock in Baillie Gifford (Trades, Portfolio)'s portfolio and an 8.29% ratio of the firm's holdings in the traded stock. The adjustment reflects Baillie Gifford (Trades, Portfolio)'s strategic portfolio management and its ongoing assessment of AbCellera's potential as an investment.

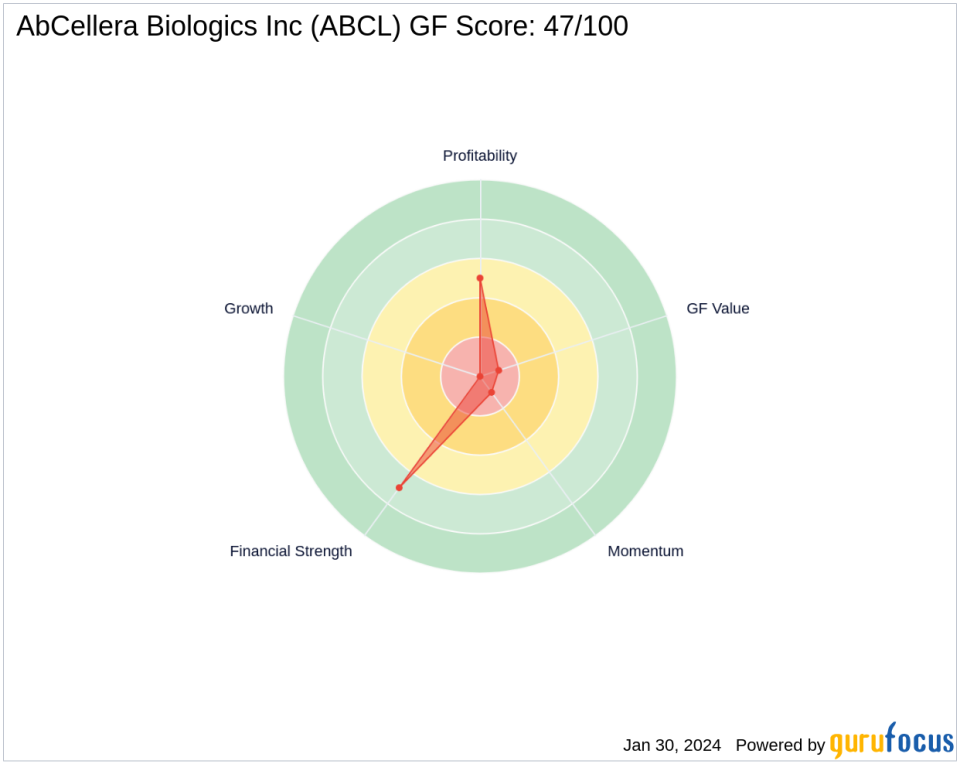

Comparative Analysis of AbCellera's Stock Metrics

Since its IPO on December 11, 2020, AbCellera's stock has experienced a significant decline of -91.39%. The year-to-date change also shows a decrease of -8.38%. The company's GF Score stands at 47/100, indicating poor future performance potential. AbCellera's financial strength and profitability are rated at 7/10 and 5/10, respectively, while its Growth Rank and GF Value Rank are at the lower end of the spectrum.

Market Reaction and Future Outlook

The market has seen a positive reaction to Baillie Gifford (Trades, Portfolio)'s trade, with AbCellera's stock price increasing since the transaction date. However, value investors may remain cautious due to the stock's significant overvaluation and mixed performance indicators. The future outlook for AbCellera will depend on its ability to capitalize on its innovative platform and the success of its partnerships in the competitive biotechnology industry.

In conclusion, Baillie Gifford (Trades, Portfolio)'s recent reduction in AbCellera Biologics Inc reflects a strategic decision that aligns with the firm's long-term investment philosophy. While the transaction has had a minimal impact on Baillie Gifford (Trades, Portfolio)'s portfolio, it underscores the importance of ongoing portfolio assessment and the firm's commitment to identifying growth opportunities for its clients.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.