Baillie Gifford Adjusts Stake in Chegg Inc

Overview of Baillie Gifford (Trades, Portfolio)'s Recent Transaction

On December 1, 2023, Baillie Gifford (Trades, Portfolio), a renowned investment management firm, made a significant adjustment to its investment in Chegg Inc (NYSE:CHGG), an American educational services company. The firm reduced its holdings by 5,236,396 shares, resulting in a 52.79% decrease in its position. This trade had a minor impact of -0.05% on the firm's portfolio, with the shares being traded at a price of $10.23 each. Following the transaction, Baillie Gifford (Trades, Portfolio)'s remaining stake in Chegg Inc amounts to 4,682,387 shares, representing 4.04% of the company's outstanding shares and 0.04% of Baillie Gifford (Trades, Portfolio)'s portfolio.

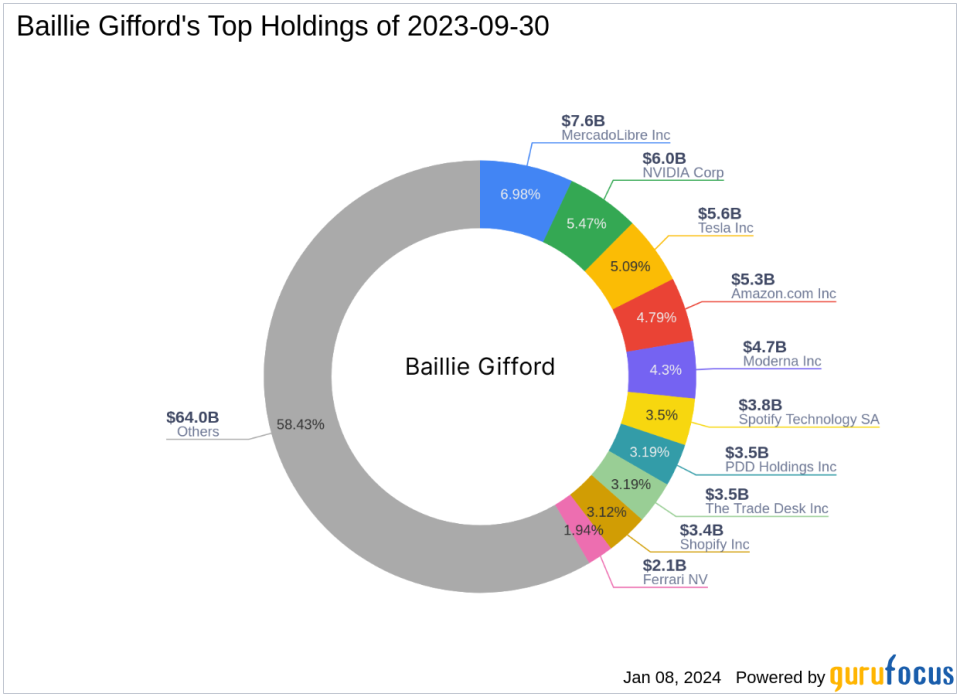

Profile of Baillie Gifford (Trades, Portfolio)

Baillie Gifford (Trades, Portfolio), with over a century of investment management experience, is known for its commitment to professional excellence and client interests. The firm manages assets for some of the world's largest professional investors, including pension funds and financial institutions across various continents. Baillie Gifford (Trades, Portfolio)'s investment philosophy is centered on long-term, bottom-up investing, with a focus on identifying companies with the potential for sustainable, above-average growth. The firm's top holdings include prominent names such as Amazon.com Inc (NASDAQ:AMZN), MercadoLibre Inc (NASDAQ:MELI), NVIDIA Corp (NASDAQ:NVDA), Tesla Inc (NASDAQ:TSLA), and Moderna Inc (NASDAQ:MRNA), with a strong inclination towards the Consumer Cyclical and Technology sectors.

Introduction to Chegg Inc

Chegg Inc offers a wide array of academic and career services, primarily through its Subscription Services and Skills and Other segments. The company's platform is designed to assist learners in accessing course materials and developing personal and professional skills. Chegg's Subscription Services include various study aids and educational tools, while the Skills and Other segment focuses on skills development, advertising services, and textbook offerings. Chegg has been publicly traded since November 13, 2013, and operates within the education industry.

Financial and Market Analysis of Chegg Inc

Chegg Inc currently holds a market capitalization of $1.28 billion, with a stock price of $11.045 as of the latest data. However, the company's PE Percentage stands at 0.00, indicating that it is not generating profits at the moment. The GF Valuation labels Chegg as a "Possible Value Trap," suggesting investors should think twice before investing, given the stock's GF Value of $29.98 and a Price to GF Value ratio of 0.37. Since the transaction date, the stock has seen a gain of 7.97%, but its performance since the IPO has been relatively flat, with a 0.41% increase.

