Baillie Gifford Adjusts Stake in Alnylam Pharmaceuticals

On December 1, 2023, Baillie Gifford (Trades, Portfolio), a renowned investment management firm, made a significant adjustment to its investment portfolio by reducing its stake in Alnylam Pharmaceuticals Inc (NASDAQ:ALNY). The transaction involved the sale of 1,196,042 shares, which resulted in a 14.65% decrease in Baillie Gifford (Trades, Portfolio)'s holdings in the company. This move had a 0.19% impact on the firm's portfolio, with the trade executed at a price of $171.41 per share. Following the transaction, Baillie Gifford (Trades, Portfolio)'s total share count in Alnylam Pharmaceuticals stood at 6,967,097, representing a 1.09% position in its portfolio and a 5.55% ownership of the biotech company.

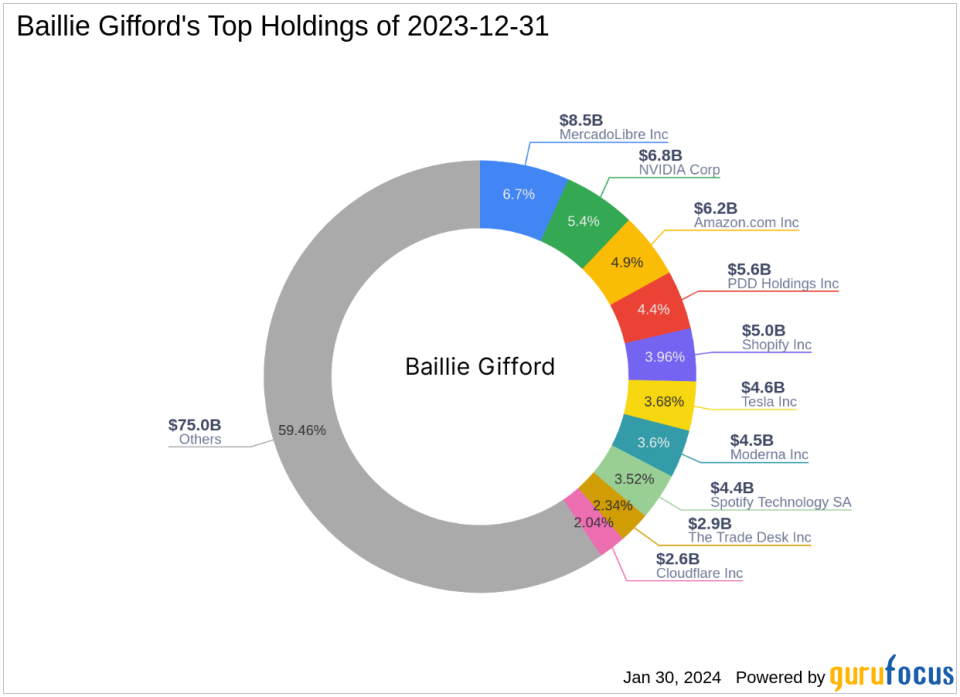

Investment Firm Profile: Baillie Gifford (Trades, Portfolio)

Baillie Gifford (Trades, Portfolio), with over a century of experience in investment management, operates as a partnership focused on delivering exceptional service and maintaining the integrity of its investment strategies. The firm is entrusted with the assets of some of the world's most prominent professional investors, including pension funds and financial institutions across various continents. Baillie Gifford (Trades, Portfolio)'s investment philosophy is anchored in a long-term, bottom-up approach, emphasizing fundamental analysis and proprietary research to identify companies with sustainable growth potential.

Alnylam Pharmaceuticals at a Glance

Alnylam Pharmaceuticals, a leader in RNA interference (RNAi) therapeutics, has been a notable presence in the biotechnology industry since its IPO on May 28, 2004. The company boasts a market capitalization of $22.74 billion and has successfully brought five drugs to market, with several more in clinical development. Alnylam's innovative approach to gene expression silencing has positioned it at the forefront of genetic medicine, cardio-metabolic diseases, and other therapeutic areas.

Impact of Baillie Gifford (Trades, Portfolio)'s Trade on Its Portfolio

The recent trade by Baillie Gifford (Trades, Portfolio) has slightly altered the composition of its investment portfolio. The reduction in Alnylam Pharmaceuticals shares has decreased the firm's exposure to the biotech sector, which may be a strategic move based on market conditions or portfolio rebalancing. The trade price of $171.41 contrasts with the current stock price of $181.225, indicating a 5.73% gain since the transaction date. This suggests that Baillie Gifford (Trades, Portfolio) capitalized on a favorable selling opportunity.

Financial Health of Alnylam Pharmaceuticals

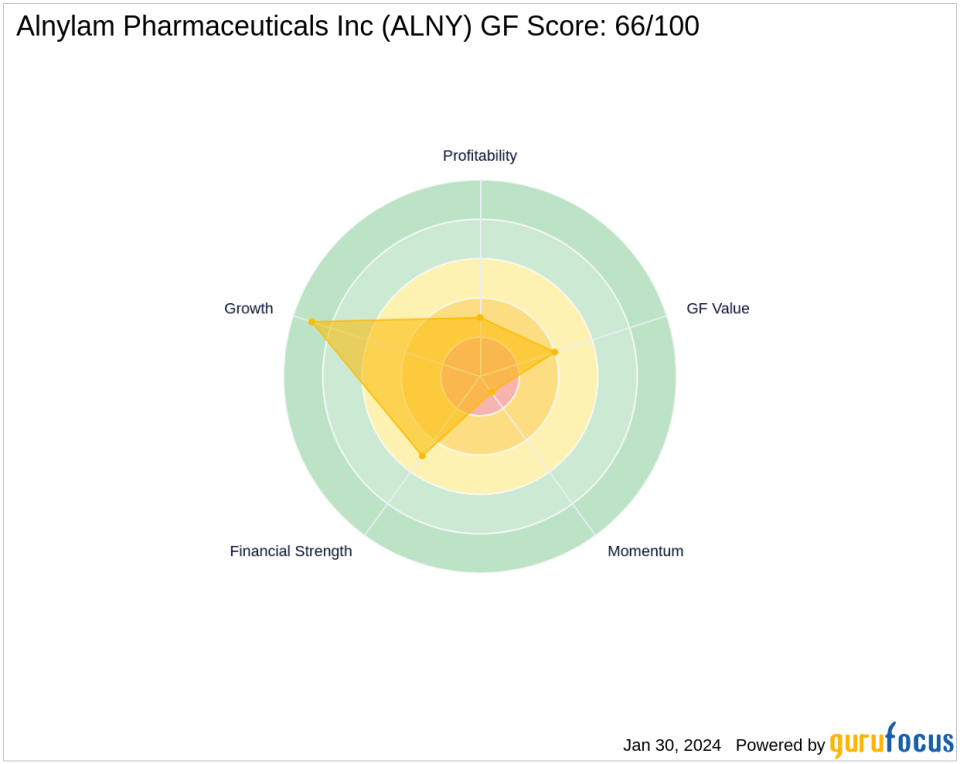

Alnylam Pharmaceuticals' financial metrics present a mixed picture. With a PE percentage of 0.00, the company is not currently profitable. The GF Value indicates a possible value trap, urging investors to think twice with a price to GF Value ratio of 0.48. Despite this, the company's Growth Rank is high at 9/10, reflecting robust growth prospects. However, the Financial Strength and Profitability Ranks are more modest at 5/10 and 3/10, respectively, suggesting areas for improvement.

Market Performance and Future Outlook

Alnylam Pharmaceuticals has experienced a significant price change since its IPO, with an increase of 2870.9%. However, the year-to-date performance shows a decline of 7.03%. The stock's GF Score of 66/100 indicates a potential for poor future performance, which investors should consider when evaluating the stock's prospects.

Industry Context and Baillie Gifford (Trades, Portfolio)'s Sector Focus

Baillie Gifford (Trades, Portfolio)'s top sectors include Technology and Consumer Cyclical, with leading holdings such as Amazon.com Inc (NASDAQ:AMZN) and NVIDIA Corp (NASDAQ:NVDA). Alnylam Pharmaceuticals, within the Biotechnology industry, competes with other firms developing RNAi therapeutics and must navigate a complex and competitive landscape to maintain its market position.

Other Notable Investors in Alnylam Pharmaceuticals

Vanguard Health Care Fund (Trades, Portfolio) is currently the largest shareholder in Alnylam Pharmaceuticals, with other significant investors including Dodge & Cox, Jefferies Group (Trades, Portfolio), and Joel Greenblatt (Trades, Portfolio). Baillie Gifford (Trades, Portfolio)'s recent reduction in shares places its position alongside these notable investors, each with their own strategies and outlooks on the company's future.

Transaction Analysis: Baillie Gifford (Trades, Portfolio)'s Strategic Move

Baillie Gifford (Trades, Portfolio)'s decision to reduce its stake in Alnylam Pharmaceuticals may reflect a strategic shift or a response to the company's financial health and market performance. With the stock's price having increased since the trade, the firm may have deemed it an opportune moment to realize gains. Investors will be watching closely to see how this transaction influences Baillie Gifford (Trades, Portfolio)'s portfolio performance in the long term.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.