Impact of Baillie Gifford (Trades, Portfolio)'s Position in Chegg Inc

Post-transaction, Baillie Gifford (Trades, Portfolio)'s stake in Chegg Inc remains substantial, with the firm holding 4,682,387 shares. This position, although reduced, still signifies a notable investment by Baillie Gifford (Trades, Portfolio) in Chegg, reflecting the firm's confidence in the company's long-term growth potential despite the current financial indicators.

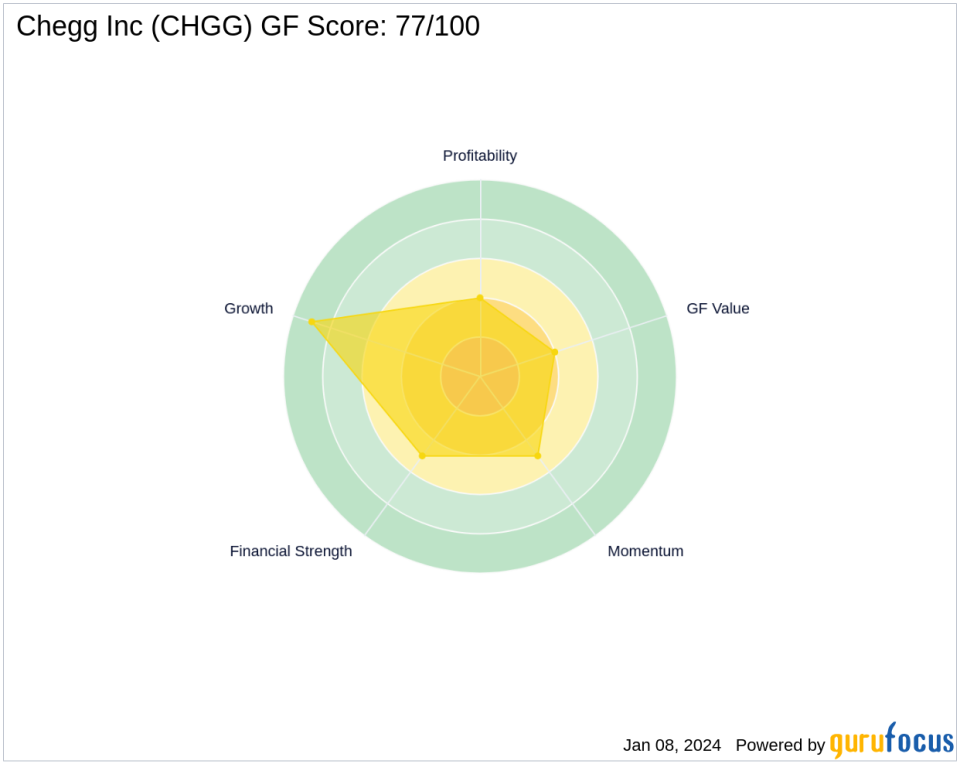

Chegg Inc's Performance Metrics

Chegg Inc's GF Score stands at 77 out of 100, indicating a strong potential for future performance. The score is a composite of various metrics, including Financial Strength, Profitability Rank, Growth Rank, GF Value Rank, and Momentum Rank. Chegg's Financial Strength and Profitability Rank are moderate, with scores of 5/10 and 4/10, respectively. However, the company's Growth Rank is impressive at 9/10, suggesting robust growth prospects. The GF Value Rank and Momentum Rank are at 4/10 and 5/10, respectively, indicating room for improvement in these areas.

Comparative Analysis with Largest Guru Shareholder

The largest guru shareholder in Chegg Inc is Leucadia National, although the specific share percentage is not provided. Comparing Baillie Gifford (Trades, Portfolio)'s position with that of Leucadia National would offer insights into the investment strategies and confidence levels of these major investors in Chegg's future.

Market Reaction and Future Outlook

Since Baillie Gifford (Trades, Portfolio)'s trade, Chegg Inc's stock price has experienced a slight uptick. The future outlook for Chegg will depend on its ability to navigate the challenges of the education industry, capitalize on growth opportunities, and improve its financial health. Investors will be closely monitoring Chegg's performance metrics, including its GF Score components, to gauge the company's potential for long-term success.

Transaction Analysis

Baillie Gifford (Trades, Portfolio)'s decision to reduce its stake in Chegg Inc has had a minimal impact on its portfolio, given the small trade impact of -0.05%. However, the firm's continued investment in Chegg suggests a belief in the company's value proposition. As Chegg works towards improving its financial and market performance, Baillie Gifford (Trades, Portfolio)'s future moves will be closely watched by investors seeking to understand the firm's long-term strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